Offshore staff

MILAN – Saipem is reportedly considering a combination with Subsea 7 in a deal that could rank as one of the European oil services industry’s biggest-ever deals, according to a Bloomberg report.

The Italian company is pursuing a potential transaction with Norway-listed Subsea 7 as it seeks to bulk up and weather a sluggish marketplace, the report said, citing anonymous sources.

Subsea 7, which has a market value of about $3.3 billion, rose as much as 8.4% in Oslo trading on Nov. 15 for the biggest advance in more than two years. Saipem jumped as much as 5.3%. Both companies later pared their gains.

Saipem, whose biggest shareholder is Italy's Eni, is valued at about $4.9 billion. No final decisions have been made, and there’s no certainty the deliberations will lead to a transaction, the report noted.

Subsea 7 and Saipem have held talks about a merger in previous years, though they failed to reach an agreement, sources indicated. Representatives for Saipem, Subsea 7 and Eni have reportedly declined to comment.

The price of Brent crude has fallen about 28% from its October 2018 peak, which has driven companies in the sector to try and bulk up to cut costs, diversify and become more competitive. Oilfield service providers have been hit hard by the drop in crude prices, as their clients have cut spending on everything from drilling rigs to support platforms.

Recovery for oilfield service companies from the downturn that started in 2014 has been slower than anticipated.

Subsea 7 reportedly made a failed attempt last year to take over McDermott International for $2 billion. Since then, Subsea 7 has made some smaller acquisitions in its effort to expand through deal making, buying technology provider 4Subsea in October for an undisclosed sum.

Commenting on unconfirmed reports that Saipem and Subsea 7 are considering a merger, Audun Martinsen, head of oilfield service research at Rystad Energy, said:

“Subsea 7 made an unsuccessful bid to merge with US rival McDermott last year. Now it could be looking at a tie-up with Italy’s Saipem, both of which have a strong standing within the so-called SURF segment – involving the construction and installation of subsea umbilicals, risers, and flowlines.”

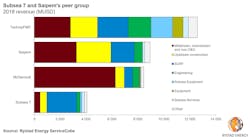

Martinsen added: “A deal would create a truly global oilfield service giant with over $12.4 billion in revenue. The combined entity would have the world’s largest fleet of subsea installation vessels and be the largest provider of SURF services, with a market share of close to 40%. In addition, Saipem has a diverse portfolio including large-diameter pipeline installation vessels, offshore drilling rigs, one of the world’s biggest crane vessels and numerous offshore fabrication yards.”

Such a merger would reportedly create the fourth-largest oilfield service company, after Schlumberger, Halliburton and Baker Hughes.

Rystad Energy says it sees this move as direct response to recent developments on several fronts in the oilfield services industry.

“We are seeing clear signs of consolidation, diversification and alliance formation in the sector. Oilfield service companies are looking to strengthen their market share in core markets but also develop new lines of business. Both Saipem and Subsea 7 have stated goals of de-carbonization in order to become greener energy service companies,” Martinsen remarked.

By combining with Saipem, Subsea 7 would also get exposure to onshore engineering and construction, where Saipem has a solid track record in the petrochemical and liquefied natural gas industries, thus reducing dependence on upstream oil and gas activities. Furthermore, Saipem has a legacy name in the Middle East and many contracts in this booming market. With this move, the merged entity could possibly vie with McDermott for the leading role in the oilfield services segment in the region, Rystad Energy says.

A potential merger could also have ramifications for the ways in which OFS companies and exploration and production companies structure subsea contracts. If this merger comes to fruition, all top five SURF suppliers will have effectively entered into a major alliance covering subsea work.

“Rival contractor TechnipFMC is having great success with the integrated subsea model, which combines subsea production systems and subsea installation,” Martinsen said. “The integrated contracts offering has pushed more risk over to the suppliers during the downturn and has been a success story for E&P companies. However, the subsea industry now faces a rising tide of new projects.”

But it remains to be seen, Martinsen noted, whether anti-trust regulators will accept the creation of a company with such a large potential market share.

11/15/2019