Editor's note: This Subsea Systems column first appeared in the March-April 2023 issue of Offshore magazine. Click here to view the full issue.

By Ariana Hurtado, Editor and Director of Special Reports

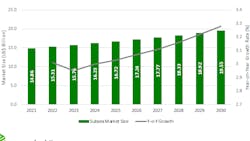

USD Analytics recently reported that the subsea systems market is projected to reach $15.3 billion by year-end 2030. There are several key drivers setting the sector on that projected path.

“Increased demand for oil and gas, in particular in developing countries, is encouraging the deep offshore exploration activities, which requires efficient subsea system components,” CH. Dakshayani Ram, a senior business analyst with USD Analytics, told Offshore. “Planned exploration activities in the US Gulf of Mexico, Brazil, China, the UK, Norway, Africa, Asia and other markets present strong support for offshore oil and gas production.”

USD Analytics reported that Qatar Petroleum, Shell, Petrobras, Total, Exxon Mobil, Equinor, Chevron, Gazprom, ADNOC and CNPC are among the companies investing in offshore oil and gas upstream projects.

Technology investments

According to Ram, leading subsea systems manufacturers are making investments to expand into these worldwide exploration activities. She added that new product launches driven by technical advancements remain a major market trend.

“Technological advances in subsea robotics, sensors, communication systems, launch of environment-friendly systems that capture and store carbon dioxide emissions, and ongoing investments in R&D support the market outlook,” Ram continued.

Many companies are investing in R&D activities in subsea technologies in areas of unmanned underwater vehicles, subsea communications and sensor networks, robotics and subsea controls.

“Companies will continue to invest in R&D to develop new technologies that improve efficiency, safety and reliability for their clients,” she explained. “Further, R&D efforts are largely based on the area of deployment. For instance, companies in the Gulf of Mexico, West Africa and other regions emphasize improving operating capabilities of their systems to support higher pressure wells. Further, cost reduction is among the key focus areas for oil and gas exploration companies in Brazil, Africa, Asia and other markets.”

Mature fields, oil and gas demand and a high oil price environment support investment in subsea equipment and services.

“The high crude oil price scenario is among the main market growth drivers in the global subsea production market,” Ram said. “In addition to maturing oil and gas fields, steady oil and gas demand coupled with a high oil price environment supports investments in subsea equipment and services.”

The EIA estimates the global liquid fuels consumption to increase by 1.1 MMbbl/d in 2023 and by 1.8 MMbbl/d in 2024, and the Brent spot price will average $85/bbl in the first half of 2023.

“Such an optimistic oil and gas demand scenario is encouraging leading companies to invest in services such as installation, asset management, product optimization, inspection, maintenance, repair services and others,” Ram explained.

Trending subsea advances

The most innovative subsea system technology advances in the market, in Ram’s opinion, are surrounding subsea robotics. This includes ROVs and AUVs, subsea drones and robotic arms that can operate in harsh environments and perform complex tasks.

In addition, she noted other hot commodities on the market include sensors and monitoring systems with real-time data transmission and alerts as well as processing systems that can handle processing and storage of oil and gas directly at the wellhead.

She added that components focusing on subsea systems for EOR continue to be on the list of all major R&D companies.

SURF segment

USD Analytics recently reported that the SURF segment generated the highest revenue in the subsea industry in 2022. So, what can be expected in 2023 and beyond?

“SURF is witnessing steady growth in demand [and] presenting strong growth opportunities. The segment accounted for 41.6% market share in 2022,” Ram explained. “The scenario is likely to remain similar in 2023 as well, amidst optimistic market conditions. With increasing complexity in subsea gathering and pipeline systems in deep and ultradeep fields, the demand for efficient subsea umbilicals, risers and flowlines equipment inspections is likely to increase steadily.”

About the Author

Ariana Hurtado

Editor-in-Chief

With more than a decade of copy editing, project management and journalism experience, Ariana Hurtado is a seasoned managing editor born and raised in the energy capital of the world—Houston, Texas. She currently serves as editor-in-chief of Offshore, overseeing the editorial team, its content and the brand's growth from a digital perspective.

Utilizing her editorial expertise, she manages digital media for the Offshore team. She also helps create and oversee new special industry reports and revolutionizes existing supplements, while also contributing content to Offshore's magazine, newsletters and website as a copy editor and writer.

Prior to her current role, she served as Offshore's editor and director of special reports from April 2022 to December 2024. Before joining Offshore, she served as senior managing editor of publications with Hart Energy. Prior to her nearly nine years with Hart, she worked on the copy desk as a news editor at the Houston Chronicle.

She graduated magna cum laude with a bachelor's degree in journalism from the University of Houston.