Offshore staff

LONDON — Despite increased take-up of North Sea semisubmersibles for drilling this year, the outlook for 2023 is less promising, according to Westwood Global Energy Group's RigLogix.

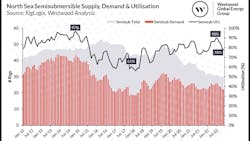

Overall North Sea semisub supply fell by 36% (17 rigs) between January 2015 and November 2022, following a prolonged lack of demand for semis, especially in the mature UK sector.

Demand for semisubs remains seasonal, with higher use in the spring and summer months.

However, in July 2022, committed utilization reached 90%, the highest figure recorded since June 2015 for the North Sea region. Demand has since fallen back to 78%, with nine semisubs idle, two of which are cold stacked.

In numerous other parts of the world, utilization is consistently in the 90% range, according to RigLogix research director Teresa Wilkie, and this has led to an increasing number of rigs leaving or being outside the northwest Europe region for new contracts with longer terms and higher day rate potential.

The same applies to the North Sea jackup segment.

This year the Island Innovator and Deepsea Bollsta semisubmersibles have departed for campaigns offshore Africa, with two more rumored to be leaving next year for assignments offshore Africa and Australia.

This mini-exodus could lead to availability issues if demand for semis in northwest Europe recovers, which RigLogix predicts may happen from early 2024 onward.

In the year to date for 2022, new contracts in northwest Europe totaled 7,399 rig days (Norway accounting for 5,661 days and the UK 1,738), the highest since 2018 (7,592 days). During third-quarter 2022, the North Sea semisub market fixed 3,899 days of contract backlog, the highest for a single quarter since 2012.

Average contract duration also is increasing, currently 264 days this year, and day rates for recent fixtures too are higher. Transocean Norge could earn $408,000 under a new deal with Wintershall Dea and OMV in Norway, Wilkie suggested, and a recent fixture for the Transocean Barents in the UK sector could reportedly be above $300,000 per day.

During 2024, Westwood expects various new Norwegian developments to go forward as operators look to exploit tax incentives implemented by the government during the pandemic in 2020. Various longer-term UK plugging and abandonment campaigns and development campaigns are also likely to start up.

But there are other factors that could affect the outlook, such as the response to the UK government’s latest windfall tax on UK oil and gas profits, and Norway’s government’s plans to phase out its tax relief package.

11.28.2022