Subsea 7 has contracted Aker Solutions to deliver umbilicals for Murphy Exploration and Production Company - USA’s King’s Quay development in the deepwater US Gulf of Mexico. The work scope includes 22 km (14 mi) of dynamic steel-tube umbilicals and distribution equipment to connect the King’s Quay floating production system (FPS) to the Samurai, Khaleesi and Mormont deepwater developments.

The King’s Quay semisubmersible FPS will be about 280 km (175 mi) south of New Orleans in the Green Canyon area.

The engineering, design, and manufacturing of the umbilicals and distribution equipment will take place at the company’s facility in Mobile, Alabama. Delivery is planned for 4Q 2021.

In addition, the company has developed a modified workover system that is said to enable faster and more cost-effective planned interventions. The concept will first be applied on Equinor’s Visund field in the North Sea.

Workover systems enable safe well access for subsea installation and completion, diagnostics, maintenance, repairs, enhanced production, and plugging and abandonment.

The operational concept entails delivering the company’s multiWOS system by vessel and landing it on either a subsea platform or a well. The vessel then extracts, and the rig picks up the stack and starts the intervention campaign.

The mobilization of the workover system can be executed well in advance of the intervention activities, hence the operator will have more flexibility both before and after operations, as the system can be parked subsea.

According to the company, the main advantage with this concept compared to the more traditional approach is that the system is kept subsea and not taken onboard the rig.

Other advantages include: use of existing multiWOS system, modification and re-use of existing components, reduced work in ‘red zone’, greatly reduced skidding, handling, and lifting on the rig, and safe and efficient operations.

“This project has been a joint collaboration between Equinor and Aker Solutions from the start. The new intervention concept is faster, more cost effective and safer than traditional workover systems,” said Andreas Kraabøl, VP Subsea Lifecycle Services, Norway.

The system and associated equipment will be modified and delivered in the spring of 2021 to perform intervention operations on Visund.

Saipem, Equinor expand collaboration

Equinor has awarded Saipem a two-year frame agreement to provide engineering services worldwide. The award covers feasibility and conceptual studies, FEED, detailed engineering and follow-on work, R&D support, and assistance to Equinor for its upcoming energy-related projects in the offshore, onshore, and floating wind sectors.

The scope extends to offshore trunklines including landfalls and flowlines, components, subsea structures, field layout and routing design for umbilicals, cables, static flexibles and power cables.

The companies have collaborated for more than a decade via frame agreements for transportation and installation and subsea construction.

Last October, Saipem signed a subsea service contract entailing the use of the company’s underwater intervention drone Hydrone-R and all-electric work-class ROV Hydrone-W on Equinor’s Njord field redevelopment in the Norwegian Sea.

Umbilical demand set for multi-year blow

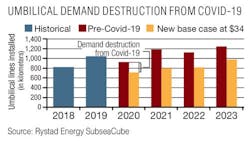

The COVID-19 pandemic and its effect on global energy investments is set to damage subsea purchases. According to Rystad Energy, demand for umbilicals is expected to fall by 32% to 713 km (443 mi) of lines in 2020, down from 1,041 km (647 mi) last year.

Umbilical demand will not match or exceed 2019 levels until after 2023, the consultant forecasts, despite definite cost savings in materials. Before the pandemic demand for umbilicals was due to slightly decrease this year compared to 2019, but to rebound and exceed last year’s levels from 2021 onwards.

Without accounting for the negative impact of a global economic downturn, the consultant sees a cost reduction of about 5% taking place from 2020 to 2022 within the umbilicals segment. If both the global recession and oil and gas industry downturn take place simultaneously, it then estimates a cost reduction of almost 14% over the same time frame.

Rystad Energy oilfield service analyst Henrik Fiskadal said: “This will provide umbilical manufacturers short-term relief regarding their own costs as material prices fall, allowing them to maintain production volumes and recover some of their margins despite cutting their own prices. However, this short-term relief may not last long as the global economy recovers from the COVID-19 pandemic.”

The materials most commonly found in the manufacturing of umbilicals are high-grade stainless steel, carbon steel armor wire, hydraulic hoses, power cables, fiber optic cables, and thermoplastic resins. In addition to the materials, engineering labor is the next largest cost input involved in the manufacturing of umbilicals. Therefore, the more complicated and unique is the design, the more strenuous and costly the fabrication and installation processes.

Prices for materials have remained relatively flat since 2014, while the service price for SURF equipment has fallen significantly, the consultant said. This illustrates the large cost savings realized by operators since 2014 and supports its belief that operators will not be able to enforce the same cost cuts from 2020 onwards, having exhausted most of the cost cutting potential in the years following the 2014 downturn.

Should there be a global recession, materials such as high-grade stainless steel may decrease significantly in price, the consultant claimed. However, when the global economy rebounds from COVID-19, material pricing could increase before the oil and gas industry is ready to accept higher prices for umbilicals.

As a result, in addition to its 2020 demand forecast downgrade, the analyst has also revised its umbilicals demand expectations for 2021-2023. In 2021, demand is expected to reach 798 km (496 mi), growing to 819 km (509 mi) the following year and to 979 km (608 mi) in 2023.