Upcycle in rig demand creates lean inventory in shipyards

Editor's note: This story first appeared in the September/October 2023 issue of Offshore magazine. Click here to view the full issue.

By Hans Jacob Bassoe, Esgian Rig Services

The ongoing multi-year drilling upcycle has resulted in a scarcity of available rigs and dayrates have reached levels not seen since the 2010-14 upcycle. The appetite for additional rigs is certainly still visible as national oil companies are looking to increase domestic production and international oil companies have increased forecasted capital expenditures. As a result of the optimistic market, investors and drilling contractors have acquired numerous stranded newbuilds in shipyards. The few stranded rigs that are left are hot takeover objectives in a booming offshore drilling market.

There are still 42 rigs in shipyards that are considered under construction, of which 14 are drillships, 6 semisubmersibles, and 22 jackups. The amount of stranded assets has decreased compared to last year, and there are currently 28 rigs that are owned by the shipyards, while the remaining 14 are owned by drilling contractors or investors. Only three of the rigs under construction are contracted for work after delivery, as most of the contracted rigs have already been delivered. These rigs are the ARO Drilling jackups ARO 2005 and ARO 2006, both contracted to Saudi Aramco, and drillship Stena Evolution, which will move to the US Gulf of Mexico on a five-year contract with Shell starting in 2024.

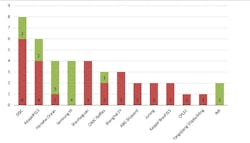

Most of the rigs under construction are in China, with almost 50% of the newbuild fleet located in the country. Chinese shipyards have 15 jackups, 2 semisubmersibles, and 3 drillships under construction. South Korea has moved up to second place, ahead of Singapore, with eight drillships under construction. However, almost all of the Korean drillships have been acquired and will likely be delivered in 2024 and 2025. Lastly, Singapore comes in third and has already had several deliveries this past year, both through acquisition and bareboat charters. The remaining newbuilds are located in Brazil (4), the U.A.E (2), and India (2).

High dayrates and increasing demand for rigs in the Middle East have created a lot of interest for jackups and several units have been acquired either through bareboat charter or purchase. Keppel FELS’ Fecon 1 (now Admarine 683) and Fecon 2 (now Admarine 684) were delivered to ADES on a bareboat charter, while Fecon 3 (now Arabdrill 110) and Clearwater B-Class4 (now ArabDrill 120) were delivered to Arabian Drilling Company on a bareboat charter in 4Q 2022; while Saipem contracted Gulf Driller VII (now Perro Negro 11) from CIMC Raffles. Meanwhile, ADNOC Drilling bought the three newbuilds Huldra, Heidrun, and Tivar from Borr Drilling, each of which have been awarded a 10-year contract with ADNOC Offshore. Sinopec Offshore Oilfield Services bought the Kan Tan VIII from Dalian Shipbuilding Industry Company (DSIC). COSL has also shown interest in expanding its fleet and the Chinese drilling contractor purchased two ex-Seadrill jackups, West Rhea and West Titan, from DSIC, with an option for an additional two.

The deepwater activity has also generated a lot of interest in drillships, as dayrates have been moving toward the $500,000 mark. Transocean announced in November 2022 that its joint venture with Perestroika AS and Lime Rock Management, Liquila Ventures Ltd., has agreed to purchase the 12,000-ft seventh-generation drillship West Aquila (now Deepwater Aquila) from DSME for about $200 million. The drilling contractor also took delivery of the two 20k BOP drillships Deepwater Atlas and Deepwater Titan in 2022, both of which moved to the US Gulf of Mexico to work for Beacon and Chevron, respectively. Another investor-backed company, the newly created Eldorado Drilling, purchased the 12,000-ft seventh-generation drillship West Dorado in January 2023 and the 10,000-ft seventh-generation drillship Pacific Zonda in April 2023, each at around $200-230 million (the exact purchase price was not reported). In addition, Eldorado is reported to have purchased a third Korean drillship.

Additionally, Valaris has confirmed that it will exercise its purchase options for two drillships, Valaris DS-13 and Valaris DS-14, and will issue $400 million (upsized from $350 million) in 8.375% senior secured second lien notes to finance the acquisition. Valaris agreed with DSME (now Hanwha Ocean) in 2021 to amend and delay the delivery date to December 2023, and was given the option to take early delivery or terminate the contracts. Now, in a higher earnings environment, the purchase price of $119 million for the DS-13 and $219 million for the DS-14 are too attractive to pass on.

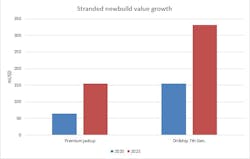

Newbuild rig values increased significantly last year, and the growth has certainly not stopped in 2023. Values for rigs under construction have on average increased by 16% year-to-date (YTD), with semisubmersibles seeing the highest growth among higher dayrates. Semisubmersible newbuilds increased by 23% YTD, while drillships increased by 19% YTD. Esgian Rig Values (ERV) estimates the most valuable newbuilds to be Nordic Spring and Nordic Winter, both over $400 million. Meanwhile, jackup newbuilds have increased by over 10% YTD, with the most valuable units being the ex-Seadrill jackups being built at DSIC with values in the $150-million range.

Nearly all the rigs under construction were ordered during the 2010-2014 upcycle, with only a handful of rigs ordered after the 2015 downturn. The drilling market was experiencing a careful optimism in 2018-2019 and two harsh-environment semisubmersibles were ordered from KeppelFELS during this time by the Norwegian drilling contractor Awilco Drilling. Both newbuilds were later cancelled and Dolphin Drilling secured the marketing rights for the two rigs, with expected delivery dates in 2024 and 2025. The Saudi Aramco-Valaris joint venture ARO Drilling also ordered jackups to be built by Lamprell and International Maritime Industries as part of a 20-rig newbuild program over the next ten years. The two first rigs, ARO 2005 and ARO 2006, will be delivered later this year.

Although there is currently a lot of demand for newbuilds, there are a few rigs that still have a questionable future. The four Sete Brasil rigs remain stranded in Brazil and their situation remains uncertain, as Petrobras has indicated that its board of directors will be considering the possible conclusion of an agreement with Sete Brasil. The four rigs under construction are the two semisubmersibles, Urca and Frade, built by Keppel BrasFELS, and the two drillships, Arpoador and Guarapari, built by Jurong (Sembcorp). The rigs were part of Sete Brasil’s large rig construction program which failed after the company was linked to the larger corruption scandal, the “Lava Jato” or “Car Wash” scandal, in Brazil. An agreement appeared to have been reached with Petrobras in 2018/19 when the Brazilian operator planned to award each rig a 10-year contract at a dayrate of $299,000, with Magni Partners acquiring the four rigs partnered by Etesco and Mubadala Gorup. However, the transaction was never completed.

Besides the newbuild fleet, the number of incremental rigs available to enter the market is limited to the non-competitive fleet. However, this fleet consists of mostly operator-owned rigs and cold-stacked vintage rigs that have been stacked for a very long time. Many of these rigs are too old and too costly to reactivate and remain scrapping candidates despite the improving market. The global fleet has been decreasing after a prolonged downturn and still almost one third of the fleet was built before 2000; many of these were built in the 1970s and 1980s. Hence, the current supply of newbuilds is not enough to cover the increasing demand.

Although additional newbuilds are needed to cover future demand, the current capacity of shipyards for offshore rig construction is unclear. The extended downturn led to large financial losses for the shipyards, and that led to a strategic shift towards the energy transition and renewable industries. Keppel O&M and Sembcorp marine (now Seatrium) completed their megamerger earlier this year, which saw Keppel Corporation exit the offshore and marine industry. The new entity will certainly continue to play an important role in the future of rig building, along with Chinese shipyards, but will also have an increasing focus on the renewable industry and offshore wind.

The stranded units available are financially advantageous compared to a newbuild. However, if current market conditions hold, the higher dayrate environment and global fleet reduction will likely spur a new newbuild cycle when most of the stranded rigs are in the market. It is not a question of if but when the next newbuild orders will start to happen. In the next few years, most of the stranded assets will be acquired, contracted and delivered by the shipyards, which will free up space for additional newbuilds. The first rigs ordered will probably be jackups, while drillships are more likely to be ordered before new semisubmersibles. However, long lead times can be expected. The earliest lead times will likely be two or three years for completion. This means that, if the first orders were placed in 2025-2026, these orders would not enter the market before 2027-2028.