Britain's chunk of the North Sea has thrown up few surprises this past decade, apart from EnCana's recent Buzzard discovery. UK operators are therefore revisiting their more marginal or problematic discoveries for potential development as a means of pro-longing UK production levels.

The majority of these discoveries, some dating back to the 1970s, have remained on the shelf due to a combination of technical risk, variable oil prices, and fiscal uncertainty. Shell Expro's Penguin Cluster in the Northern North Sea was a textbook case - a cluster of five fields collectively containing the third largest undeveloped accumulation of hydrocarbons on the UK continental shelf, behind the Clair and Bressay fields. Previous development of the Penguins had been precluded due to the large areal footprint of the cluster (strung out over some 20 km) and high subsurface risks (reservoir connectivity and quality). When at last a development opportunity was matured in the late 1990s, the project had to be suspended due to the plunging oil price. Last year, however, the timing was finally right to move the scheme forward, 26 years after the initial discovery.

Penguins A, B, C, D, and E extend over a 10-by-20-km area in blocks 211/13a and 211/14. This is roughly the same size as Shell Expro's Brent field to the south, still one of the UK's largest in terms of remaining reserves. The fields are located close to the UK/Norway median line, in water depths ranging from 140 to 200 m.

Due to continuing uncertainty over reservoir performance, development of Penguins is being phased. If all goes according to plan, up to nine subsea wells could be drilled from five drill centers across the fields, exporting their wellstream through a 65-km pipeline to the Brent C platform, shadowed by a similar length control umbilical. On arrival at the platform, the fluids will be commingled with those from Brent and separated. Oil will then be sent through the Cormorant pipeline system to the Sullom Voe terminal on Shetland. Gas will be piped through the Far-north Liquids and Associated Gas Gathering System trunkline to the St. Fergus terminal north of Aberdeen.

Difficult development

Exploration of the Penguins area was spread over 17 years through to 1991, with 10 exploration and appraisal wells following the first discovery well in 1974. All were plugged and abandoned.

"This was always viewed as a difficult development," says current subsurface team leader Edwin Verdonk. "Because of the large footprint and poor reservoir quality, a conventional platform development was not economic. We had to wait a long time for suitable long-distance subsea tieback technology to come forward. It was not until 1997 that we started looking at this as a viable solution for Penguins."

Of the five accumulations, four are high gas-to-oil ratio oil fields (A, B, C, and D) while E contains gas/condensate. Crude quality varies from 35° API for C to 45-47° API for D. The gas contains up to 3.5% CO2 in places.

Penguin A lies in Magnus sands at a depth below the seabed of 3,100 m. Penguins C, D, and E each comprise two geologically different layers. The uppermost reservoirs are in the Middle Jurassic Brent Formation at a depth of 3,100 m, and the lower reservoirs occur in the Triassic age Statfjord/Cormorant Formations over 100 m deeper. The Penguin B field, not considered for the early development phases, is situated on a substantial horst block. In this field, the Brent sequence has been completely eroded, and the hydrocarbons are found solely within the Triassic Cormorant Formation at a depth of 2,350 m.

"All the reservoirs are deeper than other known accumulations in these horizons," says Verdonk. "The geological analogue for the Brent formation reservoir is the Brent field itself."

The Brent field is a 900-ft thick interval of exceptional reservoir quality sands, with permeabilities of well over 1 darcy in some layers. The Penguins reservoir is one-third of the thickness of Brent, with permeabilities on average at least two orders of magnitude lower. Another indication of problems is that the fluid composition varies within the individual fields, which implies that the reservoirs may well be compartmentalized.

"The high level of variability, combined with the poor quality of the reservoirs, is what makes this such a complex development. The big risk is that compartmentalization will lead to a lack of communication within the reservoirs." Shell should have a better idea of the overall connectivity once the first production phase comes onstream later this year.

According to Bill Caffyn, project services and integrity manager, impetus for the development finally came in mid-1997, after a team was assembled "to make Penguins fly."

"Horizontal drilling was the key to reducing the well count to a reasonable level by simultaneously addressing the problems of the large areal extent, low permeabilities, and reservoir connectivity," Caffyn says. "We then looked at subsea tiebacks to all the nearest third-party platforms to reduce infrastructure costs. Magnus, Murchison, Statfjord, and Thistle were all potential candidates, but all of them lacked sufficient gas-handling capacity for our development without significant host platform upgrade costs. Gas-handling and export constraints also ruled out the use of an FPSO."

The Brent platforms, on the other hand, were further away but had ample processing capacity after the revamp of the field in the mid 1990s for the Brent depressurization project. The revamp had also given the platform control system a new lease on life and had brought safety systems and accommodation in line with current standards. All these factors swayed the decision in favor of tying back to Brent, and this choice was supported by the Department of Trade and Industry's own independent evaluation of the best development option from a UK point of view.

A "cocoon" protects the subsea tees.

"Taking the subsea route 65 km to Brent added to the technical risk, in terms of flow assurance, and modifications would still be needed to the host platform. However, tying back to another Shell Expro facility simplified the commercial complexity of the development enormously and gave Shell direct control over all aspects of the project," Caffyn points out.

Collapsing prices

Unfortunately, as final project sanction was edging closer in 1999, remaining subsurface uncertainty set against a background of collapsing oil prices eroded the project's economics, causing a suspension until mid-2000. On resumption, Shell took the opportunity to revalidate the evacuation route assumptions, holding further talks with BP and Kerr-McGee concerning facility availability. It was quickly confirmed that nothing had changed sufficiently to affect the choice of a development via Brent.

The break brought the added benefit of improved analysis of the Penguins subsurface, based on high-resolution 3D seismic acqu-ired in 1998. An integrated produc-tion system model was also built to allow realistic reservoir simulations to be run while taking the pipeline and host platform performance and constraints into account. Elsewhere within the corporation, Shell Global Solutions in The Hague undertook dynamic simulations for the Pen-guins pipeline, while Shell staff in Houston investigated the potential for wax formation in the production system.

Development drilling for the first phase of production began last fall. The Diamond Offshore semi-submersible Ocean Guardian has drilled and completed three of the scheduled wells, with the fourth currently in progress. These wells are being drilled on the Penguins A, C, and D fields from three separate drilling centers (DC2, DC3, and DC4), each equipped with a manifold to provide access into the 16-in., 65-km export pipeline to Brent C. A fourth manifold is being installed 5 km further down the pipeline ready for future wells on Penguins D and E.

All the manifolds have been fabricated by KYE in Lowestoft UK; DC2, DC4, and DC5 weigh 95 tons each, while DC3 is heavier, at 120 tons. They are due to be installed this month by the Toisa Polaris. DC1 only features in the second phase of development and will consist of a single well in the Penguin A field, tied back via an extended flowline to the manifold at DC2.

A 6-in. diameter umbilical is also being laid from the platform, supplying electric and hydraulic power, controls, and chemicals to the manifolds and wells. The decision was taken to mount the umbilical termination units and subsea distribution units on separate gravity structures rather than on the manifolds to reduce the individual lift weights of the structures. All four manifolds and associated control structures are spaced 3.5 to 4.5 km apart, connecting to the wells via an electro/hydraulic/chemical control jumper and a 6-in. production jumper.

Total expenditures

Phase 1 production is due to start toward the end of the year. Depending on the performance of the wells during the first three months, a second phase will be initiated in mid-2003 involving drilling up to five more wells to develop Penguin E and increase recovery from Penguins A, C, and D. The total capital expenditure planned for these two phases amounts to some £350 million.

"This field is being produced by depletion, not waterflood," Verdonk points out. "After three to four years of depressurization, some form of production enhancement will be required in the Penguins A and C fields. This could be by gas lift to improve the well performance or by using a gas miscible flood scheme to increase the ultimate recovery." Ongoing study work is also progressing on the Triassic reservoirs, and these gas reserves could be used in the enhanced oil recovery plan.

If injection is selected, an additional four wells would probably be needed (two could be conversions of the existing producers) to supply injection gas to the Penguins A and C fields via a new dedicated pipeline, likely to be 8-in. in diameter. The alternative gas lift option would involve installing a 4-in. or 6-in. gas lift line to the northernmost existing producer wells.

The respective manifolds have had a gas-lift manifold pre-installed to minimize hook-up work in the future. The gas could be supplied from the Brent C platform, or possibly via third-party infrastructure closer to Penguins. Gas lift could be handled by re-configuring an existing compressor on Brent C, but a gas injection scheme would require the installation of new compression facilities.

Design of the wells has been performed by an integrated wells/ subsurface team. "Although we had field development approval in August 2001," Verdonk explains, "we still kept working on the optimal position of the wells and drill centers during the detailed well planning process. At the end of the day, the drill center locations were determined not only by the field's areal extent, but also by the need to line up the wells to get at the right trajectory through the reservoir."

This problem was most acute on Penguin A, where there was a choice to be made between fewer drilling centers or less complex wells. The option with the simpler wells was adopted. The extended well optimization process "also gave us some headaches when trying to freeze the pipeline design in order to finalize the ordering of line pipe quantities," says Penguins Project Manager Nigel Prichard.

The poor permeability necessitates that all the wells are highly deviated or horizontal, with each one entering the top of the reservoir and then exiting via the top again lower down dip, ensuring maximum possible exposure to the borehole. Some horizontal or near-horizontal sections will be up to 6,000 ft.

The longest well is expected to be around 21,000 ft. The wells are drilled with a conventional five-string casing scheme (30-in. conductor; 18 5/8-in. surface casing; 13 3/8-in. intermediate casing; 10 3/4-in. by 9 5/8-in. production casing; and a 6 5/8-in. production liner). The upper two sections are drilled riserless using seawater and viscous bentonite pills with returns to seabed. The remaining sections are drilled with various mud systems with the marine riser or subsea BOP system installed and drilling returns handled on the rig.

All returns generated while using oil-based drilling fluids are returned to shore for processing and disposal. Sand control is not required for the Penguin wells, and the wells are installed with cemented liners. To maximize the well productivity, enhanced TCP guns are run as part of the completion and left in the hole after perforating. The wells are perforated at maximum draw-down (2,000-3,000 psi) to minimize completion skins. The wells are designed for no intervention.

Downhole measurements

All the wells are being fitted with Schlumberger's FloWatcher downhole meters, which allow pressure and temperature to be measured downhole in real time.

"We can translate that pressure into flow rate, which shows us what individual wells are flowing," Verdonk says. "This, and the Halliburton completion design, will allow us to allocate production back to individual wells."

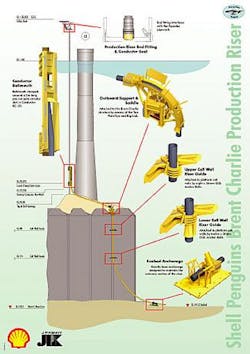

ABB Vetco Gray is supplying the 10,000-psi trees. The normal formation pressure in Penguins lies between 7,000 and 8,000 psi. The trees are being fitted with a diamond-shaped protection structure called a "cocoon" that extends from the flow base to the tree cap to limit the risk of interference from fishing activity.

According to Prichard, "If a fishing vessel's trawl gear comes into contact with the cocoon, it will either simply deflect off the top or, if too deep for that, the trawlboard will be dragged down to the base of the conductor, exerting less bending moment on the tree. This is a safer design for the trees, and it doesn't damage the fishing gear either, allowing the fishing vessel to back up and recover its gear."

The Penguins project is the first application within Shell Expro for this safety-enhancing equipment.

Subsea valves on the trees will be activated by the umbilical's hydraulic control line. A closed loop hydraulic control system will ensure that any fluid exhausted as a consequence of valve actuation will be returned to Brent C through the umbilical.

Control systems

Kværner Oilfield Products in Aberdeen provided the subsea control system, under its frame agreement with Shell. Subsea pig launching facilities are being installed at the DC3 drill center, the starting point for the 16-in. export line. The interfield 10-in. line between the two northernmost manifolds is also designed to handle subsea pigging operations.

"Our 16-in. production line shouldn't need regular operational pigging," says Caffyn, "but our corrosion management philosophy requires us to do an intelligent pigging run after two to three years to verify that our corrosion protection system is functioning as intended. We are installing two state-of-the-art subsea corrosion monitoring spools in the pipeline close to the manifolds, but these can only provide information on the condition of the pipe locally. For pigging a single line like this, a subsea pig launcher is the only option. On other subsea tiebacks, it is common practice to have two lines for production and testing, which gives potential for round-trip pigging from the platform and back."

The pig launcher is not needed initially and will be sourced when required. The north-south route for the 67-km pipeline is generally straight, apart from a small deviation west of the Murchison field complex, including two pipeline crossings. It also crosses the 12-in. buried flowline between Statfjord B and the Northern Leg Gas pipeline, 11 km north of Brent C. It will convey oil, gas, and produced water to Brent C.

The 16-in. diameter was determined by a combination of back-pressure on the production wells and flowline operability in terms of slugging, temperature control and erosional velocities.

This is also one of the world's longest pipe-in-pipe, carbon steel subsea lines, comprising 3.6 km of 10-in. inner and 16-in. outer pipe, and 61.4 km of 16-in. inner and 22-in. outer pipe. The inner pipe was supplied by Mannesmann in Germany, with the outer pipe manufactured at the Corinth steelworks in Greece. The outer pipe is also coated with a 0.4-mm layer of fusion-bonded epoxy for anti-corrosion purposes. The cavity between the pipes is filled with polyurethane foam, with a nominal core density of 100 kg/sq m and a k-value of 0.041 W/m2K maximum. This foam should have sufficient durability to withstand a continuous operating temperature of 149° C over a minimum of 30 years, although the actual operating temperature of the Penguins line is only 110° C. Overall heat transfer co-efficient for the 10/16-in. section of the line is 0.82 W/m2K, and 0.7 W/m2K for the 16/22-in. main section.

Bonding is provided through adhesion of the insulation foam to the inner and outer pipes. The pipe system will move as a whole when subjected to changes in temperatures. Lateral expansion and contraction of the line are accommodated by laying the pipeline on the seabed in a zigzag pattern (S-lay). The pipe's 5,500 sections, weighing 30,000 tons in total, were assembled and insulated by Logst r R r Oil and Gas at a specially erected site near Aalborg in northern Denmark.

JP Kenny designed the pipeline under sub-contract to the installation contractor Saipem. "We appointed Boreas Consultants in Aberdeen to advise Shell on the acceptability of the design in view of the highly complex issues surrounding the unburied pipe-in-pipe system," says Caffyn. "Both companies were involved in similar pipe-in-pipe analyses for the Erskine replacement and Jade pipelines in the Central North Sea, so we were using people we saw as among the most experienced in the world in this type of design concept.

The pipe-in-pipe design was seen as fundamental to the success of a long-distance tieback. Only pipe-in-pipe provides the level of insulation needed to keep the production system outside the hydrate region and wax deposition temperature range for the majority of the field's life.

The problem with pipe-in-pipe is the internal stresses due to differential thermal expansion. The inner pipe gets hot and expands, while the outer pipe remains cold. The resulting lateral movement of the pipeline, if not controlled, can lead to failure of the pipeline.

"For Penguins, we have the fall-back option that if the pipeline does not behave as we predict in operation on the seabed, we can always selectively rock dump or trench and bury it to stop the line moving," says Prichard. However, there are significant cost savings at stake as the prize for making the surface lay design work for the whole of the field life. The pipelay operation was recently completed by the Saipem laybarge Castoro Sei.

"We believe S-lay will work," says Prichard. "However, we will not just lay the line and leave it. We will also monitor its performance. We will be conducting an as-installed survey before start-up and another one when the pipeline has warmed up to see if the actual pipeline lateral movement differs from the predictions of our models. If it does not behave as intended, we may sanction selective rock-dumping to mitigate any negative effects."

Umbilical installation

Laying of the steel tube control umbilical was delayed due to the need to modify the Coflexip installation/trenching plow to achieve a less severe bending radius.

"This exercise took around four months, including onshore trials," Caffyn says. "We always intended that the umbilical would be trenched and buried, but with such a long single section from the nearest Penguin manifold to the platform (50 km), we are taking no chances with the installation procedure."

The umbilical provides hydraulic power, methanol, corrosion inhibitor, with spare tubes for future scale, wax, and asphaltene inhibitors, if required. Umbilical reliability is always a concern, but in this case, Prichard says, distance was less of an issue than the quality of the steel tubing.

"Historically, in the industry the main cause of failures in steel-tubed umbilicals has been the presence of 'Sigma Phase' in the Super Duplex material," he explained. "For this reason, Shell put a lot of effort into the initial specifications, quality assurance procedures, and acceptance criteria."

Shell also sent its own inspectors to all the pipe and tube suppliers for the pipeline and the umbilical, in the latter case to Sandvik's duplex tube plant in the Czech Republic and to Kværner at Moss in Norway, where the tubes are spun to form the umbilical.

"Effectively, we've doubled up on the contractors' own quality assurance systems to get the level of assurance that we want," says Prichard. "We also brought in people with knowledge of previous umbilical failures, which was important for this design."

The Technip-Coflexip Normand Pioneer was due to install the umbilical in July. There are the three short inter-manifold sections to lay, followed by the long section back to the Brent Charlie platform. The Penguins lengths are to be installed as the last leg of a multiple package for Shell also involving jobs on the Pelican and Scoter developments, all from the same reel.

"We wanted to try out the modified plow and allow the crew to gain experience on the least critical umbilicals first," says Prichard.

Caffyn adds: "If the 50-km umbilical length were to be damaged during installation, we do not believe that it would be wise to attempt to repair it in-situ. We would recover the whole thing and take it back to the factory onshore for repair. That's the risk we're trying to manage on Penguins. We'll breathe a sigh of relief when we see our umbilical installed and safely buried."

On Brent C, the umbilical riser will be pulled through an existing J-tube. The riser section is connected to the 50-km section of umbilical at the pipeline subsea isolation valve, located some 100-m from the edge of the platform's oil storage cells.

For the production pipeline, Shell also opted for an instrumented protection system. The philosophy of using an under-rated pipeline protected by a subsea instrumented protection system was first adopted in the UK North Sea by Shell on the high-pressure/high-temperature Kingfisher development. However, Kingfisher was a genuine high-pressure, high-temperature field, which called for a higher integrity, more heavily instrumented system with greater redundancy built-in.

"Our system is simpler," says Caffyn. "When we set out to develop Penguins via a subsea tieback, we believed we could install a pipeline rated to 400 bar, which is the closed-in tubing-head pressure of the wells. But as we got more into the design of the pipeline, we found two problems. The first was the sheer thickness of the steel - the 16-in. pipe would have been very thick indeed. It was not certain which pipe mills in the world, if any, could supply the pipe to the specification required. The second problem was the design of the pipe-in-pipe system itself. It soon became clear that the stresses would be too large to allow the surface S-lay option to work, and the upheaval buckling stresses would have made trenching and burying a very expensive exercise with an uncertain outcome. We therefore looked at an instrumented protection system. Our design philosophy is that, although the line is rated for lower pressure than the pressure of the wells when closed in, the line is also designed not to burst at that tubing-head pressure. It would possibly deform radially, but it wouldn't rupture, avoiding a hydrocarbon release. That determined the level of valve instrumentation required at the manifolds. For Penguins, we have called it an 'Instrumented Over-Pressure Protection System,' rather than the more widely recognized 'High Integrity Pressure Protection System.' Our philosophy has been developed in close consultation with the UK Health & Safety Executive, which has accepted our proposal for this project."

According to Verdonk, the Penguins cluster should initially produce an annual average of 25,000 b/d of oil and 40-60 MMcf/d of gas.

"Production will become gassier as the Penguin E field comes in. We don't see any of these rates being constrained by processing capacity on Brent C. Higher levels of production are possible later on, dependent on how production performs in the initial development phases."

A Framo multiphase meter has been installed on the platform for production allocation, and Solarton has also provided a wet gas meter. A state-of-the-art slug suppression system developed by Shell Global Solutions and licensed to DrilQuip has also been installed on the topsides.

"Our flow assurance work up to now has shown that we only expect to fall below the wax appearance temperature towards the end of field life," Caffyn says. "We believe the wax build-up rate in the pipeline will be slow, so we don't anticipate having to take any particular wax inhibition measures. If need be, we have capacity in the umbilical to inject wax inhibitor.

"During the last few years of production, we do, however, go close to the hydrate formation region," he added. "The aquifer is reasonably far from the wells, and it shows signs of impairment relative to the already poor reservoir quality, so there is a good chance Penguins will produce very little water. Our design premise assumes that we'll have to cope with moderate levels of water up to 25%, but not the excessive water-cuts associated with water injection schemes. We do have a strategy for injecting low dosage hydrate inhibitors continuously at the end of field life, but we won't make our choice until it becomes necessary, by which time further developments may have taken place in commercially available hydrate inhibition chemicals."