Offshore staff

OSLO, Norway – The global market for FPSOs is headed for a major renaissance with as many as 24 FPSO awards expected by 2020, driven mostly by Brazil, according to analyst Rystad Energy.

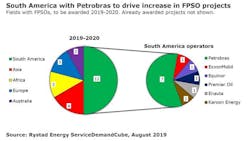

South America leads the pack with 12 sanctioned FPSO projects planned by the end of next year, followed by Asia with four, Europe and Africa with three each, and two more in Australia.

Rystad expects Brazil – currently witnessing an influx of international E&P companies – to contract seven more FPSOs in 2020, thereby bringing the country’s tally to more than one-third of the awards anticipated globally this year and next.

The seven projects already confirmed this year collectively represent production capacities of more than 700,000 b/d of oil and around 60 MMcm/d of gas.

Audun Martinsen, head of oilfield services research at Rystad Energy, said: “The ongoing upswing in newly sanctioned FPSO projects points to a brighter future for the FPSO market. Offshore operators are finding their footing again after the downturn of 2014, as a robust rise in free cash flow has fueled a significant uptick in deepwater investments.”

The FPSO boom in South America is mainly the result of large investments in deepwater exploration and field development. Another important factor has been Brazil’s recent relaxation of local content regulations, which has attracted new international players to the table, the analyst said.

“Brazil’s greater competitiveness on a global scale is a driver behind such huge FPSO awards, along with the region’s recovery from the Car Wash corruption scandal, Petrobras’ debt reduction, substantial presalt discoveries and healthier oil prices,” Martinsen noted. “These positive factors also add greater certainty to project timelines, and we no longer believe Petrobras’ developments will be subject to lengthy delays.”

FPSOs, traditionally used by oil companies for large-scale deepwater projects, are increasingly favored for a wide range of fields in more shallow waters. FPSO projects are in many cases more practical than alternative platform solutions, primarily due to the installation costs and decommissioning challenges associated with fixed platforms. The built-in storage capacity of FPSOs has also proven to be especially advantageous for remote offshore locations, where pipeline infrastructure is not economically feasible.

“With improved economic viability resulting from ongoing standardization measures, coupled with growing deepwater investments, FPSOs are likely to continue to emerge as an attractive development option for many fields in all corners of the world, in both deep and shallow water,” Martinsen added.

FPSO contractors Yinson and MODEC are particularly well-positioned to benefit from this upswing through the next wave of contract awards, according to Rystad’s projections.

08/13/2019