Clair development reflects fast-track, low-cost advances

Jeremy Beckman

Editor, Europe

Big oil finds are not always beautiful. Clair, discovered in 1977 west of the Shetlands, defied coherent analysis for almost two decades. Eventually, the pieces of this complex, heavily faulted reservoir fell into place, thanks to improved well placement and seismic imaging advances.

The development project that followed is a direct contrast: fast-track, low-cost, and technically straightforward. Operator BP's goal is to maximize returns from what remains a big unknown in terms of the reservoir's deliverability. The current first phase, focused on the south-central section of the reservoir, is targeting 250 MMbbl out of estimated reserves of 1.2 Bbbl. Depending on performance, second- and third-phase schemes are planned to the north and west.

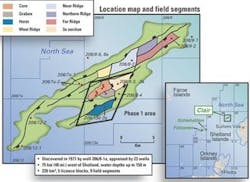

Clair extends across five blocks, in water depths of 140-160 m, in a location roughly halfway between the Shetland Islands and BP's Foinaven and Schiehallion fields. It is also situated just north of the trunkline exporting gas from these fields to the Magnus platform in the Northern North Sea.

The initial discovery, well 206/8-1, intersected a 568-m oil column in a Devonian-Carboniferous fractured sandstone sequence, overlying a Pre-Cambrian basement. Over the next decade, the four Clair license groups drilled 10 more appraisal wells that delineated a 200-sq-km, heavily faulted structure, with disappointingly weak reservoir drive.

Having failed to prove up economically recoverable reserves, the licensees pooled their resources in 1990, with BP appointed as overall operator for the blocks. During the five years that followed, 3D seismic improved understanding of the influence of fractures on the reservoir's productivity. Five more appraisal wells were also drilled, including two in block 206/8 in the south-central section. Both these wells flowed at commercial rates, enough to suggest that this Core area would also be the likely focal point of any future development.

Optimism increased in 1996 following an extended well test and a subsequent side track of a suspended well. The results demonstrated vertical connectivity in the Core area's Devonian sequences, prompting further appraisal drilling the following year on the graben and 3A segments in adjoining acreage.

According to Clair Project Director Terry Hughes, the painstaking progress was due in large part to lack of confidence in seismic imaging. Overlying multiples were obscuring the true picture of the reservoir underneath.

"In the early years, this led to wells being drilled in deeper waters, but it turned out that the seismic was fooling us," Hughes explained. "As we drilled more wells, we found that the more prospective sections lay in shallower waters where the shelf drops off. Coincidentally, this area also looked easier to develop, allowing us to contemplate a fixed platform."

The big breakthrough, in terms of understanding the reservoir, came in 2002, following analysis of a new 3D ocean bottom cable seismic survey. "OBC gets rid of the multiples, giving a better view of the reservoir," Hughes said. "In this case, it allowed us to identify the Core/graben/horst segments that form the basis of the Phase 1 development, and to optimize placement of the planned wells. We also shot more OBC than we needed, including over half the region to the west, known as the ridge. This data is being interpreted at present by our geoscientists."

Current thinking suggests that Clair is a heavy layered and fractured sandstone reservoir, divided into nine fault-bounded segments, with a common free water level and a maximum oil column of around 600 m. A gas cap overlies the structurally elevated ridge segments. Total in-place resources are estimated at 5 Bbbl, Hughes says, which would be equivalent to a Forties-type reservoir, but only about 20% are technically recoverable compared with in excess of 50% in Forties.

Unanimity of purpose

The real impetus toward development of the field built from 1998 onward. That year, Elf withdrew, leaving five fully committed partners, led by BP as operator and program coordinator, with 28.6%. Following subsequent corporate mergers, the other participants today are ConocoPhillips (24%), ChevronTexaco (19.4%), Shell (18.7%), and Amerada Hess (9.3%).

"For any field development to proceed, you need total unanimity of purpose," Hughes points out. "That means finding alignment on budgets and work programs, and determining each partner's level of technical involvement. This is what we were working on in 1999-2000."

When development was first proposed in 1998, the project appeared too risky and the capital costs too high, Hughes explained.

"During talks on alignment, we asked the partners what it would take to go ahead, i.e. `how much would you be prepared to pay for what?' They replied that they would like to see development costs in the region of $3/bbl. That was quite a challenging target. We had been working on a base case development where capital costs were close to $5/bbl capex. So, this would mean cutting our outlay by more than one-third."

To achieve this target, BP realized it would have to find new ways of managing this project that had not previously been considered on the UK shelf. "To this end, we undertook an extensive benchmarking exercise. In 1999, we interrogated BP's database, which included assets at that time inherited from the former BP and Amoco. We asked ourselves, where could we develop a similar project elsewhere in the world for around $3/bbl? The answer was the Gulf of Mexico, and the nearest analogy was the Pompano field. This featured similar quality crude, production, and injection rates, and roughly the same number of wells as we had included in our base case for Clair."

Pompano was developed in the early 1990s at a cost of under $3/bbl, via a platform designed by Mustang Engineering. Mustang later developed this design for another platform off West Africa, and the concept seemed ready for further development for Clair.

"It gave us the basic dimensions, in terms of the number of decks and topsides modules and their functional requirements," Hughes said. "We wanted to avoid working from a blank piece of paper. There are some differences that you can't escape. The storms, for instance, are worse around the Shetlands, so the platform must be beefier than a Gulf of Mexico counterpart. But you can transfer technologies and techniques that are proven in the Gulf. As an example, rather than a design philosophy that protects against potential hazards, which is the traditional North Sea approach, you spend much more time and effort eliminate those hazards. For example, instead of adding numerous blast walls to protect against explosion risk, you find ways to design and build the facility such that it is impossible for a build-up of explosive material to occur, and you do not need the wall in the first place. The facility is therefore inherently safer."

Hughes and his team also decided to adopt a more hands-on managerial approach with Clair's designated fabricators.

"That meant going to the market and saying, 'you're not building a facility for us like the ones you're used to in the North Sea. Rather, we will bring all the equipment to your yard in pre-assembled modules (skids), and you will assemble it.' Gulf of Mexico yards are used to this approach. They acknowledge that they are generally not good at wiring or constructing electrical equipment, so that work is done by smaller, more efficient suppliers, where extensive factory acceptance testing is done to ensure equality. The larger yards are then left to handle the heavy fabrication, which is their prime business."

For the Clair platform, there are several main fabricators, but assembly of most of the skid-mounted equipment has been devolved to the smaller specialists, with BP supervising factory acceptance tests and deck lifts.

"These type of measures helped drive down Clair's capex to an eventual $3.4/bbl," Hughes says. "The downside of this hands-on approach for the operator is the management challenge of dealing with dozens of yards instead of a few. On our part, we were assisted by a few managing contractors who contributed to a big effort in quality control, making sure the skids come in on time."

Mustang was contracted for front-end engineering, detailed design, and some of the managing contractor role. Conveniently for BP, the company was later acquired by Aberdeen-based Wood Group, which had greater experience with UK environmental and regulatory conditions. After engineering design had been completed in Houston, a Wood Group/Mustang team assembled in Aberdeen to manage the platform construction program.

Phase 1 platform

Clair Phase 1 production will come through a conventional steel platform supported by a four-legged, lattice-type braced jacket. This has been positioned over the existing 206/8-10z well drilled in 1996, considered the optimal central point for reservoir drainage. The topsides facilities comprise three deck levels (main, production, and cellar), housing all facilities for drilling and processing of produced fluids and gas. Topsides and jacket have both been designed for removal and subsequent re-use at the end of field life.

Hughes describes the environmental conditions in this part of the Atlantic as very similar to those found in the northern North Sea. "One difference is the swell period west of Shetland. Based on our experience at Foinaven and Schiehallion, this can be much longer and larger than in the North Sea. Big, long, lazy rolling waves abound, so the platform must be designed for these conditions. But this can be dealt with through additional steel and advanced design techniques."

In June, Saipem's crane barge S7000 installed the jacket, built by Aker Verdal in Norway. The jacket weighs 8,000 tonnes, and measures 170 m high and is 45 x 50 m at its seabed footprint. Fourteen 51-m high, 96-in. diameter piles, also supplied through Aker, were driven through the jacket's four corners in July.

"The seabed conditions in this area are soft rock, rather than sand. That entails quite a lot of energy when driving in piles. Last year we performed two test pilings, to check our design criteria and ensure the process would work. This worked well and resulted in only minor design changes and all fourteen piles were driven without any problems."

Last month, the three-level, 10,500-tonne (close to 11,800-tonne with the heavy lift aids) integrated deck sailed out of the Amec yard in Wallsend, northeast England. This was set on the jacket by the same vessel in a single-lift operation. This was followed by the 1,200-tonne, 120-cabin steel living quarters module, built by Leirvik Modular Technologies in Norway; a 2,000-tonne drilling module, supplied by Heerema Hartlepool, and a 200-tonne flare boom, assembled by Amec.

Within the main topsides unit, there are six main process modules on the platform: the well manifold system, well test system, two-train separation, an oil export system, gas compression, and produced water handling. Ten major utility systems include equipment for fuel gas and power generation, water injection, cooling of the compressors, and heating of the separators. These skid-based units were constructed in smaller yards around the UK.

The main deck, living quarters, flare, and drilling facilities were all to be installed in July, followed by a four-month hook-up and commissioning period. Total capex will be around £650 million, only slightly above the budget set back in 2001, with opex now estimated at £25-30 m a year.

"This is a very good achievement," Hughes says, "but Clair has been designed from the outset to limit operating expenses. This stems largely from maintaining a base crew of only 25 people to run high-quality, reliable equipment supplied by manufacturers who are not only competitive but also have a good track record. At peak, we'll also be housing up to 80 drilling personnel for the 23-well program, which is forecast to take around five years to complete."

Clair Phase 1 is targeting 250-300 MMbbl in the Core, graben, and horst segments. The area to be covered is laterally extensive and will be drained via high step-out, extended-reach wells. Hughes describes these as "middle of the park technology for BP – we certainly drill tougher wells elsewhere in the world." Most of the wells will be around 3 km long, but two will extend 6 km into the Horst region, with a further three extending to 5 km.

All drilling will be handled by Aberdeen-based Noble Drilling from a purpose-built and state-of-the-art platform rig, weighing 1,995 tonnes. This was co-designed by Noble and National Oilwell with the bulk of the drilling equipment supplied from the latter's base in Stavanger.

"These type of high tech rigs can be problematic to operate," Hughes says, "but I believe the Clair rig will set new standards. The design is very robust. Ours is a highly mechanized rig, which in some ways is a small step back from the absolute newest technology. Our research showed there has been a trend towards automation over the past decade, but there have also been problems getting these highly complex pieces of kit talking to each other and working well together via computerized control systems. That's why we decided to mechanize the Clair rig but to have most of the control done by a person, not a computer."

In October, the rig is scheduled to re-enter and re-complete the 206/8-10z well over which the platform is based. This will be the only pre-drilled well prior to start-up. "Pre-drilled wells are great to have," Hughes explained, "but on Clair they are an expensive luxury. This would have incurred two to three years of upfront investment, with the high cost of bringing a mobile drilling unit to operate west of Shetland. Also, Clair's wells are not in the most prolific in the North Sea. Our best wells are around 15,000 b/d.

"The reservoir is sluggish, with little natural energy to drive the oil to surface. We have therefore opted for conventional water injection to drive the oil to the producers and maintain reservoir pressure, and all the wells will also be gas-lifted to get the oil to the surface - our analysis shows that this combination is the most economic option."

When the scheme was originally approved in fall 2001, 24 wells were planned, but this has since been pared back to 23. Plans for a dedicated cuttings re-injection well have also been dropped.

"We have found an alternative way of handling cuttings in an environmentally friendly manner back down the wells," Hughes explains. Fifteen of the first-phase wells will be producers and eight water injectors. "We plan to drill in batches of two producers and one injector." If production exceeds expectations, five extra slots are available on the platform for extra wells.

"Our plan is to get all these wells in the ground by mid-2009. Nonetheless, we recognized the uncertainties associated with the reservoir's behavior, and a key feature in our design was including a mezzanine deck set aside for simultaneous well servicing, including the use of heavy coiled tubing intervention units. We have a dedicated area in between decks for this equipment and onboard cranes sufficient to rig it up. The intervention unit can be run at all times without interfering with the drilling operation."

Water injection capacity will be 60,000 b/d, purposely matching the plateau rate for oil extraction. There will also be produced water handling capability for up to 70,000 b/d. As water breakthrough is expected during the second year of production.

All producer wells will be gas-lifted from day one – associated gas production will fluctuate, depending on how the oil comes out. Peak gas flow should hit 40 MMcf/d before tailing off as production declines. Some will be retained for power generation on the platform, supplied by three low-NOx, Solar Titan 130 gas turbines. Remaining gas not required for lifting will be exported through a 10-km 6-in. spur line recently installed by Stolt into the Magnus EOR trunkline. Oil will head to the Sullom Voe terminal in Shetland via a 105-km, 22-in. pipeline laid by the Allseas vessel Solitaire last summer. Much of the route closely shadows the track of the Magnus EOR line to minimize the environmental footprint.

"The Clair development represents a new benchmark for the North Sea. But that's what it takes now to compete in a global environment. This project will hopefully serve also as a legacy for the UK supply chain to compete elsewhere in the world for high quality and competitive topsides equipment."

Next year, the partners are considering drilling a well on the northern part of Clair's ridge segment. Here, recoverable reserves could amount to a further 200-400 MMbbl, according to partner ChevronTexaco. "The water depth here is also shallow, at around 155 m," Hughes said, "and this is where we think we might put in a second processing platform under a possible Phase 2 development. We also hope to use that well as the location for this facility. A second phase should keep us busy for the next six to eight years. In the longer term, there is also potential for a subsea development in deeper water in the main area to the southwest."