FIDs in 2018 expected to nearly double last year’s tally

Matthew Fitzsimmons

Emil Varre Sandøy

Rystad Energy

Since 2014, the oil and gas industry has been challenged by falling oil prices. These lower prices have reduced both global investment levels and corresponding industry revenues to their lowest levels since 2009. However, the cyclical nature of the industry would suggest that these tough times will level off, and a new period of growth will commence. Recent market trends are indicating that this turning point will happen during 2018.

Let us first look back on recent years. After the oil price collapse in 2014, E&P companies prioritized cost cutting in order to improve the profitability of their projects. The offshore industry was especially challenged due to the complex and capital-intensive nature of their work, in comparison with onshore projects.

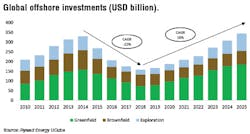

As offshore purchases have declined since 2014, no service segment has been immune. In fact, only maintenance and operations have managed to have less than a 30% decline from 2014 to 2017. Drilling contractors and seismic firms have experienced the worst of the industry’s decline. Purchases in those segments have been reduced to less than half their 2014 levels. Purchase trends will continue to get worse before they get better.

Global offshore purchases are anticipated to decline in 2018 by 5.1% vs. their 2017 totals. This will mark the fourth straight year of declines for an industry in search of good news.

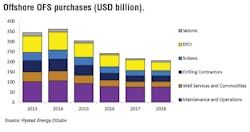

Subsea hit hard

Subsea revenues for the top eight suppliers have been on a downward trend since 2014. Due to long lead times for offshore projects, the revenue decline for the subsea sector has been slower than it has for other sectors of the upstream industry, such as onshore well stimulation services.

Current revenues are still compressed, and 4Q 2016 was particularly harsh on the subsea sector. The stable profit margins that have prevailed over the last three years have definitely come to an end, and 4Q 2017 represented the second consecutive quarter with an average decline in profits for the subsea segment. The lower margin environment is expected to last a couple of years, before we see that the supplier constraint that comes with higher activity will drive up prices for subsea equipment and services.

Floater and jackup markets

The first quarter of 2018 saw more contracting activity in the floating rig segment versus the same period in 2017. The North Sea was the most active market, with the United Kingdom accounting for 55% of the new mutual contracts in the region and Norway the remaining 45%.

While activity is picking up, only one contract award, excluding the four Sete contracts in Brazil, can claim a duration of longer than one year. More than 50% of the contracts were longer than three months, with durations ranging between four and eight months. The majority of contracts awarded to date have been for work in the North Sea (42%).

Contracting activity is being driven by majors such as Shell, Eni, Statoil, ExxonMobil, BP and Petrobras.

Utilization levels in the jack-up space have been range-bound in the low to mid-50% area.

Some drilling contractors have hinted that long-term work will be awarded soon. Ensco, Aban Offshore and Rowan have indicated one or more jack-ups will be picked up for work in the Middle East. Steady oil prices are making brownfield and near-term exploration work attractive. Better oil prices, coupled with continued low rates, are leading operators to move many projects forward.

At the time of this writing, Rystad Energy is still waiting for several long-term contract awards to materialize. Award announcements from several NOCs will provide multi-year contracts for 15 to 20 units and give a few newbuilds their initial contracts. All in all, several positive signs indicate that the rebound from declines is near.

Increasing investments

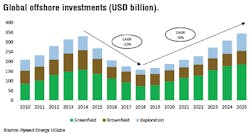

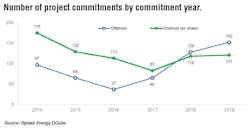

Operators have started to place faith in the offshore industry through their increasing commitments to new projects. A 75% increase in sanctioning activity was seen in 2017 versus the previous year. This trend is only growing stronger, as 2018 project sanctioning looked primed to nearly double 2017 activity.

Offshore work in Europe appears to be leading the charge. Rystad Energy estimates that 2018 will see a 4% increase in offshore purchases versus 2017 from the continent. The anticipated 2018 sanctioning of the Johan Castberg (Norway) and Neptun Deep (Romania) mega-projects will play key roles in the growth of European oilfield services procurement. All other geographies will follow suit in future years, as offshore industry purchases are poised to grow 8% yearly on average from 2018 to 2021. This is being driven by the increases in project sanctioning activity.

Regional shift

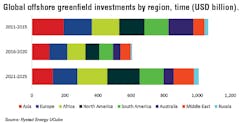

While global capex will hit a bottom in 2018, Rystad Energy estimates that this will start to increase again from 2019 and going forward. As the oil price has recovered and seems to have stabilized, E&P companies are more willing to invest in new offshore projects, and more projects have become commercial. With a strong market outlook and increased activity, there is also increasing competition to get the required services delivered at the preferred time, and this competition could drive costs higher. This mechanism was also apparent in the years building up to the 2014 peak. By 2025, Rystad Energy estimates that global offshore greenfield capex will have totally recovered and surpassed the 2014 level of investments.

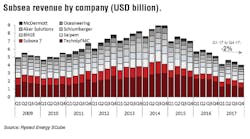

By region, there has been a shift in terms of where companies are allocating these investments. In the period from 2011 to 2015, Asia had the largest offshore investments, with Malaysia and China as the major targets. Europe, Africa, North America, Brazil and Australia all followed close behind, each with approximately 15% of the total investments.

From 2016 to 2020, a period with lower investments and high uncertainty in the market, Rystad Energy anticipates that the share of investments allocated to Australia will be cut in half. This region has seen a sharp decline in new LNG project investments.

In the last period, from 2021 to 2025, when we anticipate strong growth in investments, we see North America as the region that will experience the largest share, up from the fourth largest in the first period. We estimate on the other hand that Asia will fall from the largest to the fifth largest region in terms of investments. This drop for Asia is largely due to high breakeven prices for the non-sanctioned projects in the region, rendering many of them uncommercial in the price environment that has ruled since the collapse in 2014.

Finding value

As the offshore industry prepares for another down year, there is still money to be spent by operators. Rystad Energy estimates that $267.8 billion will be spent within the offshore industry during the calendar year. The vast majority will be through maintenance and operations contracts and EPCI awards ($76.3 billion and $41.5 billion, respectively).

For maintenance and operations, 2018 will mark the first year of increased spend since 2014. While EPCI is projected to have another year of declining expenditures, engineering expenditures are projected to increase by 15%. This signals that increased spending on equipment and construction is likely to follow soon. Similarly, other segments are starting to show signs of improvement. Offshore drilling and subsea 2018 expenditures are trending towards maintaining their 2017 levels. Rystad Energy is projecting that the industry will ‘bottom-out’ in 2018, and then commence a new period of purchase growth.

Upcoming projects

For 2018, the expected approved offshore resources are estimated to be 16.4 Bboe (7.9 Bbbl liquids). This year’s sanctioning activity is dominated by Saudi Arabia, Brazil, Norway and Iran. Collectively, these countries account for over 40% of the to-be-approved volumes.

Petrobras’ recently sanctioned Tartaruga Verde & Mestica project in Brazil represents $2.3 billion in potential contract opportunities for oilfield service companies over the next five years.

Excluding shale, 265 projects are expected to be approved in 2018. While the majority are onshore (56%), the offshore projects will give service companies the greatest opportunity for new contracts. Offshore projects sanctioned in 2018 will require nearly triple the project spend through 2025 as compared with their onshore counterparts. Operators look primed to invest $170 billion through 2025 on new offshore projects that will be sanctioned in 2018.

Of the upcoming 117 offshore developments, 63 are fixed platforms, 37 are subsea tiebacks, and 17 are floaters. While the majority of these projects are located on the offshore continental shelf, there will be significant spend in both deepwater and mid-water.

Key projects

With the estimated growth in global investments in the coming years, Rystad Energy has identified several significant projects as being the most likely to get approval in this period. In the table, we list the five largest projects, measured in resources, that are expected to achieve development approval within 2025 in each of the three key offshore areas – the North Sea, the Gulf of Mexico and Brazil.

In the North Sea, we believe current trends will continue, with a high proportion of new fields being developed as subsea tiebacks. By utilizing the existing, highly developed infrastructure in the North Sea, companies have been able to cut investments and lower breakeven prices. This has made even small discoveries commercial, as they can be tied back to existing infrastructure with spare capacity at a low cost.

In addition, the companies have been able to standardize much of the existing equipment packages and processes. For example, Statoil has been able to reduce estimated investments for the second phase of the Johan Sverdrup field from the original estimate of $9.8 billion to $5.6 billion.

The Gulf of Mexico is in many ways very similar to the North Sea, but with lower utilization of subsea solutions, especially on the continental shelf. The area is the main driver behind North America’s increasing estimated relative share of global offshore investments. Rystad Energy sees several large upcoming projects with resources in the range of 400 to 550 MMboe, a significantly larger average than the North Sea. Interestingly, there is a clear difference in breakeven prices of the top projects on the Mexican side of the Gulf, which range around $30/bbl, and those on the US side, which have breakeven prices around $45-50/bbl. The water depth can mainly explain this deviation, as the Mexican projects are located in shallow waters, between 100 and 450 m, while most of the US projects will be developed in depths between 1,000 and 2,250 meters.

The same can be observed in Brazil, where the breakeven for all the top projects are above $40/bbl. While these are projects with large amounts of resources, which drives down the unit costs, the ultra-deep waters of Brazil are nevertheless a very expensive area to develop new fields. On the top list, we see three of the four FPSOs planned for the giant Mero field, which is estimated by operator Petrobras to contain 3.3 Bbbl of oil in total. When all the FPSOs are installed on the field it will produce more than 600,000 boe/d, ranking it in the global top tier of offshore fields measured in output levels.

Recovery in sight

The cost savings that offshore operators and service companies have worked jointly to achieve of late have put the industry in a desirable position for the next several years. While the industry’s decline since 2014 has taken a toll, offshore investments appear ready to ramp up. The challenge for service companies and operators will now be to maintain their cost savings during a new period of growth in order to keep offshore projects competitive with other industries.

The authors

Matthew Fitzsimmons is Vice President Oilfield Service Research and Emil Varre Sandøy is an analyst in upstream research for Rystad Energy.