Brazil - Brazil seeks long-term partners for deepwater development

Fernando Zaider

Special Correspondent

Petrobras looks inward to expand production

Nearly seven years after the state oil monopoly came to an end, Petrobras still reigns absolute in deepwater exploration and production operations offshore Brazil. One indicator of the company's status in deepwater exploration is the number of international oil companies interested in partnering with Petrobras in deepwater projects abroad. Petrobras has confirmed its intention to form joint ventures to operate in some areas of interest to mitigate exploration risks and acknowledges participa-ting in farm-ins and farm-outs to optimize its exploration asset portfolio in Brazil.

"The company is open to long-term strategic alliances based on technological synergies with other companies," Guilherme de Oliveira Estrella, E&P director at Petrobras, said.

Over the last 50 years, Petrobras has looked for technology and know-how within Brazil. In the 1950s, when the state company was incorporated, there were no skilled professionals available on the Brazilian market. That was a void Petrobras set about filling. Today, the company is one of the largest employers of geologists in the world, with more than a thousand geoscientists. Throughout its 50 years, Petrobras has invested heavily in training geologists and assessing the oil-bearing potential of Brazil's sedimentary basins.

"This know-how gives an enormous competitive edge against other operators," Estrella said. "While they only study the blocks offered in auctions, our major advantage is having overall knowledge of the basins."

Estrella believes this workforce allows Petrobras to confront new challenges anywhere. "Geology works with analogies, and the skill of a Petrobras geologist in interpreting a Brazilian basin can be applied overseas," he said.

The portfolio

Petrobras has a balanced portfolio of exploration concessions. Its primary focus is the deepwater regions in the southeastern Espírito Santo, Campos, and Santos basins. However, the company also has blocks in productive mature basins onshore, in shallow-water basins, and in deepwater frontier basins, such as Jequitinhonha, Ceará, Barreirinhas, Pará-Maranhão, and Foz do Amazonas.

The company has four principal exploration strategies:

- Continue operating in mature onshore basins

- Explore for new oil provinces in the southeast offshore region outside the Campos basin

- Open new exploration fronts in frontier basins

- Change the company's heavy oil profile through light oil and gas discoveries.

Activity in the last two years has resulted in major heavy oil discoveries in the Campos basin, a sizable gas discovery in the Santos basin, and light oil discoveries in the Espírito Santo and Sergipe-Alagoas basins.

In 2004, operations have continued in the southeastern Espírito Santo, Campos, and Santos basins. Exploration drilling should begin soon in the frontier basins of Jequitinhonha and the equatorial margin. New discoveries are expected in the southeast basins as well as Sergipe-Alagoas, and important new exploration fronts will open in the basins of the Jequitinhonha region and the equatorial margin, the latter with higher risk but expectations of larger discoveries.

In 2004, assessment plans with regulatory Agência Nacional do Petróleo (ANP) on last year's discoveries are now into the sixth round. Estrella predicts a tough battle for the areas around the blocks that it returned from the Zero Round.

The Campos basin, the superstar of the Petrobras constellation, responsible for 83% of Brazilian crude production, is in sharp decline. Current production stands at 1.2 MMb/d, with no new discoveries in site. Production is dropping at 10% per year, around 120,000 b/d. Looking on the bright side, results achieved in 2002 and 2003 in the Espírito Santo (light oil) and Santos (gas) basins imply these regions could be important, new oil-bearing provinces.

The Campos basin itself, which has not seen major discoveries since the Roncador field in 1996, is moving into a new phase with its oil-bearing province stretching northward toward the Espírito Santo basin (BC-10 and BC-60), and southward toward the Santos basin (BC-20).

To compensate for this decline, the company is developing technological programs for heavy oil production and water production as well as mature field management. It is also investing in E&P. Two new wells will be drilled in the Campos basin's Marlim field.

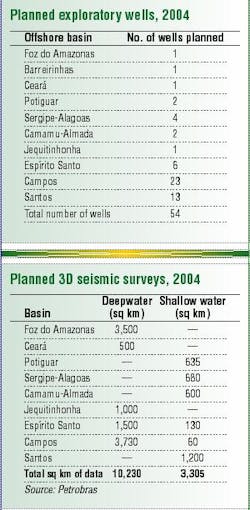

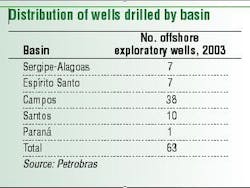

Last year, 79 exploratory wells were drilled in concessions where Petrobras has holdings. Of these, 63 were offshore wells, six of them in blocks in partnership with other companies. Of all exploratory wells drilled in 2003, 26 were considered discoveries or producers, resulting in a 33% exploration success rate. Sixteen of all drilled wildcat wells were considered discoveries, resulting in a 30% success rate. Plans for 2004 are to drill 75 exploratory wells and to acquire 13,535 sq km of 3D seismic data in Brazil's offshore basins.

The company will no longer auction mature fields, considered non-economical in the past. It reconsidered its decision when oil was at $10/bbl. Today, when the international market pays around $30 for the Brent barrel, business has changed considerably. The decision to retain areas considered profitable was based on the fact that the major E&P business of Petrobras Energia, former oil company Perez Companc, are mature fields in Argentina and Venezuela.

Vast experience is now being transferred through seminars. Petrobras also prepares new production models to sustain profitability of mature fields, which are used as test areas. "There, we learn how to deal with new and giant fields. It is easier to adopt new technologies onshore. If all goes well, we then apply it to deepwater," Estrella said, adding that the fields give profit to the shareholder since they are in producing areas where already amortized equipment is installed.

Jackpot

The planned E&P investments between 2003 and 2007, says Petrobras, will total $22.4 billion. More than 80% of this total, around $18 billion, will be allocated to domestic projects. Only $4.4 billion will be invested in international projects. In exploration alone, Petrobras will disburse $2.1 billion. But the jackpot lies in production development, to be shared among equipment suppliers and service providers to create a large volume of business in Brazil – $15.9 billion, approximately 53% of the total $34.3 billion in investments planned by the company for the period.

Estrella believes this volume is attracting foreign companies to set up businesses in Brazil to meet the goal of President Luiz Inácio Lula da Silva to have a minimum rate of 60% local content in the oil company's procurement. To meet this objective, companies have to set up subsidiaries in Brazil.

"Our investments in Brazil attracts everyone here," Estrella said, pointing to new alliances between foreign and national shipyards in São Roque do Paraguaçu, Bahia, and in Paranaguá, Paraná. The director says that Espírito Santo is also looking for an association between Brazilian and foreign shipyards.

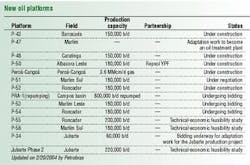

Six projects now underway with a planned total cost of at least $2.6 billion should increase the company's average daily production of around 700,000 bbl of oil and 27 MMcm of gas. The projects include converting vessels into FPSOs for the Marlim Sul, Barracuda, Caratinga, Albacora Leste, and Jubarte fields and putting the P-52 semisubmersible to work on the Roncador field.

Three projects are in the process of being bid. When ready, they will represent a rise in production of 560,000 b/d of oil and 19.2 MMcm/d of natural gas.

Fleet renewal

Petrobras is also investing money in renewing the offshore fleet. The subsidiary attending the petroleum transportation logistics system, Transpetro, has its own fleet of 53 ships. The entire Petrobras system uses 115 tankers. The company's goal is to build 22 new tankers by 2010, with investments of $1.1 billion. These will include Suezmax, Panamax, and Aframax models as well as product (light oils) ships.

A single Suezmax ship with 160,000 tons of crude capacity involves orders of 17,000 tons of steel plates, 6,000 tons of sections, 3,000 tons of pipes, 250,000 liters of paint, 900,000 cu m of oxygen, 80 km of electric cables, 12,000 sq m of flooring, and 500 tons of electrodes, among numerous other items. In the building phase of 22 ships, 24,000 direct and 120,000 indirect jobs should be created. Bidding will begin in 3Q 2004.

One of Petrobras' goals is self-sufficiency. The company intends to achieve that in 2006. Petrobras believes it will become a net exporter of petroleum and byproducts by that time. In 2003, national hydrocarbon production was around 87% of the demand. When the Barra- cuda-Caratinga, Albacora Leste, and Marlim Sul platforms start production between October 2004 and October 2005, around 300,000 b/d will be added to production levels.

The annual average production for 2003 was 1,540 MMb/d of oil, natural gas liquids, and condensate, and represented a 2.7% rise against the average production of the year before (1,500 MMb/d). Natural gas production (not liquefied) was 39.83 MMcm/d, equal to 2002 production, with a total average production of 1,791 MMboe/d, a 2.2% rise against the average for the year before (1,752 MMboe/d).

After closing 2002 with 11 Bboe in proven reserves, the company ended 2003 with 12.6 Bboe, plus its production of 600 MMboe for the year. "For each barrel produced, Petrobras discovered around 3.5 barrels to add to reserves. It is a major landmark, which does not reflect today's directors but all 50 years of the company," Estrella said.