Eight deepwater blocks and seven shallow-water blocks to be offered

Gurdip Singh

Contributing Editor

India expects $2 billion in fresh investments to be made over the next eight years in new exploration under the New Exploration Licensing Policy (NELP) IX program, which offers 34 blocks spread over 88,800 sq km (34,286 sq mi), 65% of which is virgin acreage.

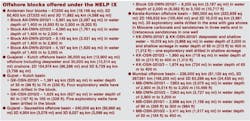

On offer are eight deepwater blocks, seven shallow-water blocks, and 19 onshore blocks.

The investment, to be spread over seven years for oil discovery and eight years for gas discovery, seems conservative, but India offers a challenging environment to international exploration companies, with more flexibility in its production sharing contract and an ever ready domestic market for indigenous oil and gas supply.

The Directorate General of Hydrocarbons’ (DGH) open bidding system calls for competitive bids while offering flexibility of operation. DGH seeks aggressive participation work program in competitive bids from exploration companies, no matter where they operate from.

Exploration companies are offered tax holidays, full rights to repatriate profits, go solo with their investments or form joint ventures, and all bonuses related to contract signing and hydrocarbon discoveries have been stopped. All equipment and material imports for exploration and field development is duty free with 100% cost recovery on investment.

Hydrocarbon exploitation remains the key work for DGH, the past efforts of which have started yielding results. The 60 MMcm/d (2.1 bcf/d) production from the KG DWN98/3 has doubled India’s indigenous gas production to 60 bcm (2.1 tcf) a year.

“We are looking for a similar success,” said DGH Director General Sunil Kumar Srivastava.

At least four new field development plans are being evaluated by the DGH.

A recently acquired 2D data is available for all new blocks under NELP IX, which has seven years for oil exploration and eight years for gas prospecting.

It is offering deepwater blocks where carbonate build up shows huge potential, said DGH Chief Geologist Suresh Kumar Tripathy.

One block is in the Kutch Sawrasthara with a sand stone reservoir; two blocks are in the prolific Mumbai basin, and two blocks are in the Kerala Konkan to test Mesozoic sediment.

The shallow water acreage includes two blocks in the Gujarat Kutch basin, next to drilled wells with hydrocarbon shows.

Two blocks are in the hydrocarbon producing Mumbai High basin, and three blocks in Kerala Konkan have hydrocarbon at build up in tertiary sediment.

Three onshore blocks are in the Assam and Arakan basin – one in Tripura and two in Assam in the north east of the country. These blocks are within the producing fields, said DGH.

Two blocks are in the Vidhyan basin of central India with a lot of gas seepage.

Ministerial address

Addressing the NELP IX road show in Singapore, India’s petroleum and natural gas minister Murli Deora assured investors of level playing fields, dismissing suggestion of any favor towards the country’s public or private sector companies.

He invited exploration and production companies from across the globe to take part in NELP IX bidding, saying the blocks holding high potential for hydrocarbon discoveries.

“Invest in Indian E&P and become partners in our progress and our efforts to enhance the energy security of the country,” said Deora, who headed a high-level delegation seeking E&P participation as well as investors from Singapore-based financial institutions.

Investment in the Indian E&P sectors is one of the most lucrative opportunities today for several reasons, he said, including the readily available market for oil and gas, well established independent judiciary, and stable democratic government.

The minister also pointed out the facility of single window clearances and assured transparent bids with immediate results of the winners.

Director General of Hydrocarbons Sunil Kumar Srivastava expects strong crude oil prices plus surging global and Indian energy demand to attract $2 billion in new exploration investment under NELP IX.

He pointed out that Indian attracted $1.1 billion in exploration investment under NELP VIII during the 2008-09 global economic recession.

Since its inception in 1997-98, the NELP has secured about $15.6 billion in E&P investment, resulting in 87 oil and gas discoveries in a total of 26 blocks with reserves of more than 640 million metric tons oil equivalent.

The Indian government has awarded 235 blocks up to NELP VIII, and would likely go for one more round before offering its acreage on open bid basis.

Overall, only 20% of India’s basins have been explored. Exploration would need to be intensified in 44% of the already tested basins and the remainder is not explored, added Srivastava on new frontiers. India has 1 million sq km (386,102 sq mi) of basins left to be explored while 2.15 million sq km (964,255 sq mi) of the basins have been leased out exploration, he added.

Industry support

Delegates at the Singapore road show agreed that Indian NELP rounds had 50% success ratios of hydrocarbon discoveries, one of the best returns in Asia, ahead of prospects in Australia and Southeast Asia.

However, India needs to find an “elephant” field with reserves of more than 1 Bbbl to increase share of indigenous resources in the domestic market, and intensify exploration activities, they said.

The round closes March 18, 2011, after road shows in Perth (Feb. 1-2), Calgary (Feb. 10-11), and Houston (Feb. 14-15).

BG, formerly British Gas, plans to submit bids under NELP IX, said its general manager for Asia, Derek Fisher. Addressing the same road show, he underlined BG’s commitment to the Indian hydrocarbon sector.

“India is a core country for BG group and focus is on gas. We are actually participating in all segment of the gas chain in India. We are partner in the offshore Penna, Mukta, and Tapti fields,” he said.

BG also has stakes in KG-OSN-2004/1, MN-DWN-2002/2, and KG-DWN-2009/1.

Showing its commitment to Indian hydrocarbon sector, Cairn India Ltd. said it has invested $4.5 billion over its 15 years of doing upstream businesses in the Indian energy sector. Cairn Exploration Director David Ginger said the company plans to invest $2 billion in the next two years. And, Cairn would continue to focus on exploration and NELP in the coming years, he added.

Meanwhile, Indian national groups ONGC, Oil India, GSPL, and Indian Oil Corp. are among the investors seeking partners for bidding for deepwater acreages under NELP IX.

The move would be to share investment risks in the deepwater, where average well could cost $30 million to $60 million. Commenting on the high cost of per well investments, an industry analyst pointed out the steep increases in insurance in upstream sector after the BP’s Macondo blowout in the Gulf of Mexico, and the limited availability of resources.

“The NELP has established that India has a clear and transparent process and does not discriminate between private and public sector,” said Vikram Mehta, hydrocarbon chief of the Confederation of Indian Industries.

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com