MONACO — Eneti Inc. has executed a previously announced senior secured green term loan facility of up to $436.0 million with a group of international banks and export credit agencies co-arranged and co-underwritten by Credit Agricole Corporate and Investment Bank and Société Générale, and with Société Générale as green loan coordinator.

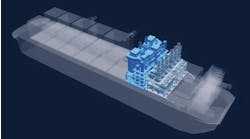

The credit facility finances about 65% of the purchase cost of Eneti’s two newbuild wind turbine installation vessels (WTIVs). It includes:

- A commercial tranche of up to $130.8 million;

- A direct tranche from the Export-Import Bank of Korea (KEXIM) of up to $115.0 million;

- A guaranteed tranche from Eksportfinansiering Norge (Eksfin) of up to $45.0 million; and

- A covered tranche from Korea Trade Insurance Corp. (K-SURE) of up to $145.2 million.

The lenders to the commercial tranche, Eksfin guaranteed tranche and K-SURE covered tranche are Credit Agricole Corporate and Investment Bank, Crédit Industriel et Commercial, New York Branch, KfW IPEX-Bank GmbH, Société Générale and The Korea Development Bank.

The maturity date of the credit facility in relation to each vessel is 12 years from the delivery date of each vessel. The credit facility bears interest at a blended margin of SOFR plus 2.36% per annum (exclusive of premiums payable to K-SURE and Eksfin). The remaining terms and conditions, including financial covenants, are similar to those of Eneti’s existing credit facility.

In November Eneti delivered the Seajacks Hydra and Seajacks Leviathan vessels to their new owner. These deliveries, along with the delivery of the Seajacks Kraken vessel in October, complete the sale of all of Eneti’s NG2500X vessels.

Eneti Chairman and CEO Emanuele Lauro said, “We are delighted to have received such strong support from the lenders and export credit agencies to allow us to successfully close this green loan facility to finance our two newbuild WTIVs.”

Seajacks UK Ltd. is a wholly owned subsidiary of Eneti Inc.

11.30.2023