Jeremy Beckman - Editor, Europe

Their presence in Pyrenees also poses a challenge to the dominant subsea contractors in the Australasia region. Sea Trucks’ newest construction vessel, theJascon 25, will perform the main installations.

This is the third of seven DP-3 multi-purpose vessels commissioned by Sea Trucks, all undergoing assembly in yards in the Far East. The previous two,Jascon 30 and Jascon 28, were delivered earlier this year, while the remaining four should be completed by end 2010.

The aim of this program is to transform the group from a West African oilfield marine services specialist into a global subsea installation/construction support contractor, capable of operating in all mild offshore environments – and also responsive to shifting market requirements.

Sea Trucks president, Jacques Roomans, established the company in Lagos in the 1970s, initially to service oil and gasfield activities in Nigeria’s Delta region. This operation has grown to encompass supply/support bases in Escravos, Onne Free Zone, Port Harcourt, and Warri. The group also operates a fabrication yard in Onne, and provides local personnel for subsea construction projects via its indigenous subsidiary, West African Ventures.

In 2000, a new expansion phase started with a major new-building program to develop an offshore construction/accommodation fleet. The first of these vessels, the 104.3-m (342-ft) long, 24.4-m (80-ft) broad construction/accommodation bargeJascon 8, was delivered in 2002. This barge has been working since 2004 in Cabinda, Angola on the Takula field under a lifting and accommodation contract for Cabgoc.

At the same time, the group started construction of a DP-3 pipelay barge designed with the help of ex-Allseas and Heerema personnel. TheJascon 5 formed the basis for the fleet currently under construction. It was delivered in 2004 and sold two years later to one of Sea Truck’s customers, the Iranian Offshore & Engineering Co.

During this period, Sea Trucks also formed an offshore contracting division in Sharjah, UAE, to manage the worldwide activities of the new fleet. The headquarters, a quayside office complex in Sharjah’s Hamriyah Free Zone, was opened in April 2004, and eventually will accommodate over 400 staff. This will adjoin a warehouse and fabrication facilities within a 70,000-sq m (83,719-sq yd) waterfront premises.

Globally, it eventually will supervise over 2,000 employees including ships’ personnel and other group offices in Angola, Australia, China, and the Netherlands. The Nigerian division, however, will remain largely autonomous.

Kevin Wood, Sea Trucks’ senior vice president, business strategy, has experience in the Australian and Asia-Pacific sectors, having worked there for the Clough Stena joint venture and later Coflexip Stena Offshore. The 1990s, he recalls, was a period of slow metamorphosis away from their original roles as North Sea diving specialists for major subsea contractors.

New tonnage gradually emerged to suit the larger-scale demands of projects outside the North Sea. This was not the case in outlying areas such as Australia, however, where an average of one new SURF (subsea, umbilicals, risers, and flowlines) development every 18 months did not justify mobilization of a heavy-lift vessel.

The contractors got by with improvisation, modifying the installation spreads of their DSVs to work in these regions. But Wood became increasingly aware of the limitations as the focus switched to deepwater, bringing with it the need for higher-performance, multi-role vessels able to transport and install larger subsea consignments. This was a view shared by Roomans and his team, which eventually found expression in theJascon 5.

The latter was an intentional shift away from the ship-shaped culture designed for the North Sea towards a more functional, self-propelled barge concept with moderate transit speeds, but offering a larger working deck space, superior accommodation, and ample craneage for over-boarding heavy subsea lifts.

“Our fleet is not designed along the same principles as the latest Norwegian boats coming onto the market,” says Wood. “But dimensions and accommodation capacity are real concerns that the industry must deal with.

“We want our vessels to operate in areas where the sea conditions will not challenge their hulls too greatly, the only exceptions being theJascon 18 and Jascon 35, due for delivery in 2010, which will be able to lay flowlines and trunklines in shallow to ultra deepwater. Otherwise, we do not want our vessels to be transiting too much between, for instance, Africa, India, and Australia.”

Features include a large clear working deck beneath the accommodation superstructure, extending through to the bow; a modular pipelay spread, allowing certain vessels to switch between rigid S-lay and flexible pipelay on the same project; twin working decks to support heavy duty, large diameter rigid pipelay equipment on other vessels; and inter-changeable deepwater and shallow stingers, both gantry-operated, with no need for de-hitching while the vessel is in transit.

Accommodation demand

First off the production line in April 2007 was the 111-m (364-ft) long, 30.5-m (100-ft) broad accommodation/hook-up bargeJascon 28. This was followed in January by the similarly dimensioned Jascon 30, a shallow water pipelay barge with a modular S-lay spread, also available for use in an accommodation role.

To date, both have been in demand, Wood says. TheJascon 28 initially went to work in Malaysia for Petronas, and now is contracted to Total on the Akpo development off Nigeria. Its 400-bed accommodation block was upgraded recently, as were its 200-metric ton (220-ton) crane and its Kongsberg Simrad SDP21 DP-3 positioning system.

Following delivery,Jascon 30 went directly to Chevron’s Agbami field in Nigeria to provide accommodation, and recently headed south to support deepwater operations for 12 months-plus on Girassol offshore Angola. Both vessels are connected to the fields’ FPSOs via hydraulic gangways.

“As more of these remote fields are developed,” Wood believes, “there will be increasing demand for stay-on-site, multi-purpose vessels.” Another issue, he adds, is that so many FPSOs under construction in yards in Asia are behind schedule, leading to some being delivered to the field before they are actually completed.

“The problem is, the installers are on very large and immovable contracts. This means that while FPSOs are indeed installed on schedule, a lot of the completion work on these floaters may, in certain cases, have to be done offshore before commissioning can start. Such situations create a requirement for vessels such as ours with very large scale accommodation facilities, good crane and deckspace, and, of course due to the deepwater locations, fully redundant DP.

“We did not see this situation coming, but it has come. Our original expectations were that our vessels would trade between the conventional rigid pipelay market; the SURF market – big in profit, but not in volume – and the construction support sector, where the reverse applies. However, we now see these two sectors remaining active, along with this third segment, deepwater accommodation, to which our vessels are ideally suited.”

Sea Trucks has no problems managing its own construction schedules. The hulls for the new fleet are all being built in China, followed (so far) by completion at yards in Singapore. The company manages its own materials procurement, and liaises directly with a team of naval architects in China that it has engaged for the past 10 years.

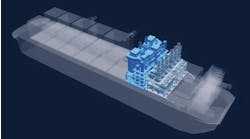

Jascon 25, delivered in November, is the first of four larger pipelay/crane/construction vessels built according to the group’s “hybrid design” philosophy. It will be able to switch between flexible pipelay and S-lay, with the starboard-mounted single-joint S-lay system installing pipes of up to 60-in. (152-cm) diameter (including coating), via a 55-m (180-ft) stinger. The 118.8-m (390-ft) long vessel offers a clear deck area of up to 1,500 sq m (1,794 sq yd), with a heave-compensated 800-metric ton (882-ton) marine crane, and accommodations for up to 355 personnel.

For Pyrenees, next February is its first contracted assignment. However, in the period towards delivery of the vessel in November, Sea Trucks received inquiries from three customers with pressing requirements.

“One wanted to install a buoy and flexibles in Australia’s North West Shelf,” Wood explains. “Another needed to do rigid lay of a 36-in. (91-cm) pipe in 25 m (82 ft) of water off Abu Dhabi – their other contracted vessel was not ready. And the last was in need for an accommodation vessel in Bohai Bay to work alongside an FPSO about to be shut down. I think that having those three separate prospects for our vessel in three different market segments very much validates our business ideas.”

Pyrenees comprises the Crosby, Ravensworth, and Stickle fields in block WA-12-R with combined recoverable oil of 80-120 MMbbl. Wellstream International is supplying around 60 km (37 mi) of flexible risers and flowlines; the Seastream - SURF Solutions partnership will install these under a separate contract and perform tiebacks to the field’s FPSO. An office has been established in Perth to manage this project.

The scope of work includes installation and pre-commissioning of the entire subsea system, including manifolds, umbilicals, mid-water arches, tie-ins to pre-installed tree flow bases, hooking up the FPSO to its turret, and installing the mooring system. Water depths across the development area range from 170 m to 250 m (558 ft to 820 ft).

“Seastream has permanent staff in Houston to market the business,” says Wood. “But what we have done in Australia is to put together the individual companies as a 50-50 ‘non-entity’ joint venture, which is a lot more flexible than a jointly owned company. There are 50 people working on the Pyrenees project in Perth.”

According to Wood, Australian customers worried about the escalating pricing demands of the established subsea contractors in a tight market. There also had been concerns over operational problems encountered with some of the older DSVs supplied for its projects (some dating back to the 1980s), including major equipment breaking down.

“In the middle of all that, BHP issued a tender for Pyrenees. We responded to them, and said ‘Wellstream with Sea Trucks can offer you an alternative’. Of course we had challenges to meet in terms of building up our operational presence to support such a project but Australia is a very strongly regulated operational regime. It’s extremely prescriptive.

“For instance, you must use unionized labor offshore, and engineering and project staff is mobile – many individuals seem to move from one project to another. All operational processes and procedures are, of course, vetted so that they comply with the stringent and robust regulations which apply to all contractors equally. These parameters have very much contributed to our ability to rapidly create a first class operational team in Australia.”

Other new installation tonnage is moving into the area with theJascon 25 such as the deepwater Sapura 3000 working for Murphy Oil off Malaysia. “I believe the more the merrier,” says Wood, “because customers in Australia and Asia will benefit from these new generation vessels with their greatly increased capacities. They will set new benchmarks and enable projects to be sized and configured in new ways. Customers will not wish to go back to the standards and capacities of service dating to the 1970s in the case of conventional pipelay vessels and 1980s in the case of many of the Asia resident ‘SURF support vessels’. ”

The future

In February this year, Seastream completed its first project on the Polvo development for Devon Energy. The work, awarded last February, involved retrieval and re-laying of a 12-in. (305-mm) flexible riser and power cable, and installation of a 10-in. (254-mm) water injection flowline and associated production riser. A third-party installation vessel was mobilized from Aberdeen, and was supported by Wellstream’s logistics base in Niteroi, Brazil.

Presently, Seastream has no work after Pyrenees. “Our competitors are quite comforted by that,” Wood says, “but we have not been bidding very many prospects lately because we do not have any ships that are not busy, nor has Wellstream had excess manufacturing capacity.”

Sea Trucks is, however, in a joint venture with Australian contractor Clough bidding for the shallow water pipelay for the Gorgon project.

Next in the sequence of new vessels for the group will be the DP-3 pipelay/crane bargeJascon 34, due for delivery in mid-2009, which will also be made available to Seastream. Later that year another DP-3 accommodation/hook-up barge Jascon 31 will be delivered, to be followed in 2010 by the more ship-shaped pipelay/crane/construction vessels Jascon 18 and the Jascon 35.

Both the latter will be the largest in the fleet, 150 m (492 ft) long and 36.8 m (121 ft) broad, with twin working decks and accommodation for up to 400. The deepwater flagshipJascon 18 will have much higher pipelay tension capacity, nearly 50% greater thruster power of 23.32 MW, and a 1,600-metric ton (1,763 ton), heave-compensated main crane. Jascon 35 will have the same pipelay system as Jascon 25, but a quicker system for removal of pipelay gear.

“Sea Trucks employs a 50-strong ship construction/design team led by very experienced senior management resident in China,” Wood explains, “and we also hire site supervision personnel according to our needs. General contracting for steelwork, pipelay, and propulsion equipment is handled out of China. We then tender completion work and installation of third-party equipment to yards in Indonesia, Malaysia, and Singapore.

“But shipyard capacity in China is increasing all the time. TheJascon 34 will go to a yard in Southeast Asia following construction of the hull, but after that we are looking at doing the completion work also in China. The yards there are getting better while, conversely, the performance of those in Southeast Asia is arguably getting worse. It is due to the fact that they are too busy, so customers pay high prices but still end up getting what they’re given.”

Once the four larger vessels are completed, Sea Trucks ideally would aim to have two in operation off West Africa, one in the Asia-Pacific, and one in both sectors of the Gulf of Mexico or off Brazil. “We are particularly interested in allocating vessels to long-term development work off Nigeria and Angola,” says Wood.

“SURF operations in West Africa require dynamic positioning capability, mainly to cope with water depth. But what the market there really needs is large deck capacities and good cranes, and generally a barge-shaped vessel is a much better solution than a comparatively small, ship-shaped hull – with some projects demanding up to 50 reels of flexible pipes, loading times take longer than actual installation times.”