Rig contracting activity slumps again in August, says Evercore ISI

Offshore staff

NEW YORK CITY – A total of eight rig contracts have been announced thus far in August, 11 below the level seen at this time last year, according to Evercore ISI’s “Offshore Rig Market Snapshot” of August 2020.

The report, issued in mid-August, comments that “given the typical end of summer lull, contracting activity is likely to fall short of the trailing seven-year average of 31 for the month of August and resume the downward trend that has dominated for much of the year.”

The report also notes that after falling for six straight months, offshore rig contracting activity temporarily rebounded in July with operators signing 16 contracts for 16 rig years. Jackup activity was particularly strong with three term contracts signed for the UAE, India and Egypt, while three floaters were signed to term contracts offshore Norway and in the US Gulf of Mexico.

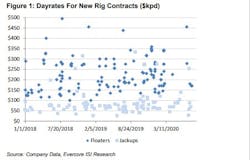

Dayrates held up fairly well, Evercore says, “dipping to the high $270s for a Norwegian harsh environment semisub and $170-$180kpd for an UDW drillship in the US GOM and Guyana.” On the jackup side, spot dayrates retreated to $30kpd for India from $40-50kpd at the end of 2019 but are holding up in SE Asia at $60-$90kpd versus $70-$90kpd previously. The report also notes that the high-spec harsh environment Maersk Integrator also secured a leading edge $254,000/dayrate for one additional well off Norway.

Meanwhile, rig contractors announced plans to retire three additional jackups and a semisub over the past month, bringing the YTD total to 14 jackups and 17 floaters. With global jackup and floater supply down 1% and 7% respectively, Evercore says that it believes that “dayrates could rise materially as a recovery takes hold.” The firm forecasts oil prices to exit the year at $50/bbl.

08/17/2020