Offshore staff

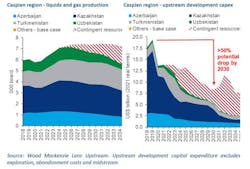

LONDON – Upstream investment in the Caspian region could fall steeply in the 2030s, according to Wood Mackenzie.

Over the current decade, marketed oil and gas production will grow, due mainly to new phases of development at the region’s offshore and onshore mega-projects.

But upstream development capex in 2030 could be less than half the 2019 level of almost $20 billion (in 2021 terms), said analyst Ashley Sherman.

Projects that may struggle to achieve commercialization include bp/SOCAR’s potentially giant Shafag Asiman deepwater gas discovery offshore Azerbaijan, Sherman added.

Much of the current spending is focused on five majors-led projects in Kazakhstan (Kashagan, Karachaganak and Tengizchevroil) and Azerbaijan (ACG and Shah Deniz).

But unlike the period between 2000 and 2020, no investment decision is imminent for an elephant-sized brownfield development.

In the past, too many major-capital projects in the area have suffered cost overruns and delays. Any new investments, Sherman suggested, should be framed to allow for early monetization from shorter capital cycles.

Pre-tax economics are another challenge, with most of the largest pre-FID brownfield and greenfield projects not generating a before-tax IRR above 20%.

The region has abundant gas resources, from deepwater Azerbaijan to Central Asia. But despite the shift in exploration toward gas, upstream economics remain largely liquids-driven, with competitive challenges in selling uncontracted Caspian to the core export destination, the European Union.

There is also a need for domestic reforms, Sherman said, to boost the case for optimizing the Caspian’s upstream development concepts, substituting major capital projects with incremental tiebacks to established infrastructure.

One positive development is the recent progress between Azerbaijan and Turkmenistan on the long-disputed offshore Dostlug oil and gas field in the South Caspian Sea, formerly known as Serdar in Turkmenistan and Kapaz in Azerbaijan.

Earlier this year the two countries signed an MoU for joint appraisal and development. The field, thought to be the largest undeveloped resource in disputed Caspian waters, was discovered in the Soviet era.

As for the Kashagan field in the shallow-water Kazakh sector, the long-term development plan must resolve multiple commercial and technical issues, Sherman said. One is the need for Kashagan’s updated full-field development concept to receive official approval in 2021, allowing studies to continue on a mix of pre-FID phases to lift oil production capacity.

06/29/2021