Association details achievements, opportunities

Joe Leask, Oil & Gas UK

‘Decommissioning iscoming of age’ is a phrase heard in the UK oil and gas industry. Now it is steadily occurring alongside exploration and production on the UK continental shelf (UKCS). It is a phrase that aptly describes the sector’s expertise, accumulated over 30 years of decommissioning offshore structures in the North Sea basin. Ensuring that knowledge is shared is crucial to developing the highly skilled teams needed to deliver projects cost-effectively.

When Oil & Gas UK launched its 2018 Decommissioning Insight report in November press headlines like ‘Industry efficiency drive cuts UK bill’ highlighted how the competitive capabilities had improved project delivery. In contrast to reports published since 2010, this Decommissioning Insight revealed for the first time a 20% reduction in forecast expenditure over the next 10 years in comparison to the 2017 Insight report.

Transformational changes are taking place on the UKCS. Through relentlessly focusing on improving efficiency throughout the oil and gas lifecycle, the industry is extending the economic viability and productive life of offshore assets, attracting fresh investment into the basin. In 2018, final investment decisions for 13 new projects were approved attracting £3.3 billion ($4.2 billion) of capital investment with the potential to produce 400 MMboe over time, adding to the taxes the UK Treasury receives from the sector.

The heavy-lift vesselSaipem 7000 removing the Miller platform in the UK central North Sea. (Image courtesy BP)

These changes push cessation of production dates and decommissioning projects into the future. They are helping to stabilize the market, with decommissioning expenditure predicted to even out at about £1.5 billion ($1.9 billion) per year.

In 2018, decommissioning represented only 8% of the oil and gas industry’s overall expenditure on the UKCS. Current trends suggest this decommissioning spend will grow slightly in the near term, possibly rising to 10%. However, market conditions including oil prices and expenditure in areas including exploration, well appraisal, and operations will influence how things might unfold in the future.

Changing UKCS dynamics offer an invaluable window of opportunity. With decommissioning scheduled to occur over a longer timeline, the country can build on existing specialist skills and expertise. While decommissioning is occurring in other oil and gas provinces around the world, a significant number of UKCS projects are substantial in scale and technically complex. Current market stability promises to deliver a steady flow of diverse work for the supply chain and a range of stimulating career prospects for people entering the industry.

The association’s Decommissioning Insight, which encompassed wider North Sea activity in Norway, Denmark and the Netherlands, outlined the scale of this opportunity. It confirms the UK will be the largest market for decommissioning over the next decade providing it with the opportunity to build a regional and indeed global capability. Industry analysts like Wood Mackenzie, taking a global perspective, observed a similar trend, anticipating the UK will be where the highest level of decommissioning expenditure will take place over the same period.

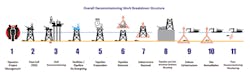

The Work Breakdown Structure provides a standard approach to modeling decommissioning projects. (Courtesy Oil & Gas UK)

The country’s experienced supply chain has a clear opportunity to develop world-class decommissioning capabilities that can be marketed worldwide as it makes the most of the steady flow of diverse and technically challenging projects on the UKCS.

In areas of highly technical complexity like well decommissioning, the industry is already delivering projects safely and in an environmentally-sound and cost-effective manner. Over the past year, forecast decommissioning costs per well have fallen by an average of 26%. While market conditions played a role in these cost reductions, the industry’s improving efficiency is helping to deliver repetitive gains in most projects. In some individual projects, the average amount of days spent on well decommissioning have halved throughout the lifecycle of the project.

Looking ahead, 1,465 UKCS wells are forecast to be decommissioned in the next decade. Representing one-fifth of the total well stock drilled to-date in the UK North Sea, this equates to a steady stream of almost 150 wells per year on average.

These activities will happen across the UKCS with decommissioning taking place on 391 wells in the northern North Sea and west of Shetland; 475 in the southern North Sea and Irish Sea; and 599 in the central North Sea. Comprising a mixture of platform, subsea and suspended exploration and appraisal wells, they represent a sizeable quantity of projects where the UK’s supply chain can both apply and hone its expertise, in highly specialized aspects of decommissioning.

The association is setting the agenda technically including in the development of tools like the Work Breakdown Structure (WBS). Giving industry a standard approach to modeling decommissioning projects, this encompasses all elements of a typical decommissioning project. Different expertise is required within each WBS phase: from engineering practitioners at the front end to operational expertise as the installation is made safe, to lifting scopes, subsea scopes and finally re-use, recycling and disposal.

Details of the WBS are included in Oil & Gas UK’s Decommissioning Cost Estimate Guidelines. The WBS establishes a common language for all those involved in decommissioning; providing the supply chain with clarity about where they fit into the spectrum, outlining good practice in contract execution to operators and defining to the regulators the cost provisions per phase.

The WBS includes aspects such as initial field economics, decommissioning security agreements toward the end of field life, planning the cessation of production and preparing decommissioning plans. The association is using this structured approach to set a global performance framework, a valuable tool for benchmarking projects.

The National Decommissioning Centre in Aberdeenshire launched in January. (Courtesy Oil & Gas UK)

In November 2018, the UK government acknowledged the industry’s coming of age when it issued a call for evidence on its plans to make the UK a global hub for decommissioning. As one of the most mature decommissioning markets, the UK can help set the agenda on how these activities are effectively regulated to ensure safety, environmental protection, and sustainability.

The UK’s growing expertise in cost-effective decommissioning combined with a stable fiscal regime is improving the competitiveness of the supply chain. With other countries already moving to secure a share of global decommissioning work, the call for evidence presents the country with a great opportunity to focus on the highly specialized areas where the UK excels such as well decommissioning, removals and subsea infrastructure decommissioning and apply these internationally.

The Oil and Gas Authority’s (OGA) UKCS Decommissioning 2018 Cost Estimate Report highlighted the country’s growing expertise, showing the industry has already reduced costs by 7% from the 2017 estimate.

The UK government is rightly focused on cost-efficient decommissioning, a desire the industry shares and is committed to deliver in a safe and environmentally responsible manner. The industry is largely responsible for covering the cost of decommissioning, which as the 2018 Insight report shows was £1.15 billion ($1.48 billion) in 2017. These are normally occurring business costs which companies can offset against current or historic profits, taking place toward the end of the lifecycle of an asset.

Companies’ decommissioning spend provides work for supply chain companies, helps develop highly exportable specialist capabilities and in turn, generates tax receipts for the UK Treasury. While the industry receives some tax relief on its decommissioning costs, it is only a small fraction of the £330 billion ($424 billion) paid in production taxes alone to the treasury since North Sea production began.

In 2016, the OGA set the sector a target to reduce forecast costs by 35% by 2022. The regulator’s Cost Estimate report shows the progress toward this goal, much of which has been achieved through better project planning and execution.

New technology has significant potential to realize efficiencies in decommissioning project delivery. Created in 2017, the Oil & Gas Technology Centre (OGTC) in Aberdeen is an industry-led research and knowledge organization, backed by the UK and Scottish governments to fund and direct projects aimed at unlocking the full potential of the UK North Sea.

Decommissioning is one of OGTC’s focus areas and there have been great examples of industry, academia, and government collaborating to develop innovative technological solutions. Spirit Energy, well specialist Interwell, and several major North Sea operators are trialling a new well decommissioning technology that could cut millions of pounds from budgets. The new method, being trialled in an onshore well, uses thermite and a controlled chemical reaction in the well rather than a traditional cement plug.

The UK’s offshore oil and gas industry is setting the agenda commercially, with companies combining their strengths to deliver broader services to operators. These innovative contracting strategies offer operators a variety of options for tendering while also enabling the participation of a greater number of supply chain companies, enhancing competition in the market.

Through developing world-leading expertise in decommissioning, the UK industry is unlocking significant potential to export this expertise to other oil provinces.

Yet, how do we build on the industry’s decommissioning achievements to date, while maximizing economic recovery from the UK North Sea?

Education and training are key in helping us build upon the advanced capabilities that exist in the UK. A growing number of initiatives are already inspiring, educating, and preparing the future decommissioning workforce, in response to the broadening awareness that decommissioning has come of age.

In 2017, the University of Aberdeen launched the world’s first MSc in Decommissioning, and Sam George of the Oil & Gas UK is one of the first students to have earned a degree in this pioneering qualification. Designed in collaboration with operators, supply chain companies and regulators, it is a positive step in ensuring experience is shared with those who wish to pursue a career in decommissioning.

Elsewhere in Aberdeen, Robert Gordon University offers a course in ‘Planning for Decommissioning.’ Developed with the OGA, the UK government’s Department for Business, Energy and Industrial Strategy, and the Health and Safety Executive, this provides students with detailed insight into decommissioning legislation.

In January 2019, the National Decommissioning Centre (NDC) was launched. The author is a member of the steering committee for this new resource in Aberdeenshire, which is the result of a £38-million ($49-million) partnership between the OGTC and the University of Aberdeen. The goal of the NDC is to be the leader in research and development that transforms decommissioning and mature field management.

The UK is now well positioned to make the most of a global market of some $80 billion over the next decade. The UK oil and gas industry is focused on making the most of this unique window of opportunity.

The Author

Joe Leask is Oil & Gas UK’s decommissioning manager.