Data Briefs

Offshore rig market faces slow start in 2025

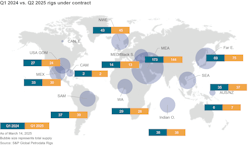

The offshore rig market has experienced a slow beginning to 2025, marked by a scarcity of fixtures and demand being deferred until 2026 and 2027. Global offshore market utilization has declined to 88.8%, down from 91.49% in the first quarter of 2024. While some regions have maintained stable or even slightly increased numbers of units under contract over the past year, others are experiencing lower utilization rates. This trend is expected to persist, especially as several deepwater rigs are anticipated to become available later this year without immediate follow-on work. Notably, the Middle East has seen a significant reduction in rigs under contract since early last year, primarily due to charter suspensions by Saudi Aramco, with Pemex recently following suit and likely continuing this trend.—Petrodata Rigs by S&P Global

Repair versus installation: a critical trade-off

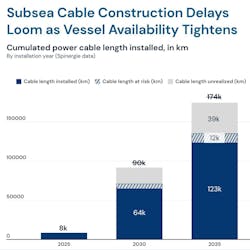

Cable layer shortages are expected to hit the subsea market by 2026 leaving 23% of cables left uninstalled by 2030. Additional strain from increased cable repair demand is also on the cards for this overburdened fleet. Of course cable failures, unlike planned installation campaigns, are unpredictable events. Their impact can be severe, disrupting entire regions and vital services. And with vessel schedules stretched thin, it becomes even more challenging to ensure rapid repair availability.—Spinergie

Key wells to watch in 2025

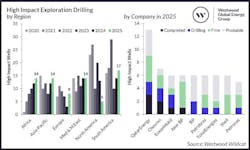

There are 21 frontier wells expected in 2025, a small increase on the 19 wells in 2024. Of the 21, 11 are targeting frontier basins, while new plays will be tested in the proven Sabah, Rio Muni, Western Black Sea, Suriname-Guyana and Cauvery basins. Emerging play wells are expected to account for ~30% of the high-impact inventory in 2025 down from 36% in 2024. High-value, >100 MMboe prospects in mature and maturing plays are forecast to make up 40% of the high-impact program, an increase on last year. The Arabian, Campos, Gulf of Mexico, Kutei, Norwegian Sea, Santa Cruz and Santos basins will all have multiple high-impact maturing/mature play prospects drilled.—Westwood Global Energy Group