Offshore staff

LONDON — Worldwide take-up of jackup drilling rigs should remain strong this year, according to a report by Westwood Global Energy Group’s RigLogx division.

More contract awards should follow in the Middle East, although probably below the large numbers issued last year. However, outstanding rig requirements off Southeast Asia and West Africa will likely help maintain a tight supply/demand balance in those regions.

Contract extensions underway in Mexico should keep the market there buoyant. But the North Sea could suffer from the UK’s 2022 windfall taxes. According to RigLogix head Terry Childs, various operators are reconsidering previously planned drilling programs, and some have already indicated they will cancel certain campaigns.

As a result, rig owners are now marketing their jackups in other regions, so additional rigs will likely depart the North Sea area this year.

Despite these localized issues, global marketed use of jackups could rise from last year’s 90% average to about 95% this year, with attendant upward pressures on day rates.

In the Middle East, rates for new fixtures topped $100,000 late in 2022. Around the same time, rates offshore Southeast Asia climbed in some cases to $134,000/d, compared with the mid-$70,000s earlier in the year.

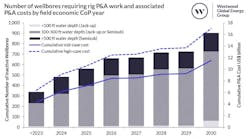

As for the floating rig fleet, encompassing semisubmersibles and drillships, outstanding requirements will lead to continued rig demand for exploration drilling, with long-term field development programs adding multi-year contracts.

RigLogix has identified 73 current rig requirements, with the Atlantic’s golden triangle area accounting for 23 of these, and the North Sea accounting for 16. Another 21 are on the books in Southeast Asia, the Far East and Australia, while operators are seeking rigs for 10 programs in the Mediterranean and Black Sea.

Last year only six semis were retired from the global fleet and no drillships at all.

Floating rigs

Currently, 83 of the 162 active floating rigs have no availability in 2023. Of the remaining 64 contracted, 28 of these are booked up through December, and 12 of these have options that, if exercised, would extend availability into 2024 or later.

Most recent floating rig tenders have specified a 2024 start date, with limited windows of opportunity for operators in some regions that have one or two wells to drill.

In areas such as the Mediterranean that have delivered recent large discoveries, E&P companies may look to move more drilling plans forward.

Offshore Norway, Westwood expects activity for floaters to rebound from the subdued levels in the second half of 2022. Elsewhere, utilization of the fleet off South America will remain at or near 100%, while activity should rise offshore Southeast Asia and Australia.

01.26.2023