Gas projects, frontier wells at risk of deferment

Growing optimism across Asia/Pacific’s offshore sector was swiftly flattened by last month’s turn of events. There were no immediate reports of project casualties, but as elsewhere, major new investments in greenfield developments involving gas or LNG look set to be pushed back as companies take urgent actions to preserve their balance sheets.

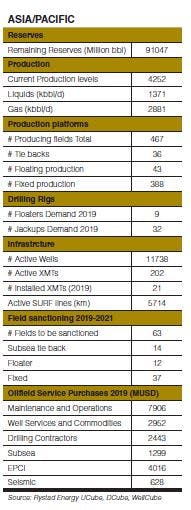

A resurgence in exploration drilling led to the region delivering five of the world’s top 20 discoveries last year, according to Wood Mackenzie, including PTTEP’s HP/HT Lang Lebah gas find in shallow water off Sarawak. The consultant’s APAC team had expected around 200 exploratory wells throughout the region this year, but numbers could now drop by up to 30%, Asia Pacific Vice Chair Gavin Thompson predicted.

Most explorers would likely delay planned campaigns with no rig commitment, or if the well economics at $35/bbl failed to meet company thresholds. This would knock up to $1 billion off the previously anticipated exploration spending this year of $4.5 billion. Thompson added that only around 16% of future APAC prospects breakeven below $35/bbl, and most of those are smaller, near-field structures.

Prior to the oil price slump, Wood Mackenzie had singled out as wells to watch Total/Woodside’s Shwe Nadi, targeting gas in Myanmar’s deepwater Moattama basin; Eni’s Dan-Day-1X in Vietnam’s Song Hong basin; Repsol’s Remcong-1X in deepwater in Indonesia’s North Sumatra basin; BP’s Ironbark, a potentially large gas structure in Australia’s North Carnarvon basin; and OMI’s pursuit of oil with the deepwater Tawhiki-1 well in New Zealand’s Great South basin. One well that has gone ahead is CNOOC’s recent play-opening Kenli-6-1 offshore China, thought to be the first oil discovery in the Laibei lower uplift region of the shallow water southern Bohai basin.

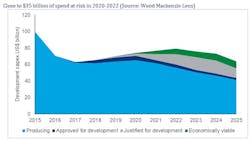

Across Asia/Pacific, nearly $35 billion of pre-final investment decision (FID) and development expenditure now appears to be at risk for 2020-2022, Thompson said, with spending on producing field facilities likely also under scrutiny. Two of the largest projects targeting FID this year are backfill LNG investments offshore northern and western Australia: in Wood Mackenzie’s calculations, Barossa (operated by Santos) and Scarborough (Woodside) account for 52% of APAC’s unsanctioned project spending and 48% of reserves.

Before the oil price crash, both companies had been seeking to farm down equity to reduce their capex commitments, with Santos agreeing to sell a 25% interest in the existing Bayu-Undan field development in the Timor Sea and the Darwin LNG complex to South Korea’s SK E&S for $390 million. Santos’ goal is to achieve increased partner alignment for Barossa and Darwin LNG, which would receive the field’s production.

The impact of recent developments on Asia/Pacific’s existing upstream supply could be softer: Thompson singled out China as the key market, a country which produces 3.7 MMb/d, representing more than 60% of the 6 MMb/d produced throughout the region. In his view, China’s output remains safe for now, although more capex will be needed to sustain development drilling on various mature field projects.

Thompson expected most other Asian NOCs to follow China’s lead, not altering their spending plans for 2020 despite lower prices as their governments typically rely on these enterprises for their tax revenues, employment and energy import decisions. But while Petronas and India’s ONGC have reportedly confirmed that they will not change direction this year, PTTEP may face greater challenges in its transition to operatorship of the Erawan gas field offshore Thailand, Thompson said.

Earlier this year Petronas’ second floating LNG facility PFLNG DUA departed the Samsung Heavy Industries shipyard in South Korea. The 393-m (1,289-ft) long vessel was due to be moored in 1,300 m (4,265 ft) of water at the Rotan gas field, 140 km (87 mi) offshore Kota Kinabalu, Sabah, with capacity to produce 1.5 MM metric tons/yr (1.65 MM tons) of LNG.

Thompson said sustained lower oil prices would bring down LNG contract prices in Asia, thereby boosting the case for gas. But the opposite might happen in India, where the lower oil price could slow the shift from oil to gas in the nation’s industrial sector, as heating oil, LPG and naphtha compete with contracted and spot LNG.

A report by Rystad Energy earlier predicted that Indonesia’s oil and gas production would probably fall this year, despite the government’s projections of a combined 8% increase. Indonesia’s upstream task force SKK Migas was targeting oil production of 755,000 b/d in 2020, while Rystad was predicting 718,000 b/d, due mainly to a decline in output from mature assets, partly offset by projects in the ramp-up phase adding 10,000 b/d. Rystad’s Senior Upstream Analyst Prateek Pandet said that out of the eight fields to come onstream this year, only Malacca Strait Phase 1 is an oil play. Rystad also forecast a decline in Indonesia’s gas output to 5,870 MMcf/d.

For the government to meet its targets, state-owned Pertamina faces pressure to stem the decline at the offshore Mahakam field since it took on operatorship in 2018, Pandet said. Eni’s Merakes gas field, due to start up this year, should lift the country’s gas production, although not significantly until at least 2021.

Thom Payne, Head of Offshore Research in Singapore at Westwood Global Energy Group, said Japan’s INPEX, “had already gone back to the drawing board” on its Abadi LNG project in Indonesia’s Arafura Sea, would probably push the FID with partner Shell to 2022 at the earliest. Payne, speaking to Offshore just at the outset of the oil price slump, predicted slow progress on other potential LNG projects in the APAC region. “The capex-intensive nature of these offshore LNG developments has seen operators attempt to farm down to reduce their capex-burden even before the price crash, in the current sub $40 environment projects like Equus, Scarborough, Crux and even Santos’ Barossa all look very challenging.”

In Payne’s view, the spread of COVID-19 will likely impact crew changes for offshore drilling rigs and platforms, “adding extra layers of bureaucracy in a region with an already diverse regulatory environment.” Discretionary spending in the current environment will be at significant risk, if any higher-profile exploration wells do go ahead, these will most likely be those with firm rig commitments offshore Western Australia, he said. “We have already started to see some E&Ps push for cancellation of offshore rig contracts, but most at risk for rig managers are the $300 million of contract options across Southeast Asia and Australia that were due to be exercised in 2020.”

The impact of COVID-19 on APAC’s ambitious offshore wind targets is yet to be seen but to date developments are advancing at a brisk pace. “China has huge wind plans involving significant volumes of turbines,” Payne said, “but there is also a high requirement for local content which has slowed down the market in the recent past.”

Elsewhere, Taiwan is well on the way to meeting its 2030 capacity target of 15 GW with the recent full commissioning of the 128-MW Formosa 1 development in January which will soon be joined by a further 2.5 GW of sanctioned capacity at Formosa 2, Changua 1 & 2a, Yunlin and Xidao and Changfang. •