Talos eyes swift subsea tieback of Gulf of Mexico Katmai West discovery

Talos Energy has proven commercial volumes of oil and gas with its Katmai West #2 appraisal well in the Ewing Bank area of the US Gulf of Mexico.

The West Vela drillship spud the well in late October 2024. Going forward, the plan is to case and suspend the well by late January while Talos finalizes completion plans, which it aims to execute during the second quarter.

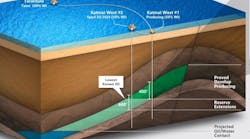

Katmai West #2 will be connected to the subsea infrastructure serving the Tarantula production platform, where capacity has been expanded to accommodate up to 35,000 boe/d.

Talos expects both Katmai West wells to produce on a rate-constrained basis, enabling extended flat-to-low decline production.

The company has a 100% operated interest in Tarantula and a 50% operated share of Katmai West, the remainder held by entities managed by Ridgewood Energy.

John Spath, Talos' interim co-president, evp and head of operations, said the high-impact deepwater well was drilled about 35% under budget and over a month ahead of schedule.

He added, “We remain optimistic about the greater Katmai area, as these results align with our pre-drill expectations.”

Katmai West #2 well was drilled to a TVD of about 27,000 ft after encountering the main target sand full-to-base, with more than 400 ft of gross hydrocarbon pay. During production, the well should deliver 15,000 to 20,000 boe/d.

Results from both wells have led to the ultimate recovery of the Katmai West field being almost doubled to about 50 MMboe. Talos sees an overall resource potential of close to 100 MMboe gross.

First production is expected in late second-quarter 2025.