Jeremy Beckman, Editor-Europe

Exploration drilling in the Eastern Mediterranean continues to deliver giant gas discoveries. The question is, how much of these are actually needed to satisfy demand from the prime European market, with strong competition from other sources such as the Caspian Sea and Qatar? Russia, too, has ambitions to expand supplies to the West through new subsea trunkline systems in the Baltic and Black seas.

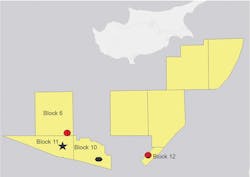

Earlier this year ExxonMobil and partner Qatar Petroleum proved gas at the second attempt on block 10 offshore southwest Cyprus, after their first well on the Delphyne prospect was unsuccessful. The second, on the Glaucus structure in 2,063 m (6,769 ft) of water, penetrated 133 m (436 ft) of gas-bearing reservoir. Early analysis indicated a 5-8 tcf resource, although further work would be needed over the next few months to firm up the potential, ExxonMobil said.

Rystad Energy analyst Palzor Shenga said Cyprus might consider building an onshore liquefaction plant to handle gas from Glaucus and the nearby deepwater Aphrodite and Calypso fields in blocks 12 and 6, operated respectively by Noble Energy and Eni. But Cyprus and near neighbor Egypt recently agreed to construct a subsea pipeline transporting supplies initially from Aphrodite, then Calypso, to Egypt’s LNG export facilities. The resultant LNG would then be re-exported to the European Union (EU). With Eni recently confirming another gas discovery – Nour – offshore Egypt in relatively shallow water 50 km (31 mi) north of the Sinai Peninsula, there might not be spare liquefaction capacity to bring Glaucus onstream until the 2030s.

At the same time, Shenga pointed out, Cyprus faces a continued threat of military intervention from Turkey, which last year sent warships to deter Eni from further exploratory drilling in waters close to Turkish-controlled northern Cyprus.

Another proposed project gaining traction is the 1,900-km (1,180-mi) Eastern Mediterranean (EastMed) pipeline – 1,300 km (808 mi) offshore and 600 km (373 mi) onshore – which would connect discovered gas resources in the Cypriot and Israeli sectors of the Levantine basin to mainland Greece, via Cyprus and Crete to the west. Parts of the proposed offshore route would be in water depths of more than 3,000 m (9,842 ft), according to recent comments by Saipem CEO Stefano Cao. EastMed’s projected throughput of 10 bcm/yr could lead to a development of a South Mediterranean gas hub, and in conjunction with supplies through the Poseidon and IGB pipelines, some of the gas could continue on to other countries in southeast Europe and Italy. The project has EU financial support.

Toward the end of 2019, Noble Energy aims to start production from Leviathan, its second deepwater gas field development in the Israeli sector. In March, the drillship Stena DrillMAX initiated development drilling on Energean’s Karish field, where subsea wells will be connected to the Eastern Mediterranean’s first FPSO. Energean has signed various sales agreements for utilities in Israel to take up to 5.3 bcm annually from Karish and the subsequent Tanin development. Leviathan’s first-phase gas is contracted to customers in Israel, Jordan and Egypt, although Jordanian protesters were recently trying to have the 15-year, 45-bcm gas supply deal to the Jordan Electric Power Co. cancelled.

At the same time, Israel has been trying to attract new companies to explore its offshore sector by inviting bids for five zones in the country’s southern waters under a second licensing round launched last November. Each zone includes several blocks which cover an area of up to 1,600 sq km (618 sq mi). ExxonMobil has reportedly held talks on a potential bid – applications are due to close on June 17.On the other side of the Arabian Peninsula, ADNOC’s ambitions include growing gas production offshore Abu Dhabi, not solely to fuel growth in domestic power generation, but also for export purposes. One of the main sources could be ultra-sour gas from the Dalma, Ghasha and Hail fields in the Ghasha offshore concession, where Eni and Wintershall recently joined ADNOC as co-venturers. Qatar, by far the region’s major offshore gas exporter to Europe (and elsewhere), announced plans last summer to construct new liquefaction trains supplied by gas from two new planned developments on the North Field in the Persian Gulf. These will eventually lift Qatar LNG’s production capacity to 110 MMt/yr. Qatar Petroleum assigned detailed design to McDermott of the six wellhead jackets for the North Field Expansion project that will supply three new LNG trains. Qatargas is working on the other new project on the southern part of the field which is thought to include two new nine-slot wellhead platforms and a new riser platform.

The Caspian Sea is emerging as another major source of gas to countries in Europe, following the start-up in June 2018 of the BP-operated Shah Deniz Stage 2 development in the Azeri sector. The $28-billion program, designed to add 16 bcm/yr to the 10 bcm/yr delivered through Stage 1, involved construction of more than 3,500 km (2,175 mi) of overland and offshore pipeline systems that will eventually transport 6 bcm/yr to Turkey and 10 bcm/yr through southeast Europe via a route known as the Southern Gas Corridor (SGC). Initially the gas heads west across Azerbaijan and Georgia through the South Caucasus Pipeline; it continues west across Turkey, through the Trans-Anatolian Pipeline (TANAP); and finally joins the Trans-Adriatic Pipeline (TAP) which traverses Greece and Albania, terminating on Italy’s east coast via an offshore section, presently under construction.

The potential for gas in the Caspian Sea is vast, said Mehmet Ögütçü, CEO of Global Resources Partnerships, during his speech for the Caspian session at IP Week in London earlier this year, organized by the Energy Institute. As with the region’s major oil-related projects to date, he suggested, the key considerations for the gas developers are where you can sell it and which routes to follow, as the sea is landlocked. “To get gas out, it has to go through a number of countries and that creates lots of problems.” In the case of Shah Deniz 2, these include the pipeline connections through Turkish Thrace to Greece, he said. There have also been some local administration issues in Italy, he added, which have created some problems that had not been foreseen.

According to Ögütçü, the 10 bcm figure is an insignificant proportion of the EU’s annual consumption of 498 bcm, out of which the EU itself currently produces 128 bcm, with the remainder imported from Russia, Norway, and Algeria. But potentially Azerbaijan could export up to 50 bcm annually to Europe through new Caspian Sea field developments such as Total’s Absheron, Babel, and Shah Deniz III. Turkmenistan also stands ready to provide 30 bcm through the SGC system from the country’s huge gas reserves. However, Russia will very likely not allow this to happen, he said, as Turkey is Gazprom’s second biggest customer for gas after Germany, and any gas from the eastern Caspian would undermine Russia’s dominance.Last November, Allseas’ Pioneering Spirit completed pipelay for the offshore section of the TurkStream gas pipeline system that will initially supply gas from Russian onshore fields to Turkey. In addition, Allseas has started work on the Nord Stream 2 trunkline system which will take more Russian supplies across the Baltic Sea to northern Germany. Although some members of the EU have expressed concern about the project, arguing that Russia is taking too dominant a position in Europe’s energy mix.

TurkStream 2, which would take 15.4 bcm a year to countries in southeastern Europe – most likely Serbia and Austria, Ogütçü said – would create further problems for would be users of the SGC network that are targeting the same markets. And at the same time, the US is pushing strongly to send LNG from shale to Europe, he added, “although it will be tough for the US to compete with Russian gas in Europe.”

Egypt at one time considered a project to take its gas north to Turkey, but this had to be shelved owing to political differences between Turkey, Greece, Cyprus, Israel, and Egypt. But Egypt has the potential to act as a gas hub for the eastern region, he suggested, thanks to the 30 tcf proven at the deepwater Zohr field, and now Nour (Eni did not issue a resource estimate, although there had been pre-drill forecasts in some quarters that the field could be three times bigger than Zohr). “If relations between the three main countries’ leaders could be improved, Egyptian gas could still go through Turkey via the TANAP pipeline, or via a swap arrangement,” he said. This arrangement might also suit Russia as Rosneft has a 30% stake in Zohr. •