Rystad Energy analysts assess likely impacts of Trump’s ‘energy blitz’

On his first day in office, President Donald Trump declared a “National Energy Emergency” in order to use executive action to boost domestic production.

Recently, Rystad Energy shared its analysis of what this means for the oil and gas industries, from various senior analysis leaders at its consulting firm.

Growth vs investor returns

Matthew Bernstein, VP, Upstream Research, said:

“Despite President Trump’s intentions, a significant uptick in US oil production is highly unlikely. The “drill, baby, drill” mantra overestimates the industry’s willingness to prioritize growth over investor returns in light of Tier 1 inventory depletion in core oil basins after 2030.

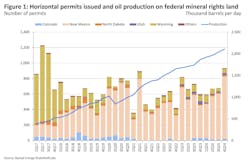

Trump hopes that speeding up permitting on federal land will help incentivize operators to extract more oil and gas, and while this is positive news for the industry, it’s unlikely to have a major impact on Lower 48 growth.

Quicker permit approvals on federal land in New Mexico will further propel development in one of the most commercial portions of the shale patch, but speed of permit approvals has not been a material roadblock drilling in the area over the past four years.

In fact, in the fourth quarter of 2024, the third highest ever number of permits were issued on land with federal mineral rights, and production reached all-time highs.”

Offshore impact

Gulf of America?

The Associated Press weighs in: "President Donald Trump has signed an executive order to rename the Gulf of Mexico to the Gulf of America. The body of water has shared borders between the US and Mexico. Trump’s order only carries authority within the United States. Mexico, as well as other countries and international bodies, do not have to recognize the name change. The Gulf of Mexico has carried that name for more than 400 years. The Associated Press will refer to it by its original name while acknowledging the new name Trump has chosen."

“Looking offshore, the geographies that the Biden administration had restricted in early January are mostly areas with very little industry interest. Areas that could potentially be more compelling for exploration – notably, the Eastern Gulf of Mexico Planning Area – were already subject to a leasing moratorium through mid-2032, which Trump had previously signed in 2020. It is unclear how the new Executive Orders will ultimately affect these areas given the high likelihood of legal challenges.

The more impactful potential developments around offshore leasing could occur at the legislative level as Republican lawmakers attempt to shepherd one or more reconciliation bills through Congress, with big implications for energy permitting, immigration, security spending, and an extension of the 2017 Trump tax cuts.

In any case, we can expect to see language around minimum leasing requirements in the Central and Western Gulf of Mexico planning areas that would go above and beyond BOEM’s current five-year lease sale plans.”

LNG and gas markets

Amber McCullagh, SVP, Oil and Gas Research, said:

“Former President Biden’s pause on approving non-FTA [free trade agreement] export licenses for proposed LNG terminals drew sharp industry criticism and halted momentum on several projects that had previously been close to taking final investment decision.

Trump ordered that non-FTA approvals resume, but we see this move as reshuffling which pre-FID projects are most likely to be sanctioned but not significantly changing the level of FIDs.

US LNG projects compete in a global market, and each additional FID draws on additional, higher-cost supplies, eroding their economic competitiveness.

To-date, LNG projects draw hardest on feedgas from the Haynesville shale, where remaining Tier 1 inventory is limited and increasingly consolidated among the largest operators.

Appalachia features the most untapped gas reserves, but moving these molecules to the coast is prohibitively expensive.

Trump is likely to push for permitting reforms, but such changes would require an act of Congress, which saw some bipartisan interest in the last session.

The outlook for gas-fired generation already had improved in recent years, as rising electrification of transportation and heat combined with rising data-center demand to accelerate electric loads and the need for dispatchable generation.

Trump signaled he would block new offshore wind leases, but these are unlikely to meaningfully impact the US [power] generation mix.

Removing subsidies for wind and solar generation would have a more significant impact, but such a move would also require Congressional approval, and Republicans’ margins are very small in the House of Representatives.

Nonetheless, with momentum in gas-fired generation already in place, rising domestic fossil fuel demand is likely.”