Market outlook: A new wave of growth is expected for the offshore wind industry

Key Highlights

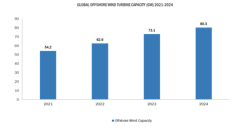

- Offshore wind capacity surpassed 80 GW in 2024, with significant growth expected through 2030, driven by technological and policy advancements.

- Countries like China, the UK, Brazil, India and Canada are leading the development, with new entrants exploring offshore wind potential along their coastlines.

- Emerging technologies such as floating turbines, digital twins and HVDC transmission are improving project efficiency, reducing costs and enabling deployment in deeper waters.

By Kapil Garg, MarketsandMarkets

The global demand for energy continues to rise at an unprecedented pace, driven by a growing population, rapid urbanization and expanding industrial activity. As more people gain access to electricity and modern conveniences, especially in developing economies, the strain on traditional energy sources intensifies.

In parallel, advancements in technology and the proliferation of digital infrastructure—from data centers to electric vehicles—are further amplifying energy consumption. This surge in demand highlights the urgent need for sustainable, scalable energy solutions that can meet future needs without compromising environmental stability.

Offshore wind energy has emerged as one of the most promising and rapidly growing sectors in the global renewable energy transition. Unlike onshore wind, offshore wind farms benefit from stronger and more consistent wind speeds over the ocean, which leads to higher energy yields and improved reliability. With global climate targets becoming more urgent, offshore wind presents a scalable, clean alternative to fossil fuels, particularly for densely populated coastal regions that demand large-scale electricity production. As of 2024, the world has more than 80 GW of installed offshore wind capacity, with projections indicating this could exceed 200 GW by 2030, making it a key player in the global decarbonization strategy.

Several driving factors are accelerating the adoption of offshore wind:

- Technological advancements such as larger and more efficient turbines, floating wind platforms, and digitalized maintenance systems are drastically improving the efficiency and feasibility of offshore projects.

- At the same time, falling costs due to economies of scale, improved supply chains and competitive auctions are making offshore wind increasingly attractive to investors.

- Governments across Europe, Asia and North America are backing this growth with ambitious targets, supportive policy frameworks and substantial funding, recognizing offshore wind’s role in meeting renewable energy commitments and creating green jobs.

Moreover, the integration of offshore wind with other emerging technologies is setting the stage for a more resilient and flexible energy system. Hybrid systems combining offshore wind with battery storage, green hydrogen production or solar power are being developed to address intermittency and provide consistent energy supply. Innovations in grid infrastructure, such as subsea interconnectors and smart grid management, are also facilitating smoother integration of offshore wind into national and regional energy networks. These synergies are turning offshore wind into a cornerstone of the future clean energy economy, both as a standalone resource and as part of a larger, interconnected system of renewables.

Market outlook

China led the global offshore wind sector again in 2024 with total capacity of 43.2 GW, little more than total capacity of Europe. UK was the second biggest offshore wind capacity installer with 17.4 GW in the same year. The global installation additions are expected to grow at double digit rate until 2030. Other key countries are Germany, Denmark and The Netherlands. The next few years will see new entrants that are exploring offshore wind, including Azerbaijan, Brazil, Canada, Colombia, India, Oman, the Philippines, Sri Lanka, and Trinidad and Tobago.

India has set ambitious targets to harness its offshore wind potential, particularly along the coasts of Tamil Nadu and Gujarat. In September 2023, the Ministry of New and Renewable Energy (MNRE) announced plans to allocate 7.2 GW of offshore wind development areas off Tamil Nadu's coast during 2024 and 2025. To streamline this development, the Indian government introduced the Offshore Wind Energy Lease Rules in December 2023, providing a regulatory framework for leasing maritime areas for wind energy projects.

Canada is taking strategic steps to establish a robust offshore wind industry, with a particular focus on its Atlantic coast. Nova Scotia is leading the charge, aiming to develop up to 5 GW of offshore wind capacity by 2030, with the first leasing round expected in 2025. In March 2025, the province identified five priority areas for potential offshore wind development, laying the foundation for long-term planning and investment.

Brazil's offshore wind breakthrough

Brazil is rapidly positioning itself as a major player in the global offshore wind industry, with an enormous technical potential estimated at more than 700 GW. As of 2024, while no offshore wind projects are operational yet, Brazil has approved more than 170 GW in licensing requests, signalling a strong pipeline for future development. The country’s vast coastline and favorable wind conditions make it an ideal location for offshore wind farms, particularly in the northeast and southeast regions.

A key milestone in unlocking Brazil's offshore wind potential came in 2024 with the passage of Bill PL 576/2021. This legislation provides a regulatory framework for the use of Brazil’s maritime space for offshore wind generation, streamlining the licensing process and defining responsibilities between the federal government and relevant agencies. The bill also introduces competitive bidding for site allocation, ensuring transparency and investor confidence. By establishing clear rules, the bill is expected to accelerate the timeline for project approvals and construction, attracting both domestic and international investment.

With strong political support, abundant natural resources and growing energy demand, Brazil is poised to become one of the world’s leading offshore wind markets in the coming decade.

Top technologies adopted by the offshore wind industry

Floating offshore wind technology: Floating wind turbines enable deployment in deeper waters, unlocking vast areas previously inaccessible for wind energy exploitation. This technology is particularly beneficial for countries with deep coastal shelves, such as Japan and the US. The scalability of floating wind farms is expected to significantly contribute to global offshore wind capacity.

Advanced power electronics: The integration of advanced power electronics, including voltage-source converters and grid-forming inverters, facilitates the synchronization of offshore wind farms with onshore grids. These technologies enhance voltage and frequency regulation, ensuring stable and reliable power delivery.

Digital twin technology: Digital twins are virtual replicas of physical wind turbines that use real-time data to monitor performance, predict maintenance needs and optimize operations. This leads to better asset management and reduced downtime.

HVDC transmission: High-voltage direct current (HVDC) technology enables efficient long-distance power transmission from offshore farms to onshore grids with minimal energy loss. It’s especially useful for large-scale offshore wind farms located far from the coast.

Autonomous maintenance drones and robotics: AI-powered drones and underwater robots are being deployed for inspections and minor maintenance tasks. These technologies improve safety, reduce costs and minimize human intervention in challenging offshore environments.

About the Author

Kapil Garg

Kapil Garg is the practice lead (manager) of the Energy & Power Practice with MarketsandMarkets.

He has more than 13 years of experience in the energy, chemical and material industries. He has worked on various consulting and business research projects in areas such as digital oil field, renewable energy, environmental technology, paints and coatings, construction chemicals, and others. He holds a bachelor’s degree in petroleum engineering from Pune University.

He can be reached at [email protected].