John Payne

Hallin Marine

The higher price of crude oil seen on the world market in recent months has created a favorable environment for offshore fields that have higher technical costs of recovery. The US EIA is reported to have forecast that oil prices could reach $150 a barrel by 2015 if new production is not brought onstream.

In addition, the pressure on production costs continues to support a need for cost-effective subsea services and light well intervention. These are subsea services that utilize existing and developing technology while supporting the drive for new vessels that can work in deeper waters and harsher environments.

Within the subsea market, there are considerable challenges as operators look to increase existing production rates and the quantity of recoverable oil from known reservoirs. The challenges multiply when these factors are present in new deepwater prospects.

As the cost of technology increases and financial and human resource constrains development, a company needs to decide clearly in which sector to operate, and the skill sets needed. Other factors that should be considered include: construction at the EPC level versus specialist works post development; and/or shallow versus deepwater.

The problem is more complex than the simple parameters mentioned. Many of the new fields presently under development have unique problems which need more analysis – for example, dealing with high-temperature high-pressure wells at a 1,200-m (3,900-ft) water depth.

What is the intervention solution, and which contractors are able to provide a full solution? This level of complexity is also linked to more updated risk management plans in the event of subsea incidents.

Subsea intervention continues to be an emerging market, despite the underlying increase in subsea wells. Some new entrants moved into the intervention market in 2008–2010 with single-operation vessel designs. However, the impact of financing constraints, high construction costs and delayed deliveries have severely impacted some market participants who can only wait for the intervention market to gain momentum.

Nevertheless, demand for multi--service vessels is rising. Operators are increasingly looking for vessels that can carry out light well intervention at multiple depths. At the same time, they are looking for vessels flexible enough to carry out a range of operations, with a cost base that is competitive across the breadth of services and depth of operations.

Additional requirements for handling capping and containment systems are being developed, but the full scope is currently far from clear. Systems today are in excess of 85 m tons (93.7 tons), so only the higher range vessel capability is suitable for this type of work. The ideal service provider is the service company with vessel and intervention capability, plus a significant downhole knowledge base.

For the foreseeable future, the multi-service vessel must be designed to work across a spectrum of markets: subsea installation, support work, IRM and well intervention – but at a price tag that works in a cyclical market.

Demand for these services is likely to rise in the coming decade as subsea hydrocarbon recovery systems increase in prominence. Currently there is insufficient well intervention demand to fully support the continued deployment of a vessel outside mature areas such as the NWCS and the GoM.

Therefore, the majority of a vessel's time is likely to be spent competing for IRM and subsea contracts. The multi-service vessel aligned with an intervention capability has a substantial competitive advantage over the majority of the offshore vessel fleet, especially if equipped with permanent intervention handling systems and with suitable deepwater lifting capability.

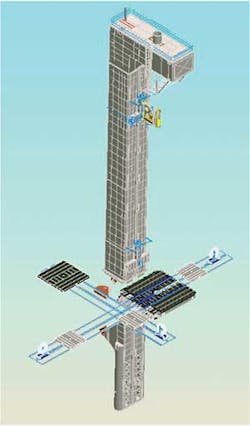

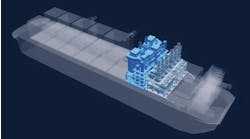

Hallin, with its joint venture partners Minnow Marine Projects Ltd. and STX Canada Marine Inc. (formerly Aker Yards Marine), has developed a vessel design that responds to the need for greater flexibility. This design also provides cost-effective solutions in both subsea services and well intervention, along with a variant for high occupancy accommodation. The vessel is designed to be a lower-cost alternative to large MSVs and traditional semisubmersibles.

The 84-m (276-ft) compact semisubmersible, with accommodation for 152 persons and increased deck space, is comparable with the larger 120-m plus (394-ft plus) vessels that have been built for the deepwater market. With a design philosophy of starboard side working, the vessel has a beam of 32 m (105 ft) which, with its twin hull, gives a significantly enhanced working platform in beam seas.

The vessel is designed to provide multiple subsea services that support the operators' desire to improve production and reduce costs, with motion characteristics that significantly exceed that of similar length units. Of particular note is the compliance with MODU regulations and guidelines. Typically, a traditional vessel would not need or be able to comply with these requirements.

The ship's classification designation is ABS +A1, Column Stabilized Drilling Unit, +AMS (E), DPS-3, UWILD, Helidk. This notation is assigned to a mobile offshore structure that depends upon the buoyancy of columns for flotation and stability for all modes of operation of raising and lowering the unit. It denotes that the unit is designed and built under ABS in accordance with the ABS Rules for Building and Classing Mobile Offshore Drilling Units.

With a purpose-built ROV and subsea intervention tooling control room, the team is able to provide both installation and subsea support which addresses construction and umbilical installation. The design also meets the embryonic light well intervention requirements that continue to be challenged by the economics of rig versus vessel and the associated risk characteristics. Such dynamics are being made more complex by the need to deal with recovery from high-temperature high-pressure subsea wells as well as enhanced risk management profiles.

With a dead weight of 3,800 m tons (4,188 tons) and a deck cargo capacity at operational draft 8.2 m (26.9 ft) of 1,500 m tons (1,653 tons), the vessel's working deck area is in excess of 1,300 sq m (13,993 sq ft). Load capability around the working moonpool is 10 m tons (11 tons) per square meter. The working deck is specifically designed to give a single length run of 60 m on the starboard side within easy access of the subsea crane.

To support subsea operations, the vessel is equipped with a MacGregor-designed-and-built 150-m ton (165-ton) knuckle-boom offshore crane and associated active heave compensation system. The main subsea sea development is the MacGregor 160-m ton (11-ton) SWL modular handling system (MHS) for deepwater intervention over a 7.5 x 7.8-m (24.6 x 25.6-ft) moon pool.

The MHS supports a 160T SWL winch wire with 3,000-m (9,842.5-ft) depth rating allowing for guided support at most working depths. The combination of MHS and crane gives a versatile twin deployment capability especially with the vessel ballasted down to 10-m (32.8-ft) deepwater capability. The enhanced stability greatly increases the dwt capability of the vessel for one-off lifts.

A key aspect of working operations is the management of the subsea modules at sea, with a built-in recessed skidding system and four off 120-m ton (132-ton) SWL pallets. The vessel is able to manage preloaded modules for transfer to the MHS and subsequent deployment through the moon pool without crane operations.

The vessel is designed with built-in ROV hangers both amidships and starboard. Hangers are suitably sized for two construction-class ROVs capable of working to a depth of 3,000 m (9,842 ft).

The compact semisubmersible (CSS) is a unique multi-hull form designed to provide greater sea-keeping capabilities when in dynamic positioning mode. The vessel design has been tank-tested and evaluated using numeric modeling based upon the potential flow theory.

The hull design selection process was initially driven by low ship motions, which require low waterplane area. The mission profile of the CSS obviously dictates a high deck cargo capacity which requires high waterplane area for stability. The final hull shape is one which has led to a large beam (32 m or 105 ft) to gain the stability required, while minimizing the waterplane area as much as possible. This hull form exhibits pitch and heave motions similar to a 50% longer monohull with greatly reduced roll motions. The forward and aft ends of the struts are streamlined to reduce wave resistance, while the pontoons are shaped to reduce resistance further when in transit and maneuvering. At the same time simple, developable shapes have been used throughout the hull to minimize construction costs.

Physical tank testing was carried out by Oceanic Consulting Corp. in St. John's, Newfoundland, Canada, on behalf of STX Canada Marine Inc. The test was designed to provide data and insight into the hull form behavior, and for comparison with the numerical model.

To evaluate performance, the following experiments were undertaken:

- Resistance experiments to determine the resistance and effective power of the design at forward and lateral speeds

- Sea keeping to determine vessel motions and the accelerations at speed in head and following sea; slamming loads on wet deck and global load on cross deck were also evaluated. The evaluation was carried out at an operational draft of 8.2 m (27 ft) in waves of 2.5 to 6.0 m (8.2 to 19.7 ft) vertical height

- Station keeping was evaluated in headings ranging from 0 to 180 degrees to determine motions and accelerations while on site at zero speed. Experiments were conducted with 2.5, 4.0, 6.0 and 12.0-m (8.2, 13.1, 19.7, and 39.3-ft) waves.

The outcomes of the tank testing verified the station-keeping capability and reconfirmed the powering requirements for the vessel in both DP3 mode and on passage to achieve speed of 11 knots.

The tank demonstrated that slamming, even in the worst seas (12.0 m or 39.3 ft), was within acceptable limits especially when at slower speeds.

Model and tank testing has shown that the vessel has good motion performance and is able to hold its own against a larger monohull vessel in the 120-m (394-ft) range.

As can be seen from the results, the CSS hull design in relation to that of the 120-m (394-ft) monohull is comparable in the three aspects considered essential during dynamic positioning and stationing. In all cases, the two hulls give similar measurements except for the roll. In this case, the semisubmersible hull shape gives a significant improvement in roll when compared to the monohull designs. This will significantly improve the working window should a deteriorating weather situation occur.

A key criterion for successful well intervention is heave at the moonpool in the working condition. Data from the tests forecast the heave at less than 2 m (6.6 ft) at center of gravity. This works out as a percentage of length as being 0.024%, which is well within the reported criteria. The vessel complies with, and in most cases exceeds, the recommendations of Project Demo 2000's report on light well intervention from a monohull vessel using subsea wireline.

The design is highly complementary to the DP3 concept, with twin engine rooms separated by full hull width rather than single bulkhead. The machinery spaces are positioned in each lower hull, providing significant continuity in the event of a hull or space damage. Fuel-oil tanks are either built in (giving double skin protection aligned to the inner side of the lower hulls) or are located in the main body of the vessel (reducing exposure to impact or grounding damage).

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com