More Gulf projects receive final investment decision

After years in the doldrums, things seem to be moving again in the Gulf of Mexico. In August, both Murphy and Shell gave long-planned projects the final investment decision (FID).

Shell said that it would move forward with the development of its PowerNap field in the deepwater US Gulf.

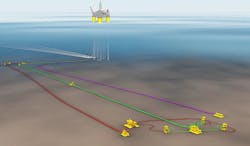

Discovered in 2014, PowerNap will be developed as a subsea tieback to the Shell-operated Olympus production hub, which is co-owned by BP Exploration and Production Inc. (28.5%). The field is in the south-central Mississippi Canyon area about 240 km (150 mi) from New Orleans in about 1,280 m (4,200 ft) of water.

The project is expected to start production in late 2021 and produce up to 35,000 boe/d at peak rates.

Production will be transported to market on the Mars pipeline, which is operated by Shell Pipeline Co. LP and co-owned by Shell Midstream Partners, L.P. (71.5%) and BP Midstream Partners LP (28.5%).

According to Shell, the project is anticipated to have a forward-looking breakeven price of less than $35/bbl and is currently estimated to contain more than 85 MMboe recoverable resources.

Michael Murphy, research analyst, Gulf of Mexico, Wood Mackenzie, said: this FID “reflects a broader trend of majors embracing subsea tiebacks that offer quicker paths to first oil and attractive returns. We estimate the PowerNap field to have a development breakeven in the low $30’s/bbl.

“This comes on the heel of Shell bringing the Kaikias subsea tieback online in 2018, with an estimated development breakeven in the low $30’s/bbl, and BP entering into the Nearly Headless Nick tieback expected to come online by the end of 2019, just a year after discovery.”

He added: “Recent exploration in the region has demonstrated how majors in the deepwater Gulf of Mexico have adapted a complimentary strategy of pursuing traditional large prospects, in addition to infrastructure-led exploration.

“With internal rate of returns above 30% and development breakeven in the low-to-mid $30’s, the sanctioning of subsea tiebacks is proving that deepwater can compete with tight oil.”

Murphy Oil Corp. has sanctioned the King’s Quay FPS, Khaleesi/Mormont, and Samurai field developments in the deepwater Gulf of Mexico, the company revealed in its 2Q results statement.

The King’s Quay FPS facility will receive and process up to 80,000 b/d of oil production anchored by the Khaleesi/Mormont and Samurai developments. It is expected to be in service in mid-2022.

The Khaleesi/Mormont field development includes seven subsea wells, of which four were previously drilled, and infrastructure tieback to King’s Quay. Khaleesi is in Green Canyon block 390 and Mormont is in Green Canyon block 478.

The Samurai field in Green Canyon block 476 will be developed as a four-subsea well tieback to King’s Quay.

President and CEO Roger W. Jenkins said: “Our planned execution on our new Gulf of Mexico revitalized asset base continues. These projects have outstanding returns offering high-margin production and a free cash flow runway going forward… This new FPS asset could be easily monetized, and we are currently evaluating all our options.

“We forecast first production from the FPS along with our two new fields in mid-2022. Initial production from these assets is expected to exceed 30,000 boe/d net at first oil.”

Wood Mackenzie analyst Mfon Usoro said: “Murphy’s sanction of the trio of projects including the King’s Quay facility, Khaleesi/Mormont, and Samurai shows that the Gulf of Mexico still offers attractive investment opportunities. The Gulf of Mexico has evolved since the downturn to shorter cycle projects and a leaner development approach which has led to lower breakevens and higher returns.”

Wood Mackenzie estimates a lead time for King’s Quay of five years from discovery to first oil. According to Usoro, this is exceptionally quick and is roughly half the average lead time of a greenfield development in deepwater Gulf of Mexico.

The analyst values Khaleesi/Mormont and Samurai at more than $2 billion (NPV 10), and each project has a development-cycle breakeven less than $35/bbl (PV 10, Brent).

“The FID of the King’s Quay facility is particularly significant because it is one of only three greenfield projects in deepwater Gulf of Mexico that have achieved FID since the downturn,” added Usoro. “With a new platform set to enter the Gulf of Mexico, it offers up opportunities to commercialize more small-scale subsea tiebacks with higher returns.”

In addition, during 2Q, Murphy drilled and completed the Dalmatian #2 well in Desoto Canyon block 4. First oil is expected in 4Q. •