Deepwater driving Nigerian oil production growth through 2030

Offshore staff

LONDON — Nigeria’s current oil and gas production remained below the average level of 3 MMboe/d from 2010-2015, due in part to a 74% reduction in capex from $27 billion in 2014 to $6 billion in 2022.

This was the estimate issued by the country’s Upstream Petroleum Regulatory Commission (NUPRC). However, prospects look good for a revival, especially in the deepwater area, following the introduction of domestic reforms to improve the country’s business environment and promote exploration.

As Westwood Global Energy Group notes in new analysis, privatization of the Nigerian National Petroleum Corporation (NNPC) in July 2022 was good news for upstream exploration as there is a requirement for 30% of the NNPC’s profits to be reinvested in the soon-to-be introduced Frontier Exploration Fund.

That should strengthen the focus on exploration of the country’s main frontier basins, said Westwood analyst Michela Francisco.

And Nigeria’s newly elected president has stated that his administration intends to boost crude production from 1.3 MMbbl/d in 2022 to 2.6 MMbbl/d. Westwood’s analysis, however, based on probable projects, is 1.9 MMbbl/d by 2030.

Those likely to be sanctioned in the near term include TotalEnergies’ offshore Preowei Phase I development (65,000 bbl/d), expected to start up in 2026; Shell’s Bonga North in 2027 (120,000 bbl/d); and ExxonMobil’s Owowo and Bosi oil (2029 and 2030).

Gas volumes too should rise with Shell’s HI and HA shallow-water developments set to go onstream in 2027 and 2029, all these projects lifting Nigeria’s overall oil and gas production to 2.6 MMboe/d by 2030.

A further stimulus could come from newly opened exploration blocks. In January bidding took place for seven ultradeep offshore blocks. Three years earlier, indigenous companies picked up 57 marginal oil and gas fields, some in swamp and shallow waters.

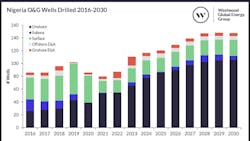

From 2026 there should be an uptick in deepwater drilling related to Shell’s Bonga Southwest-Aparo Field, Chevron’s Nsiko, TotalEnergies’ Preowei Phase II and ExxonMobil’s Uge oil fields, all in line to enter production after 2030.

And infill drilling in deepwater should continue, Francisco said, the most recent instance being TotalEnergies’ (up to) 11 infill wells on the deepawter Egina and Akpo fields starting in the current quarter.

Westwood also expects more shallow-water drilling activity, although remaining below pre-2021 levels.

But Nigeria needs to sustain its efforts to create an attractive business environment to encourage both local players and IOCs to keep investing in their assets, particularly offshore, Francisco warned.

08.25.2023