Range of new discoveries underpins growing industry interest

Buoyed by a series of recent discoveries, momentum for a new wave of E&P spending offshore Eastern Canada has been growing for the past six months. Recent events – namely the rapid growth of the COVID-19 pandemic and the even more rapid implosion of oil prices – may call some of this development into question.

Nevertheless, the region is poised to host a number of new drilling and field development activities in the near future. According to one report, deepwater areas off Newfoundland and Labrador are expected to bring in a new $4-billion wave of offshore oil and gas exploration in the next few years.

“There’s an unprecedented level of interest for offshore East Coast Canada,” said Jim Keating, executive vice president of Offshore Development at Nalcor Energy, which holds minority equity rights in three upcoming offshore projects.

Keating gave his views at the Newfoundland and Labrador Oil & Gas Industries Association (NOIA) conference held last fall. The new interest is due to new geoscience work and changes in how offshore bidding is conducted, he said.

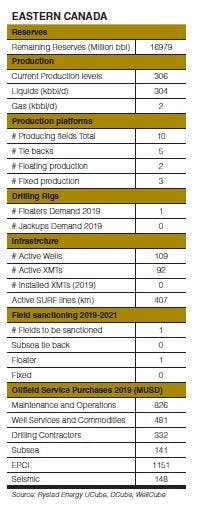

The first wave will crest by 2021, with the oil majors such as ExxonMobil, Chevron, Equinor, and CNOOC committed to spending $1.7 billion. That activity has begun, with ExxonMobil set to start drilling on a prospect identified through Nalcor’s long-running geoscience program.

By 2022, BP Canada, Navitas Petroleum, Nexen Energy and Husky have committed to spending $763 million.

And further out, to 2024, BHP, Equinor and Suncor, plan to invest $1.4 billion in exploration.

Keating described this as “bow wave” of investment as eight oil companies, with 10 exploration plans, launch almost concurrent exploration campaigns in Canadian offshore frontier areas.

“I think we’re going to peak [in drilling activity] pretty soon in the next two or three years,” Keating told NOIA conference attendees. He noted that eight or more exploration wells could be drilled in the near term, and many more in future years.

Much of the interest has been driven by the findings of a recent study which identified an additional 3 Bbbl of oil and 5.8 tcf of gas potential offshore Newfoundland. That study, the 2019 Oil and Gas Resource Assessment conducted by Nalcor Energy and Beicip-Franlab, in partnership with the government of Newfoundland and Labrador, was released last October.

The report found an overall resource potential of 52.2 Bbbl of oil and 199.6 tcf of gas in the region. It also found that the area had over 650 leads and prospects identified; eight new entrants in the past three years; and $4 billion in exploration work commitments.

Keating added: “In addition to the 2D multi-client seismic we collected with TGS and PGS over the area, we partnered with Fugro in acquiring a high resolution multibeam survey which identified a number of seep-like features coming from the ocean floor. Subsequent coring of these anomalies confirmed hydrocarbon presence which is an important insight in this frontier basin due to the limited number of wells and no discoveries to date in the area.”

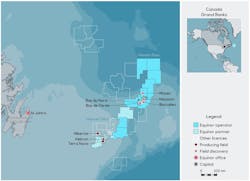

The province already has four oil-producing projects: Hebron, Hibernia, Terra Nova, and White Rose. The primary operators are ExxonMobil, Husky Energy and Suncor with Chevron and Equinor also involved.

Operations are located roughly 338 km (210 mi) off the island of Newfoundland in water about 100 m (328 ft) deep. Other companies including China’s CNOOC, BP, Australia’s BHP Group and Navitas Petroleum hold exploration licenses.

The province’s four oil production areas have produced an estimated 1.9 Bbbl of oil since 1997. Current production is about 257,000 b/d.

The companies have proposed 10 drilling projects with perhaps 100 wells in the next two to four years in deeper offshore water farther from the island of Newfoundland, according to Canada’s Financial Post publication.

West White Rose

One notable project is Husky Energy’s West White Rose project, with first oil expected by 2022. It would be the province’s fifth oil project. Husky Energy is leading development on behalf of the West White Rose project partners which include Suncor Energy and Nalcor Energy. The White Rose field and satellite extensions are in the Jeanne d’Arc basin, 350 km (217 mi) east of Newfoundland and Labrador in approximately 120 m (394 ft) of water.

The West White Rose project will be developed through a fixed drilling platform consisting of a concrete gravity structure (CGS), built by the SNC-Lavalin- Dragados-Pennecon General Partnership (SDP), and an integrated topsides facilities. SDP will be constructing the CGS in the Argentia Graving Dock, located on the Argentia Peninsula approximately 130 km (81 mi) from St. John’s.

Bay du Nord

Perhaps the most notable upcoming project is the Bay Du Nord field development program. It includes the development of the Bay du Nord, Bay de Verde, Bay de Verde East and the Baccalieu fields located in the Flemish Pass basin of the Atlantic Ocean offshore Canada.

Equinor Canada (formerly Statoil Canada) and Husky Oil Operations (Husky Energy) jointly own the project with 65% and 35% interests respectively, with the former serving as the operator.

The Bay du Nord project is currently in the initial stage of planning and development. The development activities for the project are expected to begin in 2020, while first oil is targeted for 2025.

The Bay du Nord project is located in the Flemish Pass region, approximately 450 km (280 mi) offshore east-northeast of St. John’s, Newfoundland, Canada. The project development area, spanning 450 sq km (174 sq mi), includes the exploration licenses (EL) 1125, 1126, 1143 and 1154, as well as the Significant Discovery Licenses (SDL) 1047, 1048 and 1055.

The water depth around the proposed project area ranges between 1,000 m and 1,200 m (3,280 ft and 3,937 ft).

The Bay du Nord oil field was discovered during an exploration drilling program conducted in the Flemish Pass area in 2013. The exploration and appraisal drilling program was extended for a period of 19 months from 2015.

A total of nine exploration and appraisal wells were drilled during the drilling program, which led to the discovery of the Bay de Verde and Baccalieu fields.

The Bay du Nord oil field and the Baccalieu field are estimated to hold mean recoverable resources, ranging between 300 and 600 MMboe (approximately 47.7 MMcm of crude oil). The fields contain light crude with a 36° API and a low gas-to-oil ratio.

The initial development will focus on the Bay du Nord oil field and the Baccalieu field in the SDL 1055 and EL1143. A conceptual plan was created as part of the initial development plan, which may be modified following further studies and design optimization.

The proposed development plan includes the drilling of between 10 and 30 wells using five to 10 subsea templates. The drilling program will be carried out over a period of three to five years. The drilling activity is expected to be conducted using either a semisubmersible drilling unit or a drillship.

The subsea templates, including individual satellite wells, will be tied-back using flowlines to an FPSO.

The development plan proposes the use of pressure support through water and produced gas injection to recover the oil. The production life of the project is expected to range between 12 and 20 years.

The proposed FPSO will be moored offshore in a fixed location and will have the capacity to handle crude oil production, storage and export, gas management, water injection, produced water management and other waste management.

The FPSO will have a design life of 30 years and an estimated production capacity between 94,000 and 188,000 b/d of oil. It will also have a crude oil storage capacity ranging between 143,000 m³ and 191,000 m³ (between 0.9 and 1.2 MMbbl).

The water production rate of the FPSO will range from 30,000 m³ a day to 50,000 m³ a day.

The future development plans for the Bay du Nord project are expected to extend the core life of the field to a maximum of 30 years. Potential development plans include the drilling of an additional 20 development wells, installation of up to five subsea templates, as well as drilling of satellite wells.

Call for nominations

In January, the Canada-Newfoundland and Labrador Offshore Petroleum Board (C-NLOPB) issued a Call for Nominations (Areas of Interest) NL20-CFN01 – Eastern Newfoundland. This call for nominations will assist the C-NLOPB in selecting a sector for introduction into the scheduled land tenure system. The approximate timing for subsequent announcements is as follows:

• Sector Identification: April 2020

• Call for Nominations (Parcels)

■ Opens August 2021

■ Closes November 2021

• Call for Bids (pending Board approval and ratification by the federal and provincial governments)

■ Opens March/April 2022

■ Closes November 2022. •