COSL takes over as largest offshore rig manager

Last year was a time of pulling back in many aspects, and offshore drilling was no exception, as the world faced the global pandemic of COVID-19 and the oil price crash in March. Demand for hydrocarbon products dropped as most countries around the world went into some kind of lockdown in order to try to prevent the spread of COVID-19. E&P companies pulled back on drilling campaigns around the world, enacting a sudden reversal of the slow but steady gains that had been underway in late 2019. Fast-forward to early 2021, and while some progress has been made on the vaccination front, and the oil price has been on an upward trajectory, offshore drilling rig demand has not followed pace, although IHS Markit does forecast a meaningful increase in offshore rig demand for the full year, with much of the increase coming in the latter part of the year.

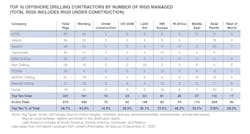

COSL tops manager list

In terms of offshore drilling rig managers, 2020 ended with state-owned China Oilfield Services (COSL) as the largest manager in the world, claiming the top spot from Valaris, which had been the largest manager at the end of 2019. Of the 10 largest managers of Arctic rigs, drill barges, drillships, jackups, semisubmersibles (semis), submersibles, and tender-assist rigs, only COSL and ADNOC Drilling increased their fleets from the previous year. ADNOC Drilling is the drilling arm of the Abu Dhabi National Oil Company.

The total number of rigs at the end of 2020 was 873, down by 41 from the end of 2019. Of the 873, nearly 40% are managed by one of the 10 largest managers. This is down from about 42% the prior year. When looking at the working rig count, at the end of the year, the 10 largest managers controlled about 43%, a decrease from approximately 47%. As expected under current global conditions, the number of new rig orders last year was very low. The only two units ordered were the previously planned jackups from ARO Drilling, which is a joint venture between the Saudi Arabian-based operator Saudi Aramco and the UK-based drilling contractor Valaris plc. They were officially placed on order with Lamprell shipyard and had steel cut last year, commencing the construction process.

Jackup newbuilds delivered

In all, 11 rigs were delivered last year – all of which were jackups. Some of these units are still awaiting their first assignments. But for those that have commenced work, most began their maiden campaigns either off China or in the Middle East. Meanwhile, of the 70 units still under construction (including units fully built but not yet delivered to an owner), several had been scheduled to be delivered in 2020 but have had their delivery dates delayed due to market conditions. The 10 largest managers own 10 of the 70 units still under construction, with Borr Drilling holding a full half of these. Borr’s five units are all jackups. COSL’s sole rig under construction at the end of 2020 is a semi that was delivered in early 2021.

Valaris has two drillships that are substantially completed but have not been contractually delivered. In connection with the company’s reorganization plan, it reached an agreement with the shipyard to delay delivery of both rigs until the end of 2023 with the option to take delivery sooner or terminate the contracts on a non-recourse basis. Transocean also has two drillships under construction. Some minor delays were experienced because of COVID-19 restrictions, but the rigs remain under construction.

European market remains attractive

One aspect unchanged from 2019 is that the top 10 managers continue to dominate the fleet in Northwest Europe, accounting for almost 74% of the supply. Because the harsh environment requires different rig capabilities than benign waters, and because of the higher cost of entry to work in certain countries that require additional safety certifications, Northwest Europe commands some of the highest day rates in the world. This makes it a desirable market to gain entry to for rig managers, and conversely, it is a market that they are generally reluctant to leave, so long as there is work to be found. Valaris, Seadrill, Maersk, and Transocean each have 10 or more rigs in the region. As the basin matures, and as the countries that make up the region take the global lead on the energy transition, the region’s rig supply has been falling the past few years.

In terms of pure count, Asia/Pacific takes the lead, with about 34% of the global fleet supply. This concentration of rigs is in part because of the broad area covered by the regional grouping, and also because most of the world’s shipyards are in this region. At the end of 2020, only two of the 70 offshore rigs that were under construction were being built outside of the Asia/Pacific region. Not to lessen the importance of the region, of the 298 units in the supply at the end of last year, 137 were under contract. China and India were by far the most dominant countries, with 58 and 39 units, respectively. Asia/Pacific is the only region that finished 2020 with the top 10 managers accounting for more of the regional fleet supply than at the end of 2019, having increased by about half a percentage point.

US Gulf suffers declines

The region that felt the biggest loss – both in terms of the dominance of the largest rig managers and the total fleet count – was the US Gulf of Mexico, which, like Northwest Europe, is a rather mature basin with a long history of drilling. The supply in the US Gulf fell by 12 from the end of 2019 to the end of 2020, and the count for the top 10 managers decreased by 10 units, leaving them to represent only about 38% of the rigs, down from almost 46% at the end of 2019. The region, which averaged 141 jackups under contract in 1985, only had two working jackups at the end of 2020. These days the working rigs in the region are mostly drillships. As with most rig types in most regions, drillship demand fell last year. While it is expected to pick up later this year, jackup demand will see little increase, as the shelf is mostly played out.

Latin America poised for growth

The only region that increased its total fleet from the end of 2019 to the end of 2020 was Latin America, which grew by one to 148. The rig count for the top 10 managers was unchanged over this same period at 52; however, there were some changes within the group. For example, Valaris decreased its presence, having only three rigs in the region at the end of 2020, down from seven. Conversely, Maersk, COSL, and Transocean each grew their rig counts. Maersk added two rigs, while COSL and Transocean added one each. IHS Markit anticipates Latin America will have the biggest increase in demand over the next couple of years with Brazil being a meaningful contributor, along with smaller increases from other countries.

Turning to West Africa, the region experienced a drop in its total fleet of seven units, due in part to the Canary Islands being a popular stacking location for idle rigs. Three of the four units retired from West Africa in 2020 were in the Canary Islands at the time of their retirements. Meanwhile, a number of rigs were mobilized into and out of West Africa over the course of the year, with the net total making up the rest of the drop in the regional rig count. None of the top 10 managers increased their West African presence from the end of 2019 to the end of 2020. Of the seven managers with rigs in the region in 2019, six decreased their fleets. Only Maersk was unchanged at two units. Meanwhile, Borr, COSL, Seadrill, and Shelf all dropped by one rig. Valaris lowered its count by two units.

The Middle East, which is almost exclusively a jackup market and has been one of the strongest and most stable regions in terms of rig count in the last several years, showed a slight decline in its total supply, dropping by two to end 2020 with 170 rigs. Over the same period, the top 10 managers shifted their fleets and ended the year with six fewer rigs in the region than at the end of 2019. This meant a drop from accounting for nearly 37%, or 63 units, of the regional fleet supply at the end of 2019 to representing almost 34%, or 57 units, at the end of 2020. As expected, the two Middle East-based managers on the top 10 list, Abu Dhabi-based ADNOC Drilling and United Arab Emirates-based Shelf Drilling, are the most dominant managers in the region. ADNOC Drilling boosted its rig count by one to end 2020 with 21 units in the region, and Shelf decreased its fleet by one to finish with 15 units.

2021 demand expected to pick up

IHS Markit forecasts that offshore drilling rig demand will pick up meaningfully over the course of 2021; however, this increase will see global demand merely returning to about where it started in 2020 – that is, before the effects of COVID-19 began to be felt widely and before the subsequent oil price crash. Oversupply remains a challenge for rig managers. Even though the total global supply fell by 41, the year-to-year drop of 26 in the working count reduced the effect of the supply drop. Additional rig attrition is also anticipated for this year, as is more consolidation among the rig managers. With a number of rig managers undergoing bankruptcy or reorganization, we may see more rigs retired this year than in 2020 – especially if there are mergers involving some of the larger rig managers – as the companies examine their go-forward fleets.

The author

Cinnamon Edralin is Associate Director, Offshore Rigs, IHS Markit.