Americas

Suriname and Guyana have resolved a long-simmering maritime boundary dispute that will open 19,700 sq mi (51,023 sq km) of coastal waters for exploration.

Under terms of a tribunal’s ruling, announced Sept. 20, Guyana was granted sovereignty over 12,800 sq mi (33,152 sq km) of coastal waters that had been in dispute. Suriname was awarded 6,900 sq mi (17,871 sq km).

The binding ruling, according to terms of the UN Convention of the Law of the Sea, is expected to lead to further offshore oil and gas exploration by both countries.

Among the parties awaiting resolution of the dispute are international oil and gas companies. The ruling ends a six-year standoff that began in June 2000 when the Suriname navy forcibly evicted personnel from an oil drilling rig owned by Canada’s CGX Energy Inc., a company Guyana had permitted to drill in the disputed area.

Guyana and Suriname have agreed to abide by the tribunal’s ruling. Both nations can now proceed with exploration in their respective territories.

Earlier in the month, Petrobras shared its own good news, announcing that it had found oil in the Xerelete field in the southern portion of the Campos basin. The new field is partially in the old BC-2 block and partially in block BM-C-14, Petrobras says. It lies 155 km (96 mi) southeast of the city of Cabo Frio and 42 km (26 mi) east of the Papa Terra field.

Preliminary geological studies indicate the accumulation’s total area could cover more than 26 sq km (10 sq mi) and could hold as much as 1.4 Bboe. Additional studies are being carried out.

The 1-EPB-1-RJS discovery well was drilled in 2,483 m (8,146 ft) water depth. Delimitation well 3-RJS-648 flowed at a rate of 2,500 b/d of oil. A new world water depth record of 2,460 m (8,071 ft) was set at this well with the use of the submerged submarine centrifugal pump, Petrobras says.

The field is Brazil’s deepest discovery to date, lying in 2,400 m (7,874 ft) of water.

Total and Devon are Petrobras’ partners in this field.

Asia-Pacific

Reliance Industries Ltd. continues its winning streak offshore India with another deepwater hit off the east coast. The Dhirubhai-36 discovery well hit oil in block KG-DWN-98/1 (KG-D4) in the Krishna basin.

This is the first oil discovery in the Krishna deepwater basin, Reliance says, and marks a new beginning in the area. Dhirubhai-36, which lies in 565 m (1,854 ft) water depth, was drilled to a target depth of 3,595 m (11,795 ft). The well encountered clastic reservoir with a gross oil column of more than 20 m (66 ft) in the Mesozoic section.

Reliance was awarded the KG-D4 deepwater block under India’s first New Exploration Licensing Policy. The company holds 100% interest in the block, which covers 8,100 sq km (3,127 sq mi).

Swiber Holdings has made some recent announcements that indicate it is strengthening its position in Asia.

In late September, the company entered into broad cooperation agreements with two Vietnamese companies, PetroVietnam Construction Joint Stock Co. and the VietSovPetro Joint Venture (VSP).

The non-exclusive cooperation agreement paves the way for Swiber, PVC, and VSP to jointly explore opportunities for exchanging information, cooperation, and technical assistance to foster mutual development and strengthen the parties’ position in the oil and gas industry in Vietnam and overseas, Swiber says.

The three-year cooperation agreement will extend the reach of Swiber to Vietnam for the first time, Swiber says.

About 10 days earlier, Swiber signed a memorandum of understanding to undertake projects in the sultanate of Brunei.

Rahaman of Brunei, an oil and gas and commodity trading company, will hold 49% stake in the Swiber-led joint venture. Swiber will contribute technology and expertise especially for offshore oil and gas work.

Africa

Angola is putting more blocks up for bid.

Sonangol E.P. took its show on the road with presentations for its recently announced 2007-2008 E&P Licensing Round, enlisting IHS Inc. to facilitate the process. Road shows were scheduled for mid-October in Luanda, Houston, and London.

Sonangol presented technical details and discussed the hydrocarbon potential for 10 blocks.

The seven offshore blocks on offer include shallow-water block 9, deepwater blocks 19, 20, and 21 in the Kwanza basin, and newly designated ultra deepwater blocks 46, 47, and 48 in the Lower Congo basin.

The Republic of Guinea is getting into the oil and gas game via a partnership with Hyperdynamics Corp. In a move to promote offshore development, the Republic of Guinea Chief of State Lansana Conte sent a delegation including the secretary general of the office of the president to Houston in late September.

Hyperdynamics Corp.’s internationally active oil and gas subsidiary SCS Corp. owns exploration rights for 31,000 sq mi (80,290 sq km) offshore the Republic of Guinea. The company has acquired 5,000 km (3,107 mi) of new 2D seismic, conducted a geochemical drop core survey, performed a remote sensing satellite study for oil seeps, and completed an independent integrated interpretation of the data.

Hyperdynamics is pursuing a farmout program with other operators to conduct additional studies of the area and to do exploratory drilling of multiple prospects offshore Guinea.

Offshore Namibia, meanwhile, Tullow Oil Plc. ran into disappointing results with the Kudu-8 appraisal well. The well tested the potential for additional reserves within the Greater Kudu field, but failed to produce commercial flow rates.

Tullow says results of the logging program indicated production from the well would not exceed the 19 MMcf/d rate recorded at Kudu-5. The well was plugged and abandoned.

“The result of the Kudu-8 well is a disappointment for Tullow,” says Aidan Heavey, chief executive of Tullow. “Despite encountering improved reservoir development, it has not proved possible to demonstrate commercial flow rates at this location and significant technical and geological work will now be undertaken to determine the best future program for the area. Tullow does not expect this result to impact on the progress of the Kudu gas-to-power project and remains committed to the joint venture and will continue the process of developing this important Namibian natural resource.”

Europe

In late September, Toreador Resources Corp. disclosed the preliminary development plan for the second phase of the South Akcakoca sub-basin (SASB) natural gas project in the Black Sea offshore Turkey. Toreador has a 36.75% interest in the SASB project.

Operator TPAO reported that the Dogu Ayazli platform in the SASB was reconnected to the pipeline and that initial gas production had begun from the Dogu Ayazli-1 and Ayazli-2 wells. Plans were in place to optimize production to achieve a stable system flow rate by the end of September.

Combined production from the Akkaya platform, which was put on production at the end of May, and the Dogu Ayazli platform is expected to be approximately 35 MMcf/d from five wells.

Middle East

In early October, Renaissance Services signed a memorandum of understanding (MoU) between its subsidiary, Topaz Energy and Marine Ltd. and Gentas Ltd., a joint venture of the Al Shoaibi Group and the Saudi Trading & Research Co., both in Al Khobar, Saudi Arabia.

The MoU lays the groundwork for the formation of a Saudi-based marine vessel company. The company would own and operate vessels to meet the growing demand for Saudi Arabia’s offshore activities.

Mediterranean

The pipeline that is to connect Spain and the Balearic Islands is moving forward. In late September, Enagas contracted a joint venture of Saipem and Fomento de Construcciones y Contratas for gas line installations across the Mediterranean Sea.

The project involves installing two stretches of pipeline to be laid in 2008-09. The second subsea line, connecting Ibiza to Mallorca, will be around 145 km (90 mi) long.

Thailand is investing in the Mediterranean Sea. In late September, PTT Exploration and Production Public Co. Ltd. and its joint venture partners signed concession agreements for two Egyptian exploration block - one onshore and one offshore - marking Thailand’s first investment in Egypt.

A 3D seismic survey is planned for 2008, with drilling to follow in 2009. Edison International SpA operates the Sidi Abd El Rahman offshore block with 40% interest. Partners include PTTEP with 30% interest and Sipetrol International S.A. with the remaining 30% interest.

Caspian Sea

In early August, Dragon Oil reported that its development well A/121 in the Caspian Sea had flowed more than 2,900 b/d of oil from the Djeitun (LAM) structure.

With the completion of well A/121, Dragon has completed five wells this year, four development wells and one appraisal well.

Testing is ongoing along with drilling on Lam A.

In late August, the 12,700-metric-ton (13,999-ton) topsides for the latest phase of the Azeri-Chirag-Gunashli (ACG) field development in the Azeri sector of the Caspian Sea sailed out of Baku.

The AMEC-Tekfen-Azfen joint venture completed the process, compression, water injection, and utilities structure two weeks ahead of its original schedule.

AIOC commissioned the topsides as part of the ongoing ACG field development. It will produce oil and gas from the deepwater Gunashli field, in 175 m (574 ft) of water, 120 km (74.5 mi) offshore.

In mid-September, Azerbaijan State Oil Co. SOCAR contracted McDermott Caspian Contractors to install an offshore gas pipeline for the Bahar field in the Azeri sector of the Caspian Sea.

McDermott will construct 66.5 km (41.3 mi) of 20-in. (50.8-cm) low-pressure gas transport pipeline in 30 m (98.4 ft) water depth from the gas separation station at Oily Rocks to the gas measuring unit in Bahar.

McDermott’sIsrafil Huseynov pipelay barge will begin working in 4Q 2007.

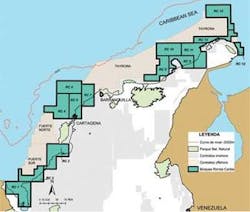

Colombia awards offshore blocks

Colombia pre-qualified 11 companies for its Caribbean exploration round, which included 13 blocks. Agencia Nacional de Hidrocarburos held a closing ceremony on Sept. 18, 2007, to mark the award of nine of the 13 blocks on offer.

Contracts for blocks awarded in Colombia’s Caribbean exploration round were signed in October.

Block RC#8, north of Chevron’s Guajira contract, was awarded to ONGC Videsh Ltd. OVL will operate the block with 40% interest. Partners include Ecopetrol with 40% interest and Petrobras Colombia Ltd. with a 20% share. The partners have agreed to an initial investment of $5.3 million.

OVL and Ecopetrol won block RC#9. Ecopetrol will operate the license with 50% interest. Investment on the block will be another $5.3 million for the first exploration phase. The partners also won block RC#10. OVL will operate RC#10 with 50%. Plans for this block include an investment of $5.3 million during the first phase of exploration.

Ecopetrol was awarded 100% interest in block RC#11. The company plans to invest $5.3 million during the first phase of exploration. Ecopetrol also won block RC#12, which also requires a $5.3-million initial investment.

Block RC#4, north of the Rosario Islands, was awarded to a consortium of three companies. BP Exploration Co. (Colombia) Ltd. will operate the concession with 35% interest. Ecopetrol holds a 35% share, and Petrobras Colombia Ltd. holds the remaining 30%. Initial investment is set at $5.5 million.

Block RC#5, north of Cartagena, was awarded to BP Exploration Co. (Colombia) Ltd. The initial investment in this block will be $5.8 million.

Block RC#7, which lies between Barranquilla and Cartagena, was awarded to a consortium made up of Petrobras, which will act as operator with a 40% share, Ecopetrol, with a 30% share, and Hess Corp., with a 30% share. Initial investment is set at $5.3 million. The same group was awarded block RC#6, which also requires a $5.3-million initial investment.