Offshore staff

OSLO, Norway — Rystad Energy Oil Market has responded to yesterday’s decision by the OPEC+ nations to cut crude production by 2 MMbbl/d in November.

ICE Brent Front Month rose to $94/bbl following the announcement, up from $88/bbl last Friday

Jorge Leon, Rystad's senior vice president, however, said it was unlikely the group could attain the full headline cut.

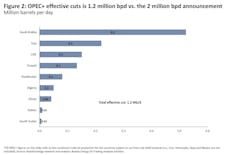

However, there is scope to deliver 1.2 MMbbl/d of effective cuts as 14 of the 23 member countries (which accounted for 39% of the group’s production in September) are underproducing, so the new quota will not be binding.

He cited Russia where production is about 9.7 MMbbl/d, but with a new quota of 10.5 MMbbl/d.

Saudi Arabia, Iraq, the UAE and Kuwait will collectively undertake the majority of the 1.2-MMbbl/d reduction in November, with further cuts in Kazakhstan, Algeria, Oman, Gabon and South Sudan.

The group also announced its Declaration of Cooperation would be extended until the end of 2023.

“This adds a year of potential sturdy oil price floor amid what OPEC+ describes as `uncertain’ global economic outlook and the need for long-term guidance in the oil market,” Leon said.

And the 23-member group will only meet every six months, suggesting the new target production level of 40.1 will not undergo changes on a month-to-month basis. But there is scope for policy tweaks should market conditions waver, he added.

“We believe that the price impact of the announced measures will be significant. By December this year Brent would reach over $100/bbl, up from our earlier call for $89/bbl.”

The US has stated its "disappointment" over the move and plans to release an additional 10 MMbbl in November. The US government may also consider legislation aimed at what has previously been dubbed “NOPEC”, restricting how OPEC+ barrels are imported to the US, Rystad claimed.

Higher oil prices will add further to global inflation headache, with potential for more interest rate rises.

10.06.2022