Jeremy Beckman - London

- Deepwater investment continues to rise, and should exceed $35 billion annually by 2013, according to a report from analysts Douglas-Westwood. ‘The World Deepwater Market Report 2009-2013’ also forecasts total spending over the coming five years of $162 billion.

- Africa, Brazil, and the Gulf of Mexico will account for 75% of the global deepwater spend, with Asia also on the rise. One of the main drivers will be the opening up of reserves farther from the coast and the incorporation of satellite fields into deepwater hubs. These activities, and drilling and completion of subsea development wells, should together account for almost 70% of total expenditure, according to analyst Thom Payne.

Americas

Petrobras has unveiled its latest five-year business plan, covering the period 2009-13. The $174.4 billion program will include for the first time development projects in the pre-salt area of the Santos and Espirito Santos basins. Most of the investments will be directed at Brazil, with the remainder ($16.8 billion) focussed on exploration and production mainly in the Gulf of Mexico, West Africa, and elsewhere in Latin America.

Four developments are planned for the pre-salt layer of the Santos basin: the Tupi Pilot, scheduled to start producing in 2010, followed by Tupi 1 and Guara 1 in 2012, and Iara 1 in 2013. Over the longer term, the company targets oil production from its interests in Brazil of 2.68 MMb/d in 2013, 3.34 MMb/d in 2015, and 3.92 MMb/d in 2020. Gas output should also grow, lifting overall domestic production from 3.31 MMboe/d in 2013 to 5.1 MMboe/d in 2020.

Pemex has contracted J. Ray McDermott to transport and install two new drilling platforms to the Bay of Campeche. The Ixtal-B platform comprises a four-leg jacket with 2,205 tons (2,000 metric tons) of piles, supporting a 2,205-ton topsides load.

The larger Maloob-C platform will feature an eight-leg jacket fixed by 3,307 tons (3,000 metric tons) of piles and 2,646 tons (2,400 metric tons) of conductors, and topsides weighing 2,535 tons (2,299 metric tons). J. Ray’s construction vesselDB50 will mobilize to the Mexican sector shortly to perform both sets of installations.

Ecopetrol is set to increase its interests in the Fuerte Norte and Fuerte Sur blocks in the Caribbean sector offshore Colombia. Subject to approval by Colombia’s licensing agency ANH, EcoPetrol will become a 50% license partner in both blocks, currently operated by BHP Billiton.

Australia/New Zealand

Nexus Energy has been offered production license AC/L9 in the Browse basin off Western Australia, encompassing an area including the Crux field and the Auriga and Caelum structures. It is the final stage of regulatory approval allowing the Crux liquids project to go forward.

Recently, Nexus entered negotiations with SBM concerning the supply and operation of an FPSO for the project. It also has finalized a settlement with Viking Oil and Gas International and Viking Shipping concerning termination of a previous agreement for an FPSO for Crux, signed in 2007.

Australian Worldwide Exploration has secured the semisubmersibleKari Tan IV on behalf of a consortium of Australian companies. The rig has been lined up to drill four exploratory wells off New Zealand – likely targets include the large Hoki oil prospect in permit PEP 38401, and two other potentially oil-bearing structures close to the producing Tui field.

Australia Worldwide Exploration’s working interests’ offshore New Zealand.

Offshore Taranaki, New Zealand Oil & Gas has won a new exploration permit, PEP 51311, covering 3,000 sq km (1,158 sq mi) west and south of the Kupe development.

The company hopes to secure the seismic vesselPacific Titan to acquire 500 km (311 mi) of 2D seismic as part of its work commitment. Regional analysis suggests prospects for oil or wet gas discoveries.

Europe

In the Norwegian North Sea, Talisman Energy Norge has brought onstream its gas-condensate accumulation Rev via two subsea wells connected to a 9-km (5.6-mi) multiphase pipeline to BG’s Armada platform in UK waters. Modifications to the platform included a new 450-ton (408-metric ton) separation module built by Burntisland Fabrications, and installation of new subsea control and hypochlorite injection systems. A third well should be added later this year.

Iceland’s National Energy Authority has unveiled the country’s first offshore licensing round, on the Dreki area in the Atlantic Ocean. The region on offer covers more than 42,700 sq km (16,487 sq mi) on the Jan Mayen Ridge, between northeast Iceland and the island of Jan Mayen. Water depths range from 3,280 to 6,562 ft (1,000 to 2,000 m).

License applications may cover one or more blocks or part-blocks, up to a maximum of 800 sq km (309 sq mi). Available data includes a speculative survey acquired in 2001, and an Icelandic-Norwegian governmental survey conducted during 1985-88.

Russia

Gazprom’s management committee has drawn up a six-point plan designed to progress development of major oil, gas, and condensate fields in the Russian Arctic Sea. It aims to bring onstream the Prirazlomonye field in 2011, Shtokman in 2013, and Kirinskoye in 2014. The committee also proposed submitting an amended program for Gazprom’s activities aimed at pursuing hydrocarbon resources development on the Russian shelf through 2030.

West Africa

Petrosen has approved Australian company FAR to assume operatorship of the Rufisque, Sangoma, and Sangomar Deep blocks offshore Senegal. The two co-venturers already have acquired over 2,000 sq km (772 sq m) of 3D seismic, and identified several exploration plays.

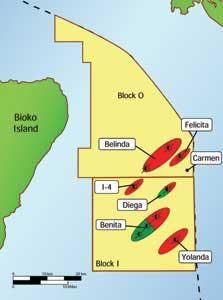

Noble Energy’s prospects offshore Equatorial Guinea.

Noble Energy has discovered oil in the Carmen prospect on block O offshore Equatorial Guinea. The well, in 150 ft (46 m) of water, encountered 26 ft (7.9 m) of net oil pay and 13 ft (4 m) of net gas pay while testing a Lower Miocene reservoir. Noble claims the oil sourcing extends from block I to the south, where it has two separate discoveries. It is aiming for first production in 2012 from a combined development which could also tie in Carmen.

Caspian Sea

The Kazakhstan Authority and its seven co-venturers in the Kashagan project have appointed a new joint operating company for the North Caspian Sea Production Sharing Agreement. North Caspian Operating Co. (NCOC) assumes all responsibilities previously held by Agip KCO, including project planning and coordination, reservoir modeling, conceptual studies, appraisal and early development planning, and interfaces with the Kazakh government.

Middle East

BP/RWE Dea have discovered gas with a deepwater well in the West Nile Delta off Egypt. The Ruby-3 well, in 920 m (3,018 ft) of water, penetrated gas-bearing sandstones in the Pliocene interval. Evaluation of the results is continuing, but the partners plan to appraise other gas finds in the area before resuming exploration of this structure.

Also in the Nile Delta region, Dana Gas has achieved its second gas discovery in quick succession this year in its West Manzala concession. The West Manzala-2 (Haggag prospect) encountered a possible 20 bcf of dry gas within two zones in the Pliocene Kafr El Shikh formation. The location is a few hundred meters from the pipeline connected to the company’s South Manzala gas processing facility.

Fabrication of four offshore platforms is under way at the new STAR yard in Dammam. This is Saudi Arabia’s first in-kingdom offshore construction facility. It was developed to service a long-term agreement contract awarded to a consortium of Snamprogetti Saudi Arabia, Saipem, and TAQA. The yard covers an area of 300,000 sq m (74 acres), and is capable of fabricating 14,000 metric tons (15,432 tons) per year of structural steel.

India

ONGC has approved the second phase of the Mumbai High North redevelopment project, designed to improve recovery from the field. Under the program, the company will drill 73 new wells and side track 38 low-performance existing producers. It also will integrate development of the small L-I and L-II reservoirs with the main L-III reservoir to lift overall oil output.

Asia-Pacific

CNOOC has earmarked $6.76 billion for upstream capital expenditure this year, an increase of 19%, with $4.38 billion budgeted for development, $1.11 billion for exploration, and $1.12 billion for production.

The company expects to have over 20 development projects under construction in 2009, with 10 projects scheduled to come onstream, including eight offshore China. It also plans to drill more than 80 wells and acquire a total of 39,200 sq km (22,196 sq mi) of 2D and 3D seismic off China and elsewhere.

American Technologies Inc. Petroleum (ATIP) is back to work on its Yen-Tu 1X well, reportedly North Vietnam’s first oil discovery. The well was spudded in 2004, encountering hydrocarbon-bearing formations in Lower Miocene and carbonate basement intervals. It was then plugged and abandoned pending further appraisal.

ATIP recently re-opened the well for testing, following another successful program on last summer’s nearby Ham Rong discovery in the Song Hong basin. Ham Rong 1X was drilled to 3,700 m (12,139 ft) TD after again finding hydrocarbons in carbonate basement. According to ATIP, drillstem testing revealed open flow production at a commercial rate.