Rystad Energy: 4 takeaways from Trump’s first day in office

In light of President Donald Trump’s first day in office and the several announcements and executive actions impacting energy markets, Rystad Energy recently shared an immediate reaction from its Head of New Energies Research, Artem Abramov.

Abramov said:

“US President Donald Trump swiftly issued a long list of orders after being sworn into office on January 20, 2025, many of which have direct implications for the energy sector.

In line with his election promises, Trump declared a national energy emergency and set out a general policy direction aimed at accelerating domestic oil and gas supply, immediately revoking former President Joe Biden’s pause on new liquefied natural gas (LNG) permitting.

In terms of the impact on low-carbon energy sectors, our assessment of the pack of orders issued on Day One reveals no surprises.”

Following this, Rystad Energy identified four major immediate implications for renewable energy and cleantech sectors, described below. Abramov offered his comments on each point.

1. Suspension of offshore wind permitting and Paris Agreement exit

RELATED CONTENT:

Trump declares national energy emergency | Offshore

President Donald Trump orders US to withdraw from Paris climate agreement.

Trump temporarily halts leasing and permitting for wind energy projects | Offshore

The US Interior Secretary will now assess environmental impact, economic costs and the effect of subsidies.

We believe the process is likely to move faster this time compared with the exit framework set during Trump’s first term. We also expect the US exit to have more significant international implications this time, as it could further strengthen support for anti-climate policies in Europe and other regions.

Similarly, Trump issued immediate suspension of offshore wind energy permitting in line with his campaign promises.

In essence, the chances of any new offshore wind developments in the US are zero for now.

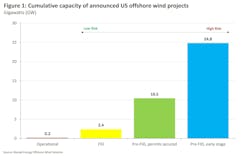

The US currently has around 2.4 gigawatts (GW) of advanced-stage offshore wind developments that have reached final investment decision and are under construction, which are unlikely to be impacted by the order.

Moderate risk amid the unfavorable investment climate is present for 10.5 GW of projects which secured necessary permits but have not reached investment decisions.

The remaining 25 GW of early-stage projects are unlikely to see any progress under the current administration.”

2. Moderately positive sentiment in the biofuels sector

RELATED CONTENT:

Trump propels pro-fossil fuel agenda with day-one orders | Oil & Gas Journal

President Trump ordered the government to resume processing LNG export permits, reversed actions to close parts of Alaska and federal waters to oil and gas development, pumped the brakes on a transition to EVs, and bid adieu to the Paris climate accords.

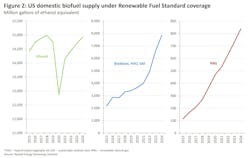

“Biofuels are explicitly mentioned in the list of domestic energy resources favored for accelerated permitting or development in Section 3 of the new administration’s ‘Unleashing American Energy’ order, together with oil, natural gas, coal, hydropower and critical minerals.

In his inauguration speech, Trump also briefly touched on the topic of E15 blend, reviving hopes for further improvement in its regulatory status and potential for year-round sales at the national level.

In general, we believe that Trump will try to find a balance between support of the US farming and oil and gas industries, and significant disruption for US bioenergy in the next four or five years is unlikely. Having said that, uncertainty around the final rules for the clean fuel tax credits persists.”

3. Electric vehicles heavily targeted

RELATED CONTENT:

Trump's auto policies would reduce US production targets | IndustryWeek

Increased tariffs, emissions rollbacks and eliminating incentives will bring turmoil and instability.

“The first day orders were heavy on the reversal of electric vehicle (EV) support programs.

Trump immediately slashed Biden’s order of federal procurement targets for EVs as well as an order for non-binding 50% EV sales target for 2030.

Moreover, Section 7 of the ‘Unleashing American Energy’ order introduces an immediate halt to federal funding for vehicle charging stations pending completion of a review process.

Finally, Trump called for the end of a waiver to adopt zero-emission vehicle rules.

We believe that the next development to monitor will be an attempt to repeal clean vehicle consumer tax credits (30D) introduced in Biden’s signature Inflation Reduction Act (IRA).

Having said that, this process might take longer and will require congressional approval.

Meanwhile, the EV market share in the US hit a record high for new sales in December 2024, and EV sales are still expected to trend upwards in 2025, while the medium-term adoption outlook might be influenced by policy changes in coming months.”

4. No immediate impact for solar, hydrogen or CCS

“We do not think there are immediate implications for any other cleantech or renewable energy sectors from the first series of executive orders. Having said that, we note that some language in Section 7 of the ‘Unleashing American Energy’ order is open to interpretation.

While it is clear that the order specifically targets EV infrastructure funding, it is possible to imagine a scenario in which the US Internal Revenue Service is hesitant to extend clean energy tax credits under Sections 45 and 48 of the US Tax Code until the administration provides further clarity.

US upstream low-carbon energy spending increased from $84 billion in 2021 to $131 billion in 2024. Our current estimate suggests spending further increased roughly 15% in 2025, to $151 billion per year.

While growth in 2025 is largely inertial and set in stone, continuous low-carbon market expansion in the US from 2026 onwards depends on successful government support for Section 45 and 48 credits and US Department of Energy loan programs.”