Report: No resurgence seen for newbuild rig construction

Offshore staff

LONDON – Despite high take-up of offshore drilling fleets worldwide, Westwood Global Energy Group does not see prospects for a resurgence in newbuild rig construction.

The analysis was offered in the latest Westwood Insight report.

According to Terry Childs, head of Westwood’s RigLogix division, even if a rig owner was able to secure financing, few shipyards would countenance building a new rig following widespread experience with non-payment for previous projects. Also, many yards having either exited the business or undergone a consolidation process.

In addition, there are still undelivered rigs in yards that had been ordered during the last newbuilding phase. These new rigs consume large amounts of capital and shipyard time.

With inventory available, various cold stacked rigs could undergo reactivation, providing rig owners with a cheaper route to boosting their fleets. And there is further scope for M&A deals to other companies and their assets rather than committing to building a new rig.

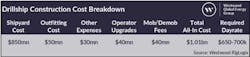

According to estimates supplied by rig owner estimates, constructing a new drillship would cost over $1 billion, with a build time of around three years. Assuming 90-95% utilization, a dayrate of $650-700,000 would be needed for a standard 12-15% return on investment over the vessel’s anticipated lifespan of ~25 years.

There are 15 drillships and seven semis, many from the last newbuild cycle, sitting idle in various yards. While three of this total have contracts, up to eight may never be delivered, leaving seven drillships and four semis available to rig owners.

Activation would cost at least $100-110 million, plus a further $250-300 million for acquiring the rig.

And as most are in Southeast Asia, mobilization would cost $35-50 million along with upgrades requested by an operator client or for use in a specific offshore region, with an estimated 12-14 months of yard time to get one of these rigs out.

RigLogix has also identified 13 cold-stacked drillships and 17 cold stacked semis, of which up to 10 are likely being marketed for drilling programs, while others look set to be scrapped.

As for reactivation, for a cold stacked drillship in Las Palmas, the Canaries, the base cost is thought to be $85-90 million, plus mobilization fees and additional upgrades, with one year of shipyard time for reactivation.

A rig owner would need a five-year initial term just to consider building a new rig, Childs said, with only a few regions offering that scope, such as Brazil and Africa. TotalEnergies recently issued a tender for two drillships working on 10-year contracts: two newbuild drillships have recently entered the US Gulf of Mexico, but there may not be further scope for the region to accommodate another.

Any new rig orders will more likely be for jackups, with some now on multi-year contracts, up to 15 years in the Middle East. At the same time, dayrates have soared to reach $160,000 in certain areas, with Borr Drilling and Shelf Drilling reporting a lack of equipment to fulfill future demand.

Building a new jackup could cost $250-300 million for a 400 ft-rated rig, with a delivery time of up to 2 ½ years. Jackup owners would expect a 15% ROI for a newbuild with 90-95% utilization and a dayrate of $200-230,000/d over the rig’s 25-year lifespan.

RigLogix has identified 20 undelivered jackups, three of which have contracts and one with a sale pending. The remaining 16 are mostly completed but would need shipyard time to finish construction and go through acceptance tests.

Of the cold-stacked fleet, 56 are available, of which six have been stacked for over 10 years, making it unlikely they would ever work again Realistically, fewer than 15-20 could potentially return to the global flee, Childs said.

However, there have been rumors that certain super majors, citing escalating rig costs, could offer initial contract terms that might entice persuade rig owners to commit to newbuild jackups. And at least three jackups previously retired with the intention of converting them to wind farm installation vessels look set to return as drilling rigs.

09.01.2023