Espen Erlingsen

Rystad Energy

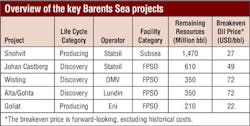

The first Norwegian Barents Sea exploration well was drilled in 1980 and 130 further wildcat and appraisal wells have since followed in the province. Over the last five years, the exploration effort has really started to pay off and when this success is converted into investments and production, the Barents Sea will be an exciting center of activity on the Norwegian continental shelf (NCS).

To date, a total of 4 Bboe of oil and gas have been discovered across the province, of which 1.8 Bbbl are liquids.

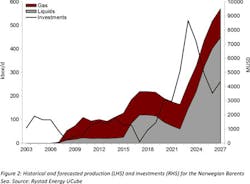

Snøhvit was the firstBarents Sea discovery in the Norwegian sector in the beginning of the 1980s. This was a large gas find contained within several reservoirs. Due to the remote location for the gas and the difficulties getting it to the market, almost 30 years passed before operator Statoil was able to start commercial production in 2007. Output from the field is exported as LNG and there have been problems with the liquefaction train, which kept the production low for several years. However, the troubles of the past seem to be behind the project; in 2015, the field achieved its highest production to date, exporting more than 5 million metric tons (5.5 million tons) of LNG.

The second largest discovery was Goliat in 2000. The Eni-operated field includes 200 MMboe of resources and has been developed via an FPSO.Goliat commenced production in March this year after being delayed for several years and incurring cost-overruns of more than 50%.

Eleven years after the initial Goliat find, exploration results started to improve again with Statoil’s discovery of Johan Castberg in 2011, eventually shown to have two primary reservoirs called Skrugard and Havis. Initially Statoil planned to develop the discovery with a floating production unit (FPU) connected to an onshore terminal, pending results from an exploration campaign in relatively close proximity to the field. The purpose was to find additional resources and improve the economics of the FPU development solution. However, the campaign was largely unsuccessful and with the oil price falling, the partners scaled back their preferred development concept to an FPSO. The new concept and current low unit prices have reduced the breakeven price from $80 to $45/bbl.

In 2013, two significant new discoveries sparked renewed interest in the sector,OMV’s Wisting Central and Lundin’s Gohta. Combined, the total discovered resources for 2013 in the Norwegian Barents Sea were just below 0.5 Bboe, making this the province with the highest discovered resources on the NCS that year.

The Barents Sea was also the leading Norwegian exploration province in 2014, as Lundin proved potentially substantial oil with its Alta discovery, while OMV followed up with the Hansteen discovery. With these additional volumes, the most likely development solution will be an FPSO at Alta/Gohta and another FPSO for Wisting/Hansteen.

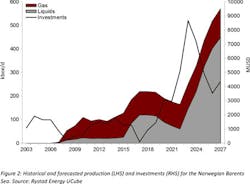

In terms of production, the Barents Sea will grow considerably. The first growth phase will be in 2016/2017 as output from Goliat continues to ramp up. The next growth phase will be in the beginning of the next decade. With the anticipated startup of Castberg, Wisting and Alta/Gohta, the total Barents production may go beyond 500,000 boe/d. This is about five times higher than current production from the area. The growth will be driven by oil, as the latest finds have been largely oil discoveries. However, substantial investments are needed to achieve this increase. Historically, annual investments for the Barents Sea have been just below $2 billion. After 2020 this number is expected to grow steadily, surpassing $8 billion. Most of the spending will be on subsea equipment, rigs, and FPSO construction.

With these new projects, the Barents Sea will become an important production province and could contribute to as much as 15% of the total Norwegian production at the end of the next decade.