Offshore staff

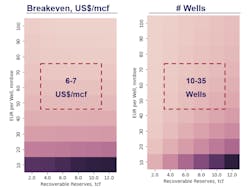

LONDON — Development of Colombia’s recent offshore gas discoveries, Gorgon, Uchuva and Orca, would need a breakeven range from $6 MMcf to 7/MMcf, according to Wood Mackenzie.

The consultants based their analysis on multiple scenarios varying the potential recoverable resources and ultimate well productivities.

They predict that the country on its current course will experience a shortage of domestic gas this decade, with a gap between gas supply, including import capacity, and demand of 560 MMcf/d by 2030.

Colombia’s sole operating regas facility, SPEC LNG in Cartagena, can import about 400 MMcf/d. Majority shareholder Promigas plans to add a further 130 MMcf/d by the second half of 2026, with 50 MMcf/d to come online in 2024.

However, plans for the country’s second 400-MMcf/d import facility (Pacific LNG) are in disarray, the consultants said, after UPME disqualified the sole consortium that had submitted a bid for the $900 million project.

“This is a substantial challenge for Colombia to overcome, and many critical conditions must be met,” said Vinicius Moraes, research analyst, Latin America Upstream for Wood Mackenzie. “As these projects are all still in the evaluation stage, there is still considerable uncertainty regarding potential production volumes, project timelines and costs. The operators drilling exploration wells have so far kept quiet on potentiality of these resources. Time is running out, and if Colombia doesn’t want to rely on LNG imports until the end of the decade, it must start progressing offshore discoveries towards the development stage.”

Infrastructure could present a further hurdle, according to Kuy Koh, senior research analyst, Latin American Upstream for Wood Mackenzie.

“Even if the offshore production materializes, there are still logistics issues as the current pipeline infrastructure is inadequate and must be extended," Koh said. “There is limited capacity to move gas from offshore projects and the coast to Colombia’s interior. If this is not addressed, it would put constraints on potential production. Furthermore, both offshore developments and expansion of onshore infrastructure would be subject to approval from communities in public consultations, which could pose additional challenges.”

Wood Mackenzie’s research suggests that offshore gas projects have an average lead time of 11 years from discovery to first gas.

“In an optimistic scenario,” Koh continued, “where Colombian offshore discoveries closest to shore could start production by 2027, they would be competing against an oversupplied LNG market with prices hovering around the $6 mark.”

09.29.2023