More rig retirements needed for sustained day rate recovery

As the economic turmoil caused by COVID-19 continues, the outlook for rig owners remains bleak. Even with lockdown-related demand destruction easing, and globally co-ordinated supply cuts keeping around 10 MMb/d of production off the market, oil prices appear unlikely to break out beyond $45-55/bbl in 2021.

Oil companies have reacted by making significant cuts to planned spending, especially on exploration. Numerous rigs have had assignments cut short as drilling campaigns are curtailed and development spending too is pushed out. Rig fixtures are being cancelled or suspended, options left uncalled, and day rates are trending downwards.

The offshore drilling industry entered this downturn with an already overstretched balance sheet, and the prospects for staying afloat by addressing indebtedness look very weak in the current situation. And what if oil prices stay lower for longer? Is it time to scrap more rigs?

Low oil, low scrapping

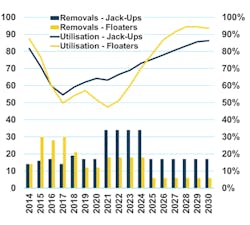

Following 2014, the final good year of the last rig market boom, jackup retirements remained relatively low over the next four years although more floaters did depart the global fleet, partly reflecting their higher fixed costs. Those withdrawals, however, did not arrest the sharp fall in rig utilization as drilling demand dwindled.

Market sentiment finally started to improve in 2019, coinciding with the lowest number of removals since 2015. Those low numbers suggest a market holding out hope of being able to benefit from the recovery cycle, but also less incentivized to remove rigs due to modest scrap prices.

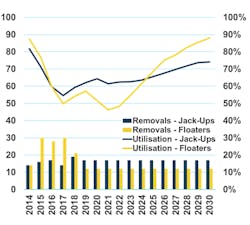

What would be the impact on rig utilization levels if removal activity stayed at that low level – only 17 jackups and 12 floaters per year – while oil prices remained at $45/bbl? In such a scenario, jackup take-up would only recover to 74% by 2030, well below the 80% the industry would typically need to secure pricing power. Without an increase in removals, jackup pricing would remain subdued. Under the same scenario, floaters would see a faster recovery, partly because of the 2015-18 scrapping cycle. Use of the remaining fleet could therefore surpass 85% by 2029, with healthier day rates in the long term.

To speed the pick-up in utilization more rigs, and especially jackups, would have to be retired. Post-2025, Maritime Strategies International (MSI) assumes that jackup removals will return to 2019/2020 levels, with floater retirements around 50% lower.

A strong removal cycle followed by more benign levels of rationalization would encourage a revival for floaters, with take-up of the remaining fleet climbing to 79% in 2025. While the recovery would be slower for jackups, utilization would still reach 76% by 2025 – a fairly balanced position for both owners and charterers. Higher levels of jackup removals than assumed in this scenario are unlikely, as stacking costs are fairly low at ~$3-4,000/d, depending on the rig and location.

So, it is possible to attain healthy utilization even in a sustained low oil price environment, but only with a stronger supply side adjustment. Whatever transpires, the next two to three years will continue be challenging for rig owners. MSI believes that near-term debt restructurings and bankruptcies will lead to increased scrapping, although whether any new owners of the rigs will choose to take the opportunity to do so remains to be seen.

Alternative scenario

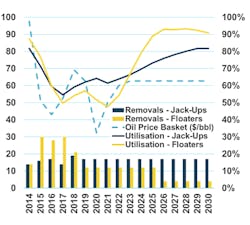

Basing corporate strategy on projections of higher oil prices was a major preoccupation during 2015-2019 among E&P and oilfield services companies. For the latter, higher commodity prices were supposed to lift demand for services. But, by the end of the 2017-2019 subdued recovery cycle, there was general acceptance that oil prices would not exceed $70/bbl as before, with the world sitting on ample reserves that could be extracted economically at that level.

MSI modeled the impact of a steady increase of oil price followed by a sustained 2019-era oil price from 2023 onwards. This envisaged rig removal remaining static at 2019 levels, but with fewer floater retirements post-2026 in order to stop the idle fleet from shrinking to zero. An improvement in the oil price could help significantly, but without more rig removals, the improvement in utilization would only be limited.

The drilling contractors that survive this downturn will have the opportunity to significantly accelerate the market recovery even in a sustained low oil price ($45/bbl) environment, achieving healthier utilization levels by 2025 of 76% for jackups and 79% for floaters, compared to 66% and 69% in the scenario based on 2019 removal levels for the forecast period.

Without doubt, a significant level of value destruction would be part of the process leading to such a recovery, but it does appear the only option available to the industry that would guarantee an increase in utilization.

* Assumptions for all scenarios: No newbuild orders (although at least a small number is likely because of political reasons); four jackups and three floaters delivered per year from 2021; order book reaching zero in 2029 for both rig categories. Oil price used in study is a basket of various oil price benchmarks; rig demand calculated using moving averages of hydrocarbon prices.

The author

Ferenc Pasztor, PhD, is Senior Offshore Analyst at MSI, responsible for guiding and contributing to the company’s efforts in offshore vessel market research and analysis, with the main focus on the development of offshore support vessel and rig market forecast models.