SATELLITE COMMUNICATIONS How the petroleum industry is using satellite services

Seamless data transfer and communications

growing as satellite use expands, costs go down

Robert G. Burke

Contributing Editor

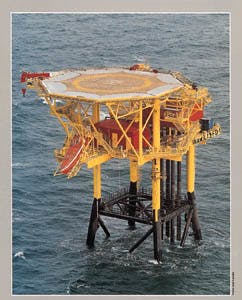

Ocean America, a semisubmersible equipped for satellite communications and operated by Diamond Offshore Drilling Co., drills for British Petroleum in the US Gulf of Mexico.

For offshore oil and gas, satellite communications seems made to order. It's fast, simple to use, and capable of moving huge amounts of voice, fax, and data from here to there, anyplace on the globe, in a fraction of a minute. Nearly everybody benefits one way or another - drillers, logging, and seismic contractors. And their clients, of course, the producers.

Right now, there's an unhappy tradeoff: costs are, quite literally, sky-high. But that's changing fast as service providers slash prices 10-15% to lure more oil and gas customers into the fold. Further price reductions will come from new compression methods offering the promise of economically sending an entire 3-D seismic survey to shore practically as it happens on the open sea. And , as savvy established clients push for volume discounts and consolidated billing.

So what are producers and service companies doing to adapt, and how do they manage under these conditions? You might be surprised at how easily they did convert, at how quickly they changed operations to fit a new, fast-emerging technology, at just how much they've already done. And more is coming in the future.

Basic services

The only global service now available for commercial users comes from Inmarsat, a consortium of 40 nations operating land earth stations. Inmarsat offers a narrow L-band analog service from five primary satellites, but a digital alternative offering voice and fax only came into play in 1993. Inmarsat plans a third generation of satellites in the sky beginning this year to provide more capacity. Within Inmarsat, four standards of service are offered - A, B, C, and M. Soon there will be P for small hand-held phones which should arrive on the market, priced about $4,000 each.

- Inmarsat A provides a high-quality phone, telex, fax and data service at transmission speeds of 9.6 kilobits per second (kbps). Manufacturers now offer a high speed data option, supporting simultaneous exchange of data in two directions at rates of 56-64 kbps, if land lines are available. Terminals for Inmarsat A from a number of manufacturers go for $30,000-50,000 in a suitcase size.

- Another analog option and most popular of all is C, an affordable service supporting Global Marine Distress and Safety Systems (GMDSS). Beginning this year, all ships and mobile offshore rigs must have a GMDSS unit on board at all times. Limited to a slow 600 bps, this analog service handles only text and data.

- Digital Inmarsat B aims for high volume users and offers fax transmissions at 9.6 kbps speed and data rates up to 56-64 kbps. Compared to A, this service promises savings in call charges and may replace A by the year 2006. While the service reaches globally, not all earth stations can handle digital signals.

- Also digital, Inmarsat M provides satellite phone, fax and data service at 2.4 kbps but isn't compatible with GMDSS.

Comsat Mobile Communications, a private company representing the US in the Inmarsat organization, and LDDS WorldComm, a private company leasing satellite circuits from Inmarsat and Intelsat, provide most satellite services. Each has earth stations on both east and west coasts and elsewhere in the world.

Outside of these, earth stations most commonly used by oil and gas are Goonhilly in the UK operated by British Telecom, Telenor's Eik in Norway, and Singapore Telecom's Sentosa. Other providers seeking to gain a foothold in this market include Japan's KDD, Station 12 of The Netherlands, Australia's Telstar, and Canada's Teleglobe.

Satellite procedures

Procedures for making calls differ from country to country. Every terminal in an Inmarsat system has a number. Each ocean area satellite has two three-digit prefix codes, one for phones and one for telex, much like area codes. In countries with automatic phones, a caller reaches Inmarsat users by dialing an international access code, the prefix code for the ocean region where the terminal is, and a terminal's assigned seven digit number.

Before satellite services came into being, a radio operator had to monitor a frequency assigned to his ship. To make a call, he had to contact a coastal radio station and wait his turn, sometimes for hours. Transmission was poor and broken by static and atmospheric interferences.

Phone calls using Inmarsat are free of noise and simple to make as placing a call from home. Pressing a request button sends a signal to an earth station and to the network control center for that satellite. Within seconds, a caller can dial a number in the conventional manner.

Intelsat, a separate consortium, also provides satellite services for phone and television broadcasts on the wider C and Ku-bands, but reach is limited. Equipment for this service is called VSAT for very small aperture terminals and requires stabilized antennas. A number of companies including Hughes Communications maintain hub stations in North America for C-band and Ku-band service.

Western Atlas Logging Service's ECLIPS unit, at work on Shell's Auger platform in deepwater Gulf of Mexico, performs simultaneous data acquisition and transmission services.

Fixed connection

"For us," says PGS's Matthew Liste, "the essential difference of VSAT over Inmarsat is having a connection ready at all times as opposed to having a dial-in on Inmarsat. Over a fixed connection, we can multiplex voice and data and even video together over the same line. Also, we can achieve faster speed, typically up to 512 kbps."

And, of course, with a fixed connection, there are no time charges. Basic VSAT equipment costs from $100,000-150,000 per marine installation, so a choice between VSAT and Inmarsat does require careful analysis.

Now coming on the market are new satellite programs assembled by private companies around the world to cover Europe, North and South America, and the Far East. These include low to intermediate orbiting satellites. One advantage they have is eliminating the half-minute delay incurred using satellite. An early contender was American Mobile Satellite Corp. offering service for North America and 600 miles out to sea including the Gulf of Mexico. AMSC attempts to connect cellular and satellite services into one program.

Administrative uses

The importance of this service to offshore oil and gas can hardly be overstated. "Satellite communications has become absolutely essential to the oil and gas offshore world," says Matthew Liste, project manager for PGS Exploration, a seismic company based in Oslo, Norway, having offices in Houston and London.

"Without that in the North Sea," he says, "we couldn't communicate at all. As a seismic contractor, we've used satellites for years, especially for voice and positioning capabilities. Three years ago when the service was added we began using high-speed data (HSD), mostly for navigational data and quality control of seismic 3-D surveys."

Randy Woodruff, manager of network support for Western Geophysical, a division of Western Atlas International in Houston, agrees: "We're doing more communicating by satellite than we did a year ago, and we'll do more in three months than we do now," he claims.

Seismic contractors, much like those involved in logging and drilling, also use satellites to phone partners and clients, pass along spreadsheets and financial accounts, and progress reports. But the most basic uses are for E-mail supplied to contractors by a number of different sources.

"We use E-mail daily on all our ships," says Dennis O'Neill, technical manager for data processing for Geco-Prakla's North and South America regions. "Not only E-mail but we can send documents and even small data files as attachments. Sometimes the latest set of view graphs for a safety lecture or personnel presentation on ship. We did a shoot for the French oil company Total off Argentina and used satellite communications to send software updates. On our VSAT-capable ships, we send data plots and quality control reports on a routine basis."

Virtually anything done on a desktop computer in an office can be accomplished at a remote site, says Geco-Prakla's O'Neill. "We even browse the Internet web."

As for drillers, new uses crop up all the time. The daily report is being automated now, says Michael Trahan, director of management information services for Diamond Offshore Drilling Co., Houston. "That would be sent over a communications data line rather than phoned in," he explains. "We're in process right now of implementing this."

Logging contractors, old hands at using satellite communications, seek better ways to communicate: "We send back wireline data acquired in the field to clients and our own offices for processing and analysis," says L. Curtis Lehmann, Jr., regional communications manager for Western Atlas Logging Services, a division of Western Atlas International based in Houston. "One growing use is Lotus Notes, a software program to accumulate business records and messages. Everything from consumable inventories to personnel records are charted. At selected times of the day, various remote sites are polled and everything sent to a commercial mail box or directly back to the home office."

Connecting data bases

Efforts to connect offshore sites into mainframe computers already have begun. "We would like to connect all our rig computer systems into our central computer system," says Diamond Offshore's Trahan. "This could open several opportunities such as allowing a rig to examine inventories on all rigs worldwide and in every warehouse for a replacement part. This would allow our materials control department to provide a more timely service."

Connecting all rigs to a central computer could also reduce the amount of inventory spares currently required by each rig, Trahan points out. "We can't do that now because Inmarsat time, nearly $10 a minute, is so expensive and VSAT startup costs are too high to justify the return of investment," he says.

Similar approaches are under close scrutiny elsewhere. Peter Sack, systems engineer for Digicon, Houston, wants to create a status report available by computer. "Doing so would allow system managers and accountants, even corporate planners, to learn a vessel's status within hours. Company officials could log onto the data base via the Internet by laptop computers from a hotel room anywhere in the world. Through passwords and other security measures, outsiders would be locked out."

Such procedures aren't far-fetched: "Digicon already has a web page," says Sack. "We're building data bases just for this. And someday, when Inmarsat P is out, we could access these data bases on a hand-held phone from anywhere in the world. Probably at lower cost than today."

This idea could extend even to providing clients access to certain files and records. Western Geophysical's Randy Woodruff believes a system will evolve allowing direct contact. "Security issues are a problem," he says. "We can't have a unique connection for each client, so we'll have to develop industry-wide security standards. Certainly, we must come to grips with this."

Quality control

According to some communication experts, another promising goal for satellites is to merge gathering of seismic field data with processing centers to analyze and interpret a survey's results while a ship remains on location.

Ordinarily, a seismic study can take up to a year to complete. Compiling data takes two to three months. Afterward, all data must be sent by jet or helicopter to specialized processing centers. If there's something wrong with the data, more seismic has to be shot, perhaps taking a year or more to complete. Then more processing and analysis.

"Now it can be down to months," says Digicon's Peter Sack. "Actually right now we can get down to days. We can bring seismic and navigational data back to shore. Two things helping us are reductions in satellite costs and acceptance of compression algorithms."

Geco-Prakla's O'Neill sees big improvements by sending seismic data to shore. "If we could get the key information to the oil company decision makers soon enough so that, for example, they could decide to extend the survey another two kilometers in a particular direction while the vessel is still on the prospect, we'd make big strides forward. There are several ways we can do this with wide-band data transmission. With conventional VSAT service, which you can obtain in the Gulf of Mexico and North Sea, you get about 64 kbps. To send enough data back you need compressions of at least 30-to-1."

Typical satellite enclosed dishes crown the midship facilities on board the Geco Diamond, a seismic vessel owned by Geco-Prakla, a seismic gathering division of Schlumberger in Houston.

"The future is to move data in a big way," believes Western Geophysical's Woodruff. "We're working now on ways to move data in a special way. The industry has a project underway for asynchronous transfer mode (ATM), a method to move data on ultra-high speed satellites never previously attempted."

Meanwhile, more conventional satellite communications allows quality control and navigational plotting to ensure better seismic, says Kelvin Brown, consultant formerly with Western Geophysical and Western Atlas Logging Services and now representing California Microwave, a manufacturer of satellite equipment.

"Seismic vessels already send navigational data back to shore for quality control of a survey," says Brown. "And they are sending back some seismic data as well. A holdup is the cost of satellite time. Data compression shortens the time needed to move data. Software programs exist to compress data as much as 10-to-1 and 40-to-1. Chevron Petroleum announced a method last year to reduce data by 100-to-1 without significant loss. Any compression algorithm has some sort of loss, and this could delay the process."

Sending navigational data to shore is another matter. "We do that routinely," says consultant Brown. "The home office or client can verify a ship's location once a day or more often. Not so much the ship but where streamer cables and shot points are located. If a vessel gets off course or noise interferes with reception, the survey can be halted and redone."

"For quality control, selected data goes to computer centers on land. We can process and determine if a client gets what he wants. If not, we change parameters as we record the seismic information," says PGS's Liste.

"We calculate velocities which are the speed of sound through rocks for given surveys and send that data back to shore for interpretation. If the client isn't satisfied with what he's getting, we can change parameters so specifications of a survey can change while the ship is on location. As a result a client saves money and turnaround time."

Additional savings accrue to prudent use of modern communications. "Employing satellites can remove the necessity of a client or third party staying at the site as a bird dog," comments Geco-Prakla's O'Neill.

Clients save as well. Since experts are senior people, they remain on shore to supervise more surveys than if they were on board a vessel.

Health and safety

Having a satellite communications link to allow teleconferencing has strong health and safety features, says Western Geophysical's Woodruff. "With video cameras out there, clients can see for themselves what safety practices are in force or how efficient a crew operates. They can watch a survey in action, see what's happening on deck or in the water. Possibilities are endless."

Medical emergencies can be handled by satellite, says consultant Brown. "Blood pressure can be read or experts consulted when a mishap occurs. A physician on land can examine a patient, ask questions to determine his condition, and decide what to do. Much can be done using today's technology and adapt to meet a situation."

"Telephone calls from rig to shore help maintain morale," suggests Diamond Offshore's Trahan. "If we put VSAT in international areas, this would allow us to have a Houston dial tone. This would allow personnel traveling overseas to make phone calls back home for the cost of a long distance charge from Houston, regardless of where the rig is located."

So many ideas exist for adapting satellite communications to offshore work, they can hardly be counted.

"Rigs produce a lot of data," says Diamond's Trahan. "Newer devices are not only monitoring data but are starting to collect and store it. The more data we have, the greater the need will be to have immediate access to it. This data is becoming extremely important in diagnosing problems."

In the future, he wants to use video monitors to view many operations on a rig. "If we are having a problem with a piece of equipment on the rig," says Trahan, "it would be convenient to use a video camera to show the problem to the maintenance department and manufacturers. We may be able to solve more problems without having to mobilize someone to the rig."

How big is the market?

Today's satellite communications market for oil and gas approaches $300 million a year, according to Charles Baldwin of Communications Marketing Services, a consultant monitoring the field from Austin, Texas. "And the potential to expand is so great it can hardly be calculated," he says.

Others within the industry estimate the use of satellite time could easily double in five years. If only a few research projects underway prove out, the jump could be much larger. And if the cost of service comes down, even only a few dollars a minute, as many expect to happen, the market will surely become even bigger.

Out of this total, which includes capital costs of equipment as well as monthly charges for time used, comes the following:

- Production: An estimated $100 million is spent by producing companies on satellite communications. About half that amount goes for high-speed data transmissions and equipment.

- Seismic, logging: Seismic and logging operations account for another $100 million, split about evenly between the two. Their uses for high-speed data transmissions have the highest potential for market gains in the future.

- Drilling: Drilling activity uses the least amount of satellite time at present, maybe on the order of $50 million a year worldwide, mostly for communicating between offshore rigs and shore. But their need will grow also.

Producers reign

Of all these uses, oil and gas producers remain at the center. They tend to use Inmarsat and VSAT levels of service for voice and fax and perhaps E-mail in their ordinary business but transfer of data has become a growing part of their operations. And while producers do not themselves hold out the greatest potential for additional uses, they are at the core of the entire operation and their needs are paramount to any future of satellite communications inside the oil and gas industry.

On their own, producers use satellite communications for voice, fax, and telex connections to a worldwide range of field and exploration offices. Pipeline controls are a common everyday use. A growing use is point-of-sale transactions which nearly every large oil company uses for retail stations, particularly in the United States.

And now, with introduction of high-speed data transmission, producers buy more Inmarsat time and will continue to do so as more ways to use the service come about. To meet this challenge and to remain competitive in the industry, contractors for seismic, logging, and drilling services look at new ways to incorporate satellites in their communications program.

ATM could be next step forward

The oil and gas industry's ATM Research and Enterprise Study (ARIES), a unique collaboration between government and industry barely two years old, may one day lead the way to a completely new, ultra-fast global communications system.

ARIES came into being to establish a communications network across the country using a new technology called asynchronous transfer mode (ATM). ATM allows very high data rate transmission over optical fibers at speeds starting at 45 megabits all the way to 1-2 gigabits, faster than tapes and disks operate, says David Beering, ARIES project technical director and senior staff analyst for Amoco Production in Chicago.

About the fastest available for standard uses today is achieved by T-1 of 1.54 megabytes per second (mbps). Inmarsat is limited to 56 or 64 kilobits per second (kbps) on high speed data equipment and VSAT transmits at rates up to 512 kbps.

Recognizing the possible uses, the American Petroleum Institute (API) came on board in 1995, and ARIES became a joint project. "We focused on seismic acquisition because so much was at stake," says Beering. Ordinarily, seismic data accumulates offshore on tape. They bring tapes to shore by helicopter or when a vessel lands in port. Surveys can take a year or more, depending on whether additional data has to be acquired.

Moving data by satellite from ship to processing centers on shore allows faster decisions. Ships can be re-directed, even on the same day. "We figure a month saved was worth $200,000," notes Beering. Since industry conducts an average 200 surveys a year, the impact was worth millions, even billions.

According to API, ARIES is one of the most significant public and private collaborations since the famed Apollo space program that put Americans on the moon. To make this possible, ARIES depends on NASA's advanced communications satellite (ACTS) program. The space agency ordinarily makes the experimental satellite available for study. ACTS has a capability of 150-155 mbps. "You can't go out and buy those kinds of services from Inmarsat and Intelsat," says Amoco's Beering.

By this time, two US government agencies, Departments of Defense and Energy, signed on. NASA brought on board the Lewis Research Center in Cleveland and Jet Propulsion Laboratory in Pasadena, Calif.

The first demonstration in December 1994 linked an oil platform off Louisiana to a Washington committee room to prove signals could be sent. A second demonstration in September 1995 connected scientists at the National Center for Atmospheric Research in Boulder, Colorado, to oil researchers in Cleveland and Columbus, Ohio, and Houston. At this, seismic data was moved and analyzed at a distant site.

Super satellites

Next was an actual test at sea. In February, The Geco Diamond, a seismic vessel 120 miles off the coast of Texas, connected to NASA's satellite. Data moved at the rate of 1-2 mbps onto a land-based ATM system, says Dennis O'Neill, technical manager for data processing for Geco-Prakla's North and South America regions.

The ATM net worked as planned. NASA's Jet Propulsion Laboratory in Pasadena, Calif., captured data and distributed to Cray Research's Minnesota Supercomputing Center in Minneapolis, Minnesota. Also connected for the test were Chevron Corp. and Sandia National Laboratories in California and Amoco Corp., Shell Oil Co., Geco-Prakla, and the Institute of Bioscience & Technology in the Texas Medical Center at Houston.

At the demonstration, in addition to seismic data, medical imagery came from the Geco Diamond to the Texas Medical Center. On a two-way video link, Dr. Michael DeBakey, noted heart surgeon, provided medical advice. He counseled a crew treating a simulated heart attack patient as part of a health and safety exercise.

The ARIES team has established regional ATM centers in Houston with Teleport Communications Group and in San Francisco with Pacific Bell. The long-distance network, which operates at the T-3 speed of 45 mbps, is provided by AT&T and Sprint, Beering says. Additional centers in Chicago and Washington, DC, will provide connections for sites in Dallas, Los Angeles and New Orleans.

ARIES is a true research project aimed at commercial implementation of ATM so once this takes place, the use of NASA's ACTS satellite will no longer be available. And that could lead to a new generation of super satellites.

"This won't work within Inmarsat or existing VSAT frequencies, I'm afraid," says Geco's O'Neill. "Typically, they work on Ku or C-Band. ACTS uses what is called KA-band which has a 20-30 gigahertz frequency."

Commercialization

"NASA wants to see commercial providers of 64 kb services adopt this technology so we could view it on a commercial basis," says Amoco's Beering. "Certainly to the Gulf of Mexico to start and worldwide beyond that."

Without commercial service today, the ARIES team is already examining other possibilities. Both US Department of Defense and NASA have satellites already in the sky capable of providing service, says Beering. A feasibility study is underway to use one or two.

"We need new satellites," says Geco-Prakla's O'Neill. "Service providers like Hughes Aerospace or Intelsat might accept a NASA decision and launch four or five of these satellites."

Different satellites - either new or borrowed from Defense - would transmit in the range of 1-2 mbps. "So maybe we won't need 30-fold compression rates to get full-fidelity seismic data off the boat," says O'Neill. "Maybe you only need two fold compression which has no losses."

Copyright 1996 Offshore. All Rights Reserved.