David Paganie, Houston

Bush lifts ban on Gulf, Alaska acreage

US President George W. Bush has lifted the executive ban on oil and gas leasing in two areas in the outer continental shelf (OCS), one in Lease Sale 181 South in the central Gulf of Mexico and the other in the Bristol Bay, North Aleutian basin of Alaska.

Interior Secretary Dick Kempthorne now has the option of offering these areas during the MMS’ next five-year (2007-2012) OCS oil and gas leasing program.

Kempthorne also has increased the royalty rate for new offshore deepwater federal oil and gas leases (excluding Alaska) from 12.5% to 16.7%. He projects that this could yield up to $4.5 billion over 20 years.

“Together, these actions will enhance America’s energy security by improving opportunities for domestic energy production, and also will increase the revenues that the federal government collects from oil and gas companies on behalf of American taxpayers,” says Kempthorne.

The NOIA has a different view. The organization says the rate increase may not yield the anticipated additional revenue. “By increasing the royalty rate, the government is increasing oil and gas companies’ operating costs, which could drive exploration overseas and reduce domestic production, resulting in decreased revenue to the federal treasury, and less oil and gas for the American consumer.

“Raising royalty rates is bad public policy that could either reduce domestic production and drive up prices, or simply delay when the treasury collects its compensation,” adds the agency.

Nevertheless, the new rates will take effect with the first 2007 GoM lease sale, which is scheduled for late August.

The new Gulf area opened for leasing was withdrawn from consideration through 2012 by former US President Bill Clinton in 1998. The North Aleutian basin area opened for leasing was held under a Congress-imposed moratorium from 1990 through 2003, and then discontinued in 2004.

The 2007-2012 OCS Oil and Gas Proposed Final Program and Final Environmental Impact Statement are scheduled for release in the spring.

Environmental review under way

The MMS is conducting environmental reviews on 580,000 offshore acres in the eastern Gulf, as directed by the Gulf of Mexico Energy Security Act of 2006, signed by President Bush on Dec. 20, 2006.

The legislation allows for oil and gas leasing in two areas: the 181 Area, comprising 2 million acres in the central GoM Planning Area and a segment of 580,000 acres in the eastern GoM Planning Area; and in the 181 South Area, consisting of 5.8 million acres in the central GoM Planning Area.

The central portion of the 181 Area was reviewed in a draft Environmental Impact Statement published in November 2006. This area will be available for lease in Sale 205 scheduled for early fall.

Helix Producer I under construction

Construction is under way on Helix Energy Solution’s $140-million disconnectable floating production system for installation on the Phoenix (previously Typhoon) field in Green Canyon block 236/237.

The train ferryKarl is being converted in Croatia into the Helix Producer I (HPI), also called Kommandor 5000. A 50/50 JV (Kommandor Llc.) comprising Helix and KR RØMØ will own the DP2 vessel.

The re-deployable unit will be fitted to handle 45,000 b/d of oil and 70 MMcf/d of gas. It also will have a quick-disconnect riser system for relocation from an imminent hurricane. Hydrocarbons will be exported through the Gulf’s existing pipeline network.

The contract for supply of the vessel’s external riser turret has been issued, and long lead items for the topside facilities have been ordered. Subsea infrastructure will be installed by the company’sIntrepid or Express.

Subsea wells from the Helix-operated Phoenix, Boris (Green Canyon block 282), and Little Burn (Green Canyon block 238) fields will be tied back to the HPI, with first production expected in mid-2008. Helix recently acquired 100% working interest in these fields from Chevron, BHP Billiton, and Noble Energy. Wells from the Balvenie (Green Canyon block 235), Tornado (Green Canyon block 280/281), and Kissy Suzuki (Green Canyon block 325/326) prospects will be tied back to the facility as well, pending drilling results with the company’sQ4000.

Meanwhile, Helix is designing aQ4000 look-a-like. GVA, under contract to Helix, is performing the detailed design of the semisubmersible drilling rig, Q4500. The owner has ordered $23 million worth of thrusters and engines for the rig, and was scheduled to issue an RFP in January for construction. Pending project sanction, which is anticipated in the first half of this year, the semi is expected to be ready for service in late 2009.

Independence Hub sets sail

TheIndependence Hub floating production platform set sail on Jan. 29 from Corpus Christi, Texas, for a five-day trip to Mississippi Canyon block 920 where it will be installed. The hub, owned by Enterprise Products Partners (80%) and Helix Energy Solutions Group (20%), will be moored 241 km (150 mi) southeast of Venice, Louisiana, in 2,438 m (8,000 ft) of water, the deepest to date for an offshore platform, according to Enterprise.

TheIndependence Hub semisubmersible floating production unit is under tow to Mississippi Canyon block 920.

Mechanical completion of the platform is expected by mid-March, followed by first production in the second half of the year.

The semi’s hull was fabricated in Singapore and its topsides, designed with capacity for 1 bcf/d of natural gas, were built at Kiewit Offshore Services. In September 2006, the platform’s topsides were integrated with the hull in Corpus Christi. Heerema Marine Contractors is responsible for the hull and mooring system transport and installation.

Other major contractors include Atlantia Offshore for the hull and mooring system design and fabrication; Alliance Engineering for topsides engineering; and Allseas for installation of the flowlines and gas export pipeline.

The $2 billion dollar project is anchored by an initial 10 subsea fields in water depths from 2,377 - 2,743 m (7,800 - 9,000 ft).

Technip picked up a contract from Mariner Energy Inc. for the fabrication and installation of a subsea flowline and risers for the Bass Lite development.

The contract calls for the engineering, procurement, fabrication, and installation of a steel flowline that will tieback subsea wells in Atwater Valley bock 426 in 2,057 m (6,750 ft) of water to a steel catenary riser to be installed on theDevils Tower spar moored in 1,707 m (5,600 ft) of water.

Technip also will design and manufacture one FLET (flowline end termination), two FLMTs (flowline midline terminations), and manufacture and install a jumper.

Detailed engineering and project management will be in Houston; assembly of the flowline and SCRs will occur at the company’s spoolbase in Mobile, Alabama. The contractor’s pipelay vesselDeep Blue will carry out installation in the fourth quarter.

Socotherm has secured a deepwater contract as well. The company was awarded an $8 million contract by Murphy Oil to insulate pipe for the Thunder Hawk project in 1,700-1,900 m (5,577-6,234 ft) of water.

The contract calls for the insulation of 22 km (14 mi) of 8-in. (80 mm) pipe for installation on the Thunder Hawk field in Mississippi Canyon block 735. Socotherm will apply its wetiskokote syntactic polypropylene external insulation with hollow glass spheres for thermal insulation and mechanical strength.

Socotherm will execute the contract with alliance partner Tenaris. Installation is scheduled to begin in the third quarter.

The Murphy-operated Thunder Hawk project includes mooring of an Atlantia-designed semisubmersible production facility in 1,800 m (5,905 ft) of water. Aker Kvaerner will carry out facility installation with its vesselBoa Sub C in 2Q 2008.

Hess completes Pony sidetrack

Hess Corp. has completed the Pony sidetrack well No. 2 in Green Canyon block 468.

The well, drilled to 9,337 m (30,634 ft) TD, encountered 85 m (280 ft) of oil pay in Miocene age reservoirs after penetrating 60% of its objective.

According to the company, the sidetrack well established a record for the deepest conventional core ever recovered in the Gulf of Mexico, at 137 m (450 ft). The company says the oil bearing section in the sidetrack well is similar in thickness and quality to the equivalent interval in the discovery well, which was drilled to 9,890 m (32,448 ft) TD and encountered 145 m (475 ft) of oil pay.

Total hydrocarbon resources are estimated in the range of 100-600 MMboe. Hess has a 100% working interest in Pony.

The company has arranged for the semiOcean Baroness to appraise Pony No. 2.

Semi study for Gotcha

Total USA E&P has contracted Exmar Offshore Co. to provide project management and engineering services for the semisubmersible pre-FEED study for the Gotcha development.

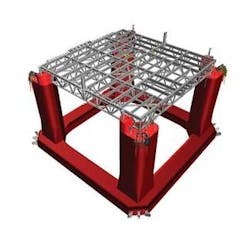

3D image of the hull and truss deck of the Exmar-designed semisubmersible production facility, OPTI-6000. The re-deployable platform will be leased under short-term contracts for early production or marginal field developments.

The field is in Alaminos Canyon block 856 in 2,438 m (8,000 ft) of water.

Exmar will be the main engineering contractor. The company also will provide engineering and analysis for the proposed standalone semisubmersible floating production facility, based on its proprietary design, OPTI-6000.

The re-deployable semi will be fitted with upgradeable capacity to handle initially 40,000 b/d of oil and 40 MMcf/d of gas.

Other companies in the study include Houston Offshore Engineering for riser analysis, Intec Engineering for subsea production systems and flow assurance, Mustang Engineering for topsides design, and Aker Marine Contractors for mooring installation.

The study is scheduled for completion by the end of April. Construction of the semi is expected to be completed in 1Q 2009.

Exmar says it will lease the facility to operators for early production or marginal field development under short-term contracts.

Total operates Gotcha with a 70% working interest; Nexen holds the remaining 30%.

ATP acquires acreage

ATP has completed the acquisition of a percentage working interest in a number of US Gulf of Mexico blocks.

The company now owns a 50% working interest in Aconcagua (Mississippi Canyon block 305), a 16.67% working interest in Camden Hills (Mississippi Canyon block 348), and an additional 25.83% interest in the Canyon Express Pipeline Common System.

Aconcagua currently produces 10 MMcfe/d net to ATP, and Camden Hills produced previously, but currently is shut-in.

Aconcagua, in 2,079 m (6,820 ft) of water, Camden Hills, in 2,168 m (7,112 ft) of water, and the company’s King’s Peak field (DeSoto Canyon block 133), in 1,994 m (6,541 ft) of water, all produce through Canyon Express. ATP now owns a 45.08% interest in Canyon Express as a result of the acquisitions.

The company says it completed the transaction primarily to acquire the undeveloped reservoirs of Aconcagua, for further study of Camden Hills, and to expand its interest in the King’s Peak/Canyon Express hub area. In 2009, ATP expects to be named operator of Aconcagua and Canyon Express, and will begin planning further development of Aconcagua.

The company also has increased its working interest from 50% to 100% in Ship Shoal block 351 in 107 m (350 ft) of water. Drilling is planned to begin in the first quarter.