Offshore staff

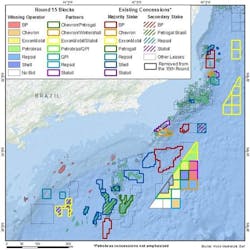

RIO DE JANEIRO– Brazil’s 15th bid round concluded with the award of 22 of the 47 offshore blocks offered, according to the National Agency of Petroleum, Natural Gas and Biofuels.

Horacio Cuenca, research director for Latin America at Wood Mackenzie, said: “In contrast to previous rounds, Round 15 stood out as more diverse, both in terms of companies bidding and geographies bid on. Although improved oil prices played a part,Brazil’s recent regulatory improvements clearly had an effect in this round drawing a more diverse group of majors and large E&Ps, and bids to less established basins.”

ExxonMobil and Petrobras dominated Brazil’s 15th bid round by acquiring stakes in eight and seven deepwater blocks, respectively.

Exxon will operate blocks C-M-753 and C-M-789 in the Campos basin, with partners Petrobras and Qatar Petroleum.

Petrobras will operate blocks C-M-709 and C-M-657 in the Campos basin, with partners Exxon and Statoil.

Shell Brasil will operate block C-M-791 in the Campos basin, with partners Petrogal Brasil and Chevron Brazil.

BP will operate blocks C-M-755 and C-M-793 in the Campos basin, with partner Statoil.

Repsol will operate blocks C-M-821 and C-M-823 in the Campos basin, with partners Wintershall Holding and Chevron.

Exxon will operate blocks S-M-536 and S-M-647 in the Santos basin, with partner Qatar Petroleum.

Chevron Brazil will operate block S-M-764 in the Santos basin, with partners Wintershall Holding and Repsol.

Exxon will operate blocks SEAL-M-430 and SEAL-M-573 in the Sergipe-Alagoas basin, with partners Queiroz Galvão Exploração e Produção and Murphy Oil Corp.

In contrast with recent rounds, Wood Mackenzie pointed out, the less established Potiguar and Ceara basins also saw active bidding, which has not happened since Round 11 in 2013. Low bonus and work commitment levels drew attention to this Equatorial Margin acreage where securing environmental licenses has been difficult in recent years.

Petrobras will operate blocks POT-M-859 and POT-M-952 in the Potiguar basin, with partner Shell Brasil.

Also in the Potiguar basin, Petrobras secured 100% of block POT-M-762, and Shell Brasil secured 100% of block POT-M-948.

Wintershall Holding secured 100% of blocks POT-M-857, POT-M-863, and POT-M-865 in the Potiguar basin and block EC-M-601 in the Ceara basin.

The round set a record in bonus government revenue, with a total of $2.4 billion committed, according to Wood Mackenzie, well above government expectations of $390 million and almost double the $1.2 billion raised inRound 14 last year.

Looking ahead to PSC Round 4 in June, the analyst firm noted, a realistic cap on bidding would serve Brazil well to maximize overall government revenue and ensure the development of future discoveries.

“Last year, after Petrobras and ExxonMobil placed record high bids in Round 14, it is very likely Brazil adjusted its bid strategies upwards in theOctober PSC Rounds 2 and 3,” Cuenca said. “If that were to happen again in the upcoming June PSC Round 4, Brazil risks setting excessively high government profit-share rates and establishing a new, potentially uneconomic, norm for its presalt projects of the coming decade.”

The concession agreements from the bid round are scheduled to be signed up to Nov. 30, 2018.

04/02/2018