Total, partners launch major gas development on South Pars

Severe winter weather pushed Iran into an energy crisis last year, underlining the importance of the South Pars gas-condensate development.

The field, estimated to contain about 300 tcf of gas, is located in 70 meters of water in the Persian Gulf. It is an extension of the same Khuff reservoirs forming Qatar's super-giant North Field.

Iran needs to harness these reserves urgently, not just to fuel its own power stations and domestic markets, but to sustain production from its mature oilfields through gas injection. There are also pressures from export projects such as the proposed gasline to Pakistan.

While NIOC finalizes development of South Pars Phase 1, Total is carrying out Phases 2 and 3 development, in partnership with Petronas and Gazprom. This contract was secured in October 1997 and presents a challenge as the largest offshore gasfield the French major has ever worked on.

Gas targets

Following re-interpretation of existing seismic and drilling of two delineation wells on South Pars last summer, Total and its partners embarked on a three-year journey towards first production in September 2001.

Once the full development is completed, in mid-2001, output will be at a plateau of 2 bcf/d. Latest estimate for the overall project cost is $2.012 billion, funded entirely by the three partners (Total 40%, Petronas and Gazprom, 30% each). The field is expected to produce 14 tcf over 25 years.

Once the production phase has started, operation will pass to NIOC. The three partners will be compensated over a seven-year period in the form of liquid condensates produced from the field. The rate of production is thought to amount to 80,000 b/d. South Pars' gas, however, will remain exclusively with NIOC.

Total Middle East Vice President Patrick de Genevraye claims it will leave his company well placed for further oil-related buyback projects, with the objective to develop its involvement in the Iranian oil and gas sector over the long term.

Last year's delineation drilling found gas as expected, says de Genevraye. Volumes appeared to justify a minimum facilities wellhead platform for both locations, each with its own 32-in., 110-km export pipeline feeding supplies into a gas treatment plant onshore at Assaluyeh.

Production routing

There will be no separation on the platforms. Instead, the water/gas/condensate mix will be piped directly to Assaluyeh, where condensate will be stripped. Gas will be treated to remove hydrogen sulfide and mercaptans before being transmitted through a 56-in. trunkline to the mainland gas network at Kangan.

Corrosion issues are being addressed by piggybacking 4.2-in glycol lines onto both the sealines. Fluid within these lines will circulate to and from a glycol regeneration plant onshore.

Both wellhead platforms, featuring limited topsides weighing 1,700 tons only, are being built by NPCC in Abu Dhabi. RTA in Iran is building the pipelines, with a German manufacturer providing the steel. Total and Doris Engineering undertook basic engineering in Paris, while NPCC handled detailed engineering for the platforms.

At Assaluyeh, four gas treatment trains will be brought on line at three-month intervals, between September 2001 and June 2002. Twenty deviated development wells are to be drilled from mid-2000. Drilling costs are estimated at $450 million, with around $100 million budgeted for the platforms, $270 million for the pipelines, and $1.1 billion for the onshore facilities.

Sirri onstream

Sirri delivered first oil from its Persian Gulf location last October. By May 1999, production had risen to 8,000 b/d, from three wells. A second platform is due to be installed on the field next year, eventually boosting total output to 20,000 b/d from 11 wells. Water depth is 65 meters.

Sirri E, the other development entrusted to Total (60%) and Petronas (40%), also started via a wellhead platform and a processing platform. Two wellhead platforms will be connected later this year, pushing production from Sirri E towards a plateau of around 100,000 b/d. As with South Pars, NIOC will take the reins as production builds.

However, Total's involvement does not end at that point. Negotiations are in progress to export some of the gas to Dubai, at a rate of 80 MMcf/d. Total will be responsible for the gas contracts. This arrangement will also serve to reduce flaring from Sirri.

Ultra-deepwater pipelayer capable of rigid and flexible installations

Coflexip Stena Offshore's new ultra-deepwater pipelay and construction vessel should begin operations within 18 months. Hyundai's Mipo Dockyard won the contract for the $170 million newbuilding. CSO had planned a conversion of the submersible carrier Kitt, acquired in December 1997, but decided that a new vessel, for an extra outlay of $20 million, represented a better long-term investment.

The unnamed vessel will be 192 meters long, 32 meters wide, and will have a maximum displacement of 52,000 tons. It will lay rigid flexible pipes and umbilicals in waters up to 2,500 meters deep. CSO says it will be the only vessel in its class capable of rigid and flexible pipeline and riser installations in these depths.

Storage capacity will be 8,000 tons, with a heavy lift capability of 400 tons, and a transit speed of 13 knots. Unique pipelay equipment,

will consist of two large reels for rigid pipe, two carousels for flexible pipes and umbilicals, and a tiltable ramp equipped with tensioners, situated above the central moonpool. The vessel will also feature two advanced work class remotely operated vehicles (ROV). Main targeted provinces for the vessel are Brazil, West Africa, and the Gulf of Mexico, although it should also be capable of North Sea operations. A decision on the Kitt's future was not announced.

In the North Sea, CSO's UK division recently completed its largest subsea lift to date. A crane vessel on subcontract to the company installed the Shearwater gas export pipeline SSIV and associated tie-in spool (as part of a new trunkline system serving this and the Elgin/Franklin fields). Width and height of the SSIV end were respectively 10 meters and 6.5 meters. The length was 78 meters, including the 51-meter, 34-in. diameter spool. The weight was 262 tons, including lift beam and rigging.

This was the last of a nine-lift campaign that occupied 134 vessel days. It was performed on behalf of the Elgin/Franklin pipelines EPIC contractor ETPM (UK). CSO's spool base in Evanton, northern Scotland, fabricated 13 spools of 24-in. and 34-in. diameter for this project.

According to Dave Lothian, the CSO project manager, "the decision to avoid individual component installation - which is a design feature of all six subsea structures - greatly reduced installation risk and afforded us the opportunity to eliminate one hyperbaric weld from future tie-in programs.";

Low upkeep seismic streamer overcomes low frequency noise

Solid streamer production at Thomson Marconi Sonar's plant in France is expected to surge over the next few months, due to demand from Western Geophysical and other seismic contractors.

The factory is currently operating 16 hours per day, via two shifts, to meet an output target of 200 km. This represents 25% of the annual seismic streamer market, according to Jean-Jacques Periou, Civil Systems Product Line Manager for Thomson Marconi Sonar in Brest. However, as more orders pour in, production is expected to climb shortly by 50% to 300 km annually, which may necessitate further revision of shifts.

Periou claims that replacement needs account for 10% of the overall market, and theoretically, it would take 10 years of full production at the plant to meet global requirements. The Sydney plant produces the Sentry solid streamer which was first applied by Western three years ago for a 3D survey offshore Indonesia, from the Western Monarch. The technology emerged partly from Thomson Marconi Sonar's experience with solid towed arrays for submarine use. The cable has been developed further to overcome low frequency noise and stress relief problems.

"We use a polyurethane polymer to decrease the noise level so that the signal-noise ratio of the acoustic receivers is better than in other systems," says Periou. That negates interference commonly caused by mechanical vibration and high seas, in turn providing increased operating time in variable weather conditions.

The product is consistently buoyant - there is no need to re-ballast, Periou claims. "And unusually, it is repairable on board the vessel. Furthermore, because the system is solid, with no liquid inside, there is no need to store special oils onboard for replacement purposes." When conventional streamers suffer a cut, oil inside usually seeps out. Other cables have also been know to lose their acoustic transducers in such cases, he adds.

Although the cost is no lower than for conventional streamers, downtime is less as the system is more reliable, and therefore maintenance costs are much lower. Breaking tension is greater than 60 kN. The PU/PVC alloy skin is also claimed to be completely waterproof, with totally enclosed hydrophones.

Sentry is produced in streamer lengths up to 10,000 meters. Sections are configured either in 100-meter lengths for eight seismic channels and two depth transducers (MSX-compatible), or in 150-meter lengths with 12 seismic channels and two transducers (for Syntrak data collection systems).;

Brittany forging stronger links with offshore engineering groups

Although Paris is France's oil and gas commercial powerhouse, it trails Brest in breadth of marine technology capability. Around 60% of France's maritime-related R&D is concentrated in this area, according to Christian Charles, Assistant Director of Technopole Brest-Iroise.

That figure is not surprising, given Brest's long tradition of ship and submarine building. It also has a favorable position on a spacious bay in Finistere, on France's north-west tip. Furthermore, the area houses one of the country's leading deepwater test basins.

The Technopole science park is a non-profit organization, part-funded by the government and the European Union. It exists largely to generate synergies between private sector companies, colleges and R&D institutes.

"One of our main aims is to create new projects involving existing companies," says Charles. A good example is G2RA, which was created to mobilize Brittany's underwater acoustic specialists to research new technologies for towed arrays, ultra-short baseline systems, high speed data links and so on, and also to commercialize technologies developed by local research institutes. This program has Fr 100 million funding over four years, of which Technopole is supplying Fr 20 million.

Charles' brief is also to use subsidies to encourage new companies to start up in the park. A recent event which helped raise the area's profile to the offshore sector was the ISOPE exhibition and conference. Technopole played an active part in bringing this largely scientific annual event to Brest.

Among the foremost institutes in Brest with offshore links are:

- ENIB - an engineering school specializing in marine science, image and signal processing (with its own virtual reality facilities)

- ENSIETA - another training school, which this year introduced its first offshore engineering course. Twenty students are enrolled. Their program includes design of jackets, FPSOs, semisubmersibles, risers, pipelines and mooring, and extends to metocean classes. In the past, ENSIETA students have also worked with DCN and with Bouygues Offshore on a production and storage barge concept

- ENST Bretagne provides graduate courses in telecommunications, including studies on data and signal processing for underwater acoustics. Graduates have gone on to work with local companies such as Thomson Marconi Sonar

- CEDRE is a leading center for oil pollution studies, providing training in crisis management and qualification of new spill combat equipment

- BRGM is the main institute in France for Earth Science studies, including seabed geological and sedimentological mapping.

Charles would like more offshore engineering contractors to move in as partners for some of the research projects. He also feels Brest could be stronger in robotics.

Basin studies

Ifremer is a government-owned research institute with main centers in Brest and Toulon. Multi-disciplinary expertise offered to the offshore sector from these locations includes geology, geotechnics, metocean studies, hydrodynamics, marine environment materials research, ROVs, bathymetry imaging and acoustics technologies.

Among Ifremer's current programs are scientific studies on margin geology and sedimentary processes. This kind of activity can lead to formation of joint research/industrial projects. For example, in the context of deepwater exploration in the Gulf of Guinea, Ifremer has formed a three-year study with Elf-EP. Objectives include margin structure, turbiditic systems, slope stability and gas hydrate studies. An initial campaign of regional data acquisition was performed late last year using the R/V l'Atalante equipped with a Simrad EM 12 dual multibeam echosounder system and 2D high resolution seismics. Other operations planned for 1999-2000 include studies at different scales on deep geology, sedimentology and geohazards.

Ifremer's best known asset in Brest is its 25-year old deepwater test basin. This is a filtered and treated seawater tank measuring 50 meters long, 12.5 m wide and 10 m deep with a 12.5 x 12.5 m pit 20 meters deep. It can generate waves with periods of 0.8 to 5 seconds (maximum amplitude of 0.55 m trough).

As well as providing comprehensive testing of ROVs and associated instrumentation, the basin can be used for numerical simulation validation with regards to new types of offshore platform structures. Among these are a deep draught semisubmersible platform for Bouygues Offshore's SAS (Site Assembled Semisubmersible). This is a new deepwater production concept, targeted mainly at West Africa, comprising a rectangular deck resting on four articulated deep draught cylinder buoys. Ifremer is also a partner in this project, the others being Elf, Principia and Technip-Geoproduction.

Ifremer was commissioned to perform basin studies of the hydrodynamic behaviour of these buoys (or columns), and to generate a database for validation of numerical models. Work first involved investigation of damping on the proposed mooring system, followed by dynamic behavior analysis of a single column, and culminating in full model testing. The deep draught buoy model was a rigid cylinder with flat plates at its ends, and a draught of 3 m.

Weight, center of gravity, and inertia were altered through use of two adjustable loads. The model was positioned 20.4 m from the basin's wave generator, in order to achieve the requested length and angle for the mooring lines. Instrumentation was deployed to measure the buoy's six degrees of freedom, tensions at the top ends of the two mooring lines, and pressure at the bottom of the float. The mooring lines comprised a pair of thin cables/chains anchored at a depth of 9.8 m in the basin, at an angle of 15 deg from the traveling direction of the waves. Horizontal anchoring forces were counterbalanced by an equivalent weight.

Results to date have shown good correlation between irregular and regular wave behavior with the predicted models.

Shortly, the basin will be used for further tests - mainly in irregular waves - of another new Bouygues Offshore concept, the wellhead barge, to simulate the effects of currents. Ifremer is also responsible here for post-test results analysis for the numerical model validation. This new concept includes a moonpool to accommodate riser top connection in calm seas.

Other ongoing programs involving Ifremer technicians in Brest are:

- The Shell-led JIP Wacsis (Wave Crest Sensor Intercomparison Study)

- A joint industry project with Elf, Total, BP and others to evaluate the risk of hydrogen embrittlement of high strength steels in the deep sea

- Studies with Technip-Geoproduction on the fatigue potential of high strength steels in marine environments

- Behavior of oil export lines from FPSOs in varying currents offshore West Africa

- Studies of the mechanical behavior of synthetic ropes, including laboratory tests and on-site experiments with adequate monitoring of a drilling rig's mooring lines (research conducted with IFP, Bureau Veritas, Elf, Total)

- Acoustic monitoring systems for use with subsea completions (jointly with Cooper Cameron in Beziers, southern France)

- Development of advanced telemanipulator systems for IRM tasks with Cybernetix, such as the deepwater Swimmer AUV project.

"There are too many currents in this part of France to stage open sea trials," says Ifremer's Offshore Technology Division Director Lionel Lemoine. "For those we use our Toulon center... other test basins may be more commercial than ours - our aims in our R&D programs are chiefly to improve methodologies and understanding of fluid/structure interactions."

Acoustic instrumentation

Among Brest's privately owned companies, MORS is a specialist in acoustic release systems for water depths up to 6,000 m. According to Commercial and Export Manager for MORS Environnement in France, Max Audric, these systems have various uses in the offshore sector:

- as a command receiver to activate hydraulic valves subsea

- to aid installation of templates and anchors

- for laying of cables, flexible pipes, riser or spoolpiece installations (projects include Åsgard in 1998).

Audric claims that MORS is the leader for heavy duty applications. Acoustic release systems weighing from 15-300 t can be rented by the day or over a period of months. They can be manufactured in the Brest headquarters with duplex stainless steel housings to withstand severe deepwater conditions.

MORS also has a joint venture with Thomson Marconi Sonar called Posidonia, a USBL tracking system designed to operate in noisy environments in ultra-deep waters. Trials with Ifremer have proven accuracy of better than 50 m in 6,000 m simulation.

Another local company is ORCA Instrumentation, which specializes in acoustic data transmission systems and acoustic modems. Its offshore references include an interface with a Gyrocompass to provide two-way data transmission for loading of suction anchors in the Norwegian sector. ORCA has also developed an acoustic image transmission system from an underwater crawler (used for pipeline inspection) to the pipelay vessel.

The moored GIB buoy, developed jointly by ORCA and ACSA, based in Meyreuil, could also be transferred from naval to offshore applications, according to ORCA's Director Jean-Michel Coudeville. This is an underwater acoustic location and tracking system comprising four or more buoys deployed in a network, also featuring a synchronized pinger on the object to be tracked (perhaps an AUV) and an operation station with a GPS correction receiver.;

Repair yard also interested in drillships

When Sedco Forex awarded DCN the contract to build two new drilling semis, this was viewed as a new departure for Brest, away from its naval traditions. However, the nearby Sobrena yard has been engaged in offshore industry vessel repairs and fabrication for decades.

A series of big pipelayers have been berthed at the yard over the years, including the Castoro Sei, the DLB 1601 and the LB 200. Other semisubmersible accommodation units such as the Polycastle have dropped by this decade to be fitted with new dynamically positioned thrusters, new diesel generating sets, additional sponsons and so on.

Among the more recent visitors were ETPM's LB 200, which came in for pontoon repairs, blasting and magnetic particle inspection prior to its current job laying the Åsgard large diameter gas trunkline in Norway's Halten Bank. Last September, the advanced shuttle tanker Hanne Knutsen underwent general maintenance which included an overhaul of its two bow and two aft thrusters, tail shaft and propeller, plus steel repairs to some ballast tanks.

Sobrena's yard has three dry docks, with minimum access draft varying from 7 to 10 meters (at any tide). It can accommodate 420 x 80 m vessels. Further out, the Bay of Brest has 20 m deepwater anchorage, with no bridge to restrict vessel movement. This is a very important asset, according to Sobrena's Director Paul Philippe.

The 3,500 sq m mechanical workshop is equipped with overhead gantry cranes up to 60 t. There is also a foundry for re-babbiting bearings. The 5,000 sq m steel workshop features overhead gantry cranes up to 40 t, with a sliding skylight roof. It can be used to fabricate modules up to 150 t, which can be transferred directly from the shop to either the third dry dock or the fourth repair berth. TIG and MIG welding is provided. The pipe shop includes hydraulic pickling and flushing plant as well as equipment for high pressure testing and boiler work.

The company is keen to gain more offshore work, but within limits - it has no interest in building a large design facility. "We are a repair yard with 250 full-time employees, which can be quickly doubled," says Philippe. Our system is designed to produce 450,000 manhours of work per year."

Sobrena worked for a time with DCN and two other partners on the Sedco Forex units, supplying steel sections, pipes mechanical and painting services. "We could be interested in other offshore projects," Philippe adds, "provided that a) we can continue with our bread and butter work on ships at the same time, b) we can make a profit". Conceivably, Sobrena could also work with DCN to convert drillships, if contracts became available.;

Deepwater separation/injection module under review by Elf, Total

A French conglomerate is working on an integrated subsea separation and injection module, capable of operating in 1,500 meters water depth or beyond. Construction of a prototype should begin next year, possibly with European Union funding. A fully tested system could be available by 2001, in time for consideration for field developments such as Elf's Dalia or Girassol Phase 2.

Dipsis (deep integrated production separation and injection system) was initiated early in 1998. Project leader Doris Engineering is responsible for overall conceptual engineering, marine operations, cost estimation and reliability studies. Prosernat is working on the subsea separation system, while Sulzer Pompes is in charge of the injection pump and associated power supply.

The other participants are Cybernetix (ROV interface), ECA (subsea control system )and IFP, which this year has undertaken a hydraulic study of the proposed module using its multiphase flow simulation software Tacite. Elf and Total have recently joined as consultants, and French R&D body CEPM has funded half the FFr 8 million studies to date.

Work on the concept is being performed in phases. Last year's initial study was based on a module weighing 340 tons in air and 260 tons in water. According to Doris' Francois Marchais, analysis proved the feasibility of a module treating 120,000 b/d of effluent and injecting 70,000 b/d of water, in conditions 100 bar above the proposed separator's normal operating pressure. After completing this study, the team is now adapting the concept to 1,500 meters water depth operations.

"The objective of the Dipsis team this year," Marchais says, "is to perform an advanced design of a smaller module - 10 meters by 10 meters by 6 meters - that will treat three wells close to a subsea manifold. The reason for having separation as close as possible to the producer wells is to remove water very early in the production process. This permits injection of chemical dispersing agents to combat hydrate plug formation, in turn allowing the wellstream at this depth to be transported longer distances."

Parameters laid down for this study are not fixed in stone. Configurations for the equipment could be flexible, depending on the oil/gas ratio and also the operator's priorities. These may be to get the oil and gas out quickly, or to extend the production profile as long as possible. Six DIPSIS modules could be deployed for a subsea development tied back to an FPSO, which could involve two units located at the foot of each riser, near the wellheads or next to the subsea manifold. Alternatively, greater quantities of modules with smaller dimensions could be positioned close to each manifold or riser, and so on.

Soil conditions in Angolan Block 17 are very soft, which would likely necessitate use of suction piles to install the Dipsis template. The plan is to use a drilling or crane vessel to install the module complete or in several sections, without guidewires. Once in place on the seabed, all components would be accessible by ROV for maintenance or valve override purposes. The module itself would be fully operable from the host production facility at the surface.

Multiphase potential

According to Prosernat's Lionel Waintraub, other groups are looking at alternative deepwater separation solutions, for instance, using hydrocyclones linked to downhole pumps within the subsea completion itself.

Dipsis is the only group studying multi-well, controlled separation, he claims. "We could even go to three-phase instead of two-phase separation by combining our separator with a multiphase pump." This technology could be supplied by Sulzer or IFP.

Power for the existing pump concept could come from a conventional variable frequency motor, he adds. "But it has not been decided if electrical distribution would be situated subsea or provided from the surface. It could come through an umbilical."

Another feature that distinguishes Dipsis from other concepts is the planned incorporation of a de-sander module to clean out sand and oil deposits. If prototype tests go to plan, concerted maintenance of the entire system would only be required every five years.

"We are trying to achieve a design to cover a wide range of systems," Waintraub adds. "The current plan for the prototype is for a field producing 50,000 b/d of oil and 70,000 b/d of water, with a water injection rate of 0-80%. This is not fixed, but the idea is to allow production from quite a number of wells using several of these units.

"At 200-300 meters water depth, normal pressure ratings apply. But down at 1,500 meters or more, tremendous weight problems arise which affect lifting and positioning of the module and its associated cables. So, we are looking at alternatives to steel for manufacturing the pressure vessels. We may also need new types of cranes for the installation."

GPS-based system improves vessel motion analysis

Accurate motion measurement sensors are usually inertial central measurement systems, including accelerometers and gyrometers, with laser technology and sophisticated electronics to obtain accurate data of vessel motions. For these systems to be highly reliable as well as accurate, their associated costs are also usually high.

Sometimes they are coupled (or hybridized) with global positioning system (GPS) sensors to improve

performance further, but few employ only GPS sensors. However, GPS technology is a reliable and relatively low cost solution.

Nantes-based R & D/technology center, Sirehna, recently tested its own GPS motion sensor, the GPMS-2000, to validate motions on a CGG geophysical vessel. The system has been developed under the Eureka

project, Hullmos, in association with MLR Electronique. It is designed to measure motions, angular and linear speeds and position, primarily of

vessels during sea trials for maneuvrability and large motion detection, but could also be used to record motions of offshore platforms in a seaway.

The GPMS-2000 is a high accuracy motion sensor featuring a four-antenna array with integrated seven-channel L1 GPS receivers, plus one central processor unit.

Between December 1998 and March this year, the GPMS-2000 underwent its first trials in a comparison exercise with a high precision inertial POS/MV navigation system from Applanix. Trials were conducted with a small prototype (distance between antennae of 2 m). The purpose was to analyse the duration of the ambiguities' resolution and to control the system response on model attitude. For dynamic tests, the structure was fixed on a roll and pitch machine.

Following analysis, some improvements were made to the processing software, to eliminate erroneous carrier phase readings, and to the GPS receiver, to improve its reliability.

Full-scale sea trials were performed on a ship at the Chantiers de l'Atlantique yard in St Nazaire this May. Industrialization of the system will shortly be completed, with a commercial system due to be available this fall.;

Current prediction improvements needed to avoid future deepwater incidents

Installation of platforms such as Ekpe and Oso off Nigeria and Cobo off Angola have demonstrated that West African sea state parameters are generally understood. But for deeper water activity, more precise information is needed on the actions of currents. Measurements performed by exploration teams indicate that strong, irregular currents (>4 kt) can disrupt or halt operations, even damaging risers.

While drilling offshore Angola in depths beyond 400 meters, Sedco Forex's drilling barge Omega was suddenly hit by currents induced by internal waves of over 3 kt that led to a displacement of 18 meters, almost causing the barge

to be evacuated. Similar incidents have been reported during work on the Nkossa field offshore Congo, in addition to others in the Andaman and China Seas and West of Shetland.

These internal waves are observed mostly at upper sea levels, but they also exist in deep waters. Their amplitude can reach 30-120 meters with a maximum of 600 meters around the thermocline. Among the effects generated by tide flow on the sea bottom are solitons. These are a non-stationary phenomenon comprising seven or eight solitary waves which materialize following a sudden increase in current speed and abrupt direction changes.

Soliton packets

Soliton packets always decrease in intensity from the first soliton to the last. The spacing can vary 1-30 meters and 200 meters-1 km-plus. Field measurements observations suggest that they can be generated by internal tide passing over continental shelves or shoals with water stratification.

Accordingly, several projects are being mounted to find ways of improving metocean services by providing data on the predicted current. Among these are the Anais program involving numerous French contractors, oil companies and research bodies. MeteoMer, which is one of the participants, has implemented its own characterization tools, derived from remote sensing, in situ measurements and numerical simulation models:

- Remote sensing: Satellite observations such as radar, optical and infra-red images have highlighted current anomalies on different oceanic areas.

- Synthetic aperture radars (SAR): These measure ocean surface short waves with wavelengths of a few centimeters, caused by local wind.

Any perturbation on these short waves will modify the energy picked up by radar, making the anomaly visible on the image. The back-scattered signal reduces when the sea state smoothens (dark zones) and increases when the sea state gets rough (bright zones). In this way, soliton-induced effects show up well on SAR images.

Initial analysis of these images is put through the short wave transform method in order to detect and characterize the solitons and calculate parameters such as location, orientation, wavelength, and numbers of peaks. Another processing tool works by extracting a 6 by 6 km imagette from an SAR image (100 km by 100 km) to elaborate its spectrum, in order to provide the usual sea state data and ascertain the direction and wavelength of the solitons. SAR images are wide enough to allow two successive soliton packets to show up on the same image. When these have been generated by tide (time interval around 12 hr), and once distance between each soliton has been calculated, the wave propagation speed can be determined. Infra-red images can be used to show thermal structures probably associated to an internal tide (during a period of strong tidal activity). The link between these structures and continental slopes becomes evident when superimposing this image on the corresponding bathymetric chart.

- In-situ measurement: Among instruments that can be provided for field measurements are CTD XBT sounders, thermistance chains and Doppler profiler acoustic current meters. Readings can be applied to calculate and validate tidal harmonic components, to distinguish between tide current and drift current, and to make comparisons between predicted and measured tide current. Moreover, these instruments can measure amplitude, speed and phase of the internal waves throughout the water column, and results can be compared to those issued by the prediction models.

- Numerical simulation models: MeteoMer can highlight tide current anomalies based on numerical simulation models for tides, tide internal waves and SAR images.

Offshore operators have often experienced perturbations of sub-surface currents due to barocline purposes such as solitons or internal waves. Strong hydrodynamic perturbations have been measured off the mouth of the Zaire river during drilling operations in the Gulf of Guinea.

During floods around this location, fluvial waters spread onto the ocean surface with a significant density gradient. In the Gulf of Guinea, where amplitude of the half-diurnal tide often reaches 1 meter, the interface of fresh/sea water will oscillate due to the alternating tidal effect. So, internal waves forming near the breaking zone of the continental slope will be at their maximum during periods of flood and spring tide.

A hydrodynamic numerical model can be used to represent the real situation. However, numerical models also help the process of understanding the ocean mechanism. Meteomer has applied such models in the Gulf of Guinea.

Bi-dimensional model

A bi-dimensional model of internal wave has been implemented with regard to anomalies linked to internal waves arising from the effects of topographic features on tide. Equation solving is based on the finite differences with regard to non-linear interactions - the action of a barotropic tide on a calm sea can be simulated with a dense stratification and an uneven relief.

Simulating SAR images allows a characterization tool to be employed for current anomalies and comparison for hydrodynamic simulations (internal waves). The model adopted is based on:

- Balanced spectrum - for example, a coherent wave field including short waves with no external perturbations such as those caused by tide current

- Hydro-dynamic model of interactions between these waves' field and the surface current, giving a perturbed spectrum

- Model for the interactions between sea surface waves and electro-magnetic waves. Necessary data include wind force and direction as well as variable surface current caused by the internal wave.

All Meteomer's models are deployed in real and near real-time. First, the practical means of implementing the study are examined. Once risk zones are defined, regularity and intensity of the phenomena are specified along with abnormal currents that they generate in each zone. Then a daily prediction of abnormal currents is established, including beginning and end-hour of the predicted event, and the current intensity.

Should real-time measurement devices be implemented and developed regarding temperature and current profile, analysis would improve, models would be better controlled and calibrated, and ultimately accurate prediction could be guaranteed.

Advanced jacking system deployed on Caspian newbuild rig

Following confirmation of a major gas discovery on the Shah Deniz Field, there will likely be renewed calls for a fleet of jackups based in the Caspian. One contractor expressing intentions to fill this need is Sedco Forex, currently building the new Trident 20 rig, which may already be contracted to Mobil.

The jackup, due to be delivered to the client in Baku in April 2001, is a Keppel FELS design suited for shallow water operations up to 350 ft in the Caspian. Among the equipment subcontractors is Nantes-based BLM Offshore, which is designing and supplying the jacking system.

Over the years, BLM has developed a range of rack and pinion elevating systems with lifting capacities of 75-727 tons per pinion. Typically, they consist of a set of simultaneously operated units fitted in pairs on each side of the two opposing racks welded to the rig's leg. Each unit incorporates a climbing pinion that meshes with one rack. Systems can be used with either tubular or lattice-type legs.

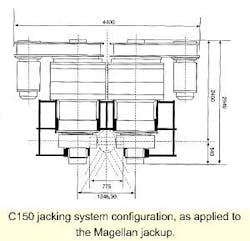

Jacking units each incorporate one reduction gear with a watertight steel casing. BLM also designs and supplies the motor, jacking system control center and associated switchgear. The jacking system chosen for the Trident 20 is BLM's C150 (also deployed on the Magellan drilling rig). This features:

- Normal load rating of 450 tons and pre-load of 620 tons

- Holding capacity of 727 tons

- Lifting speed of 0.46 meters/ minute, via a 48kW motor outputting 600V, 60Hz

- Total weight of 13,500 kg.

Load monitor

All BLM's jacking systems allow the load to be transferred to the rack chocks following jacking, if required. An electric load transfer (ELT) system manages this operation by progressively relieving the torque on the climbing pinions. The ELT also allows the jacking system to be loaded chord by chord, which means that each jack case can be controlled individually.

BLM has also developed a monitoring system that constantly measures and displays the loads of each pinion. This has become a more critical requirement from drilling contractors, the company claims, particularly with regard to the newly emerging generation of jacking systems.

In BLM's case, every jacking train incorporates a cell that measures the load on each pinion. The cell emits an electronic signal that varies according to the size of the load. Electronic processing of the signal then conveys the reading at the jacking control room console, to an accuracy of within 1%. When rack chords are engaged and pinions are disengaged, the load value is equivalent to zero, assuming there is no contact between pinion and rack.

Another problem associated traditionally with jacking systems is uneven load distribution between the jacking pinion of a chord and a leg, something which may occur during the static holding and pre-load operations. This can lead to overload of certain pinions.

BLM's pinion electric re-torquing system allows the user to calculate the average load that should be applied to each pinion, and then to re-torque the chock pinions at this level from the control console, where the user can view immediately the exact impact of the operation on pinion loading. The system is quicker, more accurate and more controllable than traditional manual torquing methods, BLM claims.;

Floatover method updated with higher air gap for rough seas

Unideck TPG is a floatover/installation technique devised by Technip Geoproduction for large platform decks. The method, which has most recently been applied to the Cobo and North Fields offshore Angola and Qatar, involves transfer of the completed deck in one piece from the yard to the installation barge.

Once the vessel reaches its field location, it is guided onto the jacket and secured between the specially designed jacket piles. The deck is then lowered onto the jack through a combination of ballasting and jacking. Once the full load has been transferred, the barge eases away following further ballasting and jacking.

This system has worked well with decks of around 10,000 tons in reasonably clement weather, where a 7.8-meter air gap is sufficient for the installation. However, Technip-Geo production (TPG) felt less confident about the hydraulic jacking system's capability in rougher seas in such areas as the Gulf of Guinea, Gulf of Mexico and Indonesia. These also happen to be the areas where most of the large decks today are heading.

"For Unideck, the most critical operations are mating and removing of the barge," says TPG's Pierre- Armand Thomas. "If this takes too long in bad weather, it

could prove difficult. As an example, we decided to install one deck following a good weather forecast. But in the event, the operation took 16-17 hours, as the weather prediction duration was over-estimated."

Solutions

The obvious solution was a higher air gap for the installation, but applying this effectively was another matter, given the Unideck jacking system's limited stroke. Speed of the de-ballasting operation could also prove a liability during an emergency. This is effected currently via injection of ballast water into a compressed air tank to have a fully reversible operation. "You simply open a valve and the compressed air pushes the water away," says Thomas. "But pumping the water this way takes time."

TPG's solution involves a rectangular lifting module, the dimensions of which can be adapted to the chosen barge. Jacking systems are incorporated at both ends of the module. The deck would be skidded from the construction yard directly onto the barge, then towed to the field location in the same position. Once there, the deck could be jacked into place, using an air gap of 15-20 meters, if required.

"With the new system," says Thomas, "you can introduce the barge and deck inside the jacket, following elevation of the deck at a certain speed in order to minimize power demand. This operation could last 30 minutes. Subsequent mating would then involve the same system of shock absorbers and damping as for Unideck."

The new technique, however, would also feature dual-speed capability for the jacking . "You could jack the deck up slowly, insert it into the jacking piles, then jack it down at a higher speed (this method avoids multiple hammering of the deck). Jacking down and subsequent mating of the deck could be effected within one minute." He estimates one hour altogether for jacking up and jacking down. The barge itself is then raised by 1 meter and disconnected via a quick release system that avoids ballasting. The envisioned release speed of 1.5 meters/minute would be a big improvement over the 4-5 hours required currently for deballasting.

Advantages

Cost of the method could be slightly lower, in terms of reduced barge time, but the main advantage derives from improved safety, should the weather suddenly deteriorate. "Sea state limits would be the same as for Unideck," says Thomas. "Wave height and period are the most important consideration - barge motions are particularly sensitive to period. In between a 9 second and 12 second period swell, the barge can move twice more." In this case, the higher air gap and quicker disconnect speed pays off.

Once the contract for a suitable deck was secured, TPG would be prepared to invest in the larger air gap capability. The system could suit integrated decks up to 15,000 tons. "We could also employ three or four modules, with six or even 12 pinions per module bearing a 3,600-ton weight.

"Our system could also be used to optimize the barge - we wouldn't require a fixed dynamic stability. A 36-40 meter wide barge would suffice." Security/stability of the load would be guaranteed throughout the tow by lowering the air gap above the barge deck.

The system is being included by TPG in current bids for construction contracts for Middle East and West African offshore projects. It might also work in the North Sea, Thomas adds, provided that the disconnect procedure was very quick. "The speed (per pinion) could theoretically be doubled, but that would involve compromising onboard power generation. We assume a 25kW motor would be needed to achieve a 1.5 meters/minute jacking operation." Being reversible, the system might also be applicable for removing heavy decks from abandoned platform jackets."