Lease sale offshore Massachusetts yields $405 million in winning bids

In mid-December, the US Department of Interior and the Bureau of Ocean Energy Management (BOEM) completed what it described as the nation’s eighth and highest grossing competitive lease sale for renewable energy in federal waters.

The lease sale offered about 390,000 acres offshore Massachusetts for potential wind energy development and drew competitive winning bids from three companies totaling about $405 million. If fully developed, the areas could support approximately 4.1 gigawatts of commercial wind generation, enough electricity to power nearly 1.5 million homes.

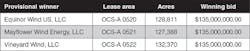

The provisional winners of the lease sale are:

The following companies participated in the lease sale: Cobra Industrial Services, Inc.; East Wind, LLC; EC&R Development, LLC; EDF Renewables Development, Inc.; Equinor Wind US, LLC; Innogy US Renewable Projects, LLC; Mayflower Wind Energy, LLC; Northeast Wind Energy, LLC; PNE WIND USA, Inc.; Vineya qrd Wind, LLC; and wpd offshore Alpha, LLC.

The three lease areas auctioned are located 19.8 nautical miles from Martha’s Vineyard, 16.7 nautical miles from Nantucket, and 44.5 nautical miles from Block Island.

“This auction will further the administration’s comprehensive effort to secure the nation’s energy future,” said BOEM Acting Director Cruickshank. “The Commonwealth of Massachusetts and members of the Massachusetts Renewable Energy Task Force have been great partners throughout this process. We look forward to working with them and the lessees as we move forward with next steps for developing offshore wind energy in a responsible manner.”

Before the lease is executed, the Department of Justice and Federal Trade Commission will conduct an anti-competitiveness review of the auction, and the provisional winner will be required to pay the winning bid and provide financial assurance to BOEM.

The lease will have a preliminary term of one year, during which the lessee may submit a site assessment plan (SAP) to BOEM for approval. The SAP will describe the facilities (e.g., meteorological towers or buoys) a lessee plans to install or deploy for the assessment of the wind resources and ocean conditions of its commercial lease area.

The December 2018 lease sale offshore Massachusetts offered about 390,000 acres for potential wind energy development. (Courtesy BOEM)

Following approval of an SAP, the lessee will then have four and a half years to submit a construction and operations plan (COP) to BOEM for approval. Once BOEM receives a COP, it will conduct an environmental review of the proposed project and reasonable alternatives. Public input will be an important part of BOEM’s review process. If BOEM approves the COP, the lessee will then have a term of 33 years to construct and operate the project.

Before this lease sale, the highest grossing offshore wind lease sale in the US was held in December 2016 for the lease area offshore New York. That lease sale received a winning bid of over $42 million, according to BOEM.

After this auction, BOEM now has 15 active wind leases. The bureau added that these lease sales have generated more than $473 million in winning bids for nearly 2 million acres in federal waters.

New technologies

A number of leading oil and gas service companies and manufacturers are gearing up to serve the growing offshore wind market. A brief survey of some of the now offerings is below.

Wind floater concept wins AIP. SBM Offshore has announced that its wind floater design, including its mooring system and featuring a commercially available offshore wind turbine, has been granted an Approval in Principle (AIP) by classification society American Bureau of Shipping (ABS).

Based on a TLP concept, SBM Offshore says that its wind floater has been designed for operations across the full life cycle. (Courtesy SBM Offshore)

Based on a TLP concept, SBM says that the wind floater has been designed for operations across the full life cycle, including in-place conditions, as well as for wet tow with the turbine installed and mooring hook-up phase. The approved design has been developed to a technology maturity level of a front-end engineering design for all relevant extreme and fatigue load cases, using detailed wind and metocean conditions for a site offshore France.

SBM says that the complete design was developed in-house and in collaboration with its partner, IFP Energies Nouvelles, using proprietary design tools and the detailed wind turbine model, including the controller.

The AIP verifies that the floater is feasible for the intended application and, in principle, in compliance with the applicable requirements of the ABS Guide for Building and Classing Floating Offshore Wind Turbine Installations and with sound engineering practices.

SBM says that the independent review supports its confidence in its wind floater’s performance, particularly related to its low mass, its minimal seabed footprint and low motions at nacelle level.

Wärtsilä launches SceneScan. This is described as the first laser sensor developed for offshore wind farm applications where the need for installing fixed reflective targets is eliminated. The new technology has been designed to increase safety onboard service operation vessels (SOVs), since vessel positioning sensors that rely on targets fixed to the structure are often unreliable because of poor placement, poor quality, and obscurement by workers on the platform. The SceneScan has been designed and developed by Guidance Marine, which was acquired by Wärtsilä in 2017. According to Wärtsilä, the SceneScan Monopole’s software allows for the measurement of range and bearing to the offshore wind turbine, independent of the use of targets and GPS. The technology is said to be highly applicable for China’s developing offshore wind market, as well as for North Sea wind farms. The first SceneScan Monopole was delivered in summer 2018 for a Chinese SOV newbuild project carried out by GE Power Conversion, a subsidiary of General Electric.

The system successfully underwent sea trials earlier this year onboard theWindea La Cour, a purpose-built SOV owned by Bernhard Schulte Offshore. The vessel is fitted with other Wärtsilä sensor solutions, including the RangeGuard Monopole, which is said to be the first targetless local position reference sensor based on radar technology.

New contracts

While oil and gas service companies and OEMs are gearing up for the offshore wind market, developers are looking to offshore oil and gas installation contractors to help advance their projects.

Subsea 7 has announced the award of a contract to Seaway Offshore Cables (SOC), an entity in Subsea 7’s Renewables and Heavy Lifting Business Unit, for the Yunlin Offshore Wind Farm project by YunNen Wind Power Co. for the supply and installation of the export and inner array grid cable system.

Sea trials for the SceneScan system (a) were successfully carried out onboard theWindea La Cour(b) earlier this year. (Copyright: Bernhard Schulte)

The Yunlin offshore wind farm is located approximately 8 km off the coast of Yunlin County within the Taiwan Strait on the west coast of Taiwan and comprises 80 wind turbine generators each with a capacity of 8 megawatts. In addition to the submarine cable installation works, SOC will also provide the pre-installation of horizontal drilling conduits, submarine cable route surveys, post lay trenching, termination and testing services. Associated materials will be provided including the supply of submarine composite cables and cable protection systems. Project engineering will commence immediately from SOC offices in Leer, Germany and Taipei, Taiwan. Offshore activities are planned for execution in 2020.

Elsewhere, Nexans has won a multi-million-euro contract for Ørsted’s Borssele 1 and 2 wind farms off the Netherlands coast. The contract for the 66-kilovolt (kV) submarine inter-array cable with associated accessories is the first to be placed under a new five-year framework agreement recently signed by Nexans and Ørsted.

The Netherlands plans to increase its use of renewable energy to represent 14% of its energy mix in 2020 and 16% in 2023. Offshore wind energy is an important part of this transition, and a major milestone is expected to be reached in 2020 when Ørsted brings its Borssele 1 and 2 wind farms online.

Nexans is supplying a total length of between 170 km and 190 km of subsea cable rated at a maximum operating voltage of 72.5 kV to provide the inter-array connections between the turbines and the offshore substations.

Borssele 1 and 2 are located around 23 km off the Dutch coast in 14 to 36 m of water. Together, they will have a total of 94 wind turbines generating 752 megawatt of power, which is enough electricity to meet the needs of around one million domestic households.

The array cables will be produced at the Nexans Germany plant in Hanover for delivery in 2019. After they have been laid in place on the seabed, Nexans Subsea and Land Systems will complete connection to the turbine bases using in-house jointing expertise in 2020. The cable accessories will be supplied by Nexans Euromold facility based in Erembodegem, Belgium.