Report: North Sea jackup demand expected to rise in 2H 2024

Offshore staff

NEW YORK CITY – The North Sea jackup market continues to face challenges, according to Evercore ISI’s latest Offshore Oracle Report. These challenges include a lack of work and lower dayrates compared to other regions due to excess profit taxes in the UK and uncertain government rules.

But the challenges also stem from the region’s “perceived advancements in the energy transition, leading to stricter regulations and environmental activism,” the firm wrote in its report.

However, Evercore says that tighter environmental regulations and growing interest in sustainability in Europe may drive demand for rigs, primarily for CCS and P&A projects.

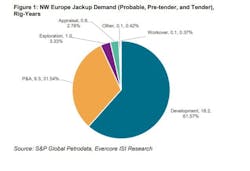

Out of 29.6 total jackup rig years, the firm notes that 18.2 rig years (62%) are related to development drilling, while 9.3 rig years (32%) are P&A work. The remainder is split between exploration, appraisal, workover, and others.

Evercore says that there are currently eight open demands for P&A work across the UK and Norway regions from Harbour Energy, NAM, Repsol, Spirit Energy, TotalEnergies, and Waldorf Production. These P&A projects will commence between April 2025 and March 2027.

Comparably, out of 39.8 total semisubmersible-rig years, 32.7 rig years (82%) are related to development drilling, and 6.4 rig years (16%) are P&A work. Evercore notes that semi-P&A projects will commence between July 2024 and April 2028.

The firm also said that “we believe [that] the Norwegian jackup market will remain subdued in 2024.” It noted that there are currently seven jackups working in Norway, which will increase to eight once the Shelf Drilling Barsk commences its two wells plus options contract at Equinor’s Sleipner West in 2H 2024. The report also noted that “average jackup demand is likely to remain flat [in Norway] in 2025.”

The North Sea jackup market outside Norway is expected to recover in 2H 2024. Evercore noted that there are currently 17 jackups working in these regions, including Denmark, the Netherlands, and the UK. An average demand of 19.8 units is expected for 2024, which is further expected to increase to 21.9 units in 2025.

02.28.2024