Stranded offshore gas fields are what they are because of the challenges involved in bringing the resource to market. Shell and Petronas have had some success with floating LNG on mid-size fields off Australia and Malaysia. But other FLNG projects have collapsed after hitting financial and regulatory roadblocks.

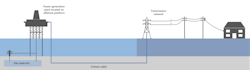

Marginal Field Development Co. (MFDevCo) has come up with an alternative proposal, ‘Gas-to-Wire’, targeted at stranded offshore gas accumulations that would otherwise stand little chance of development, due mainly to infrastructure constraints. The concept entails adapting platforms serving reservoirs with falling production rates to a new role, converting gas from the existing field and potentially nearby fields, developed or undeveloped, to electrical power. This would be exported through a subsea cable to the shore for onward delivery to the national grid – or, alternatively, the cable could be connected to an offshore wind farm in the vicinity, employing ullage in the system or providing back-up power during calm conditions.

According to the company, the arrangement would benefit the platform owners, allowing them to defer the cost of decommissioning; the partners in the satellite gas fields; host governments looking to maximize their country’s offshore resources; and local utilities seeking to strengthen security of their energy supply.

Turnkey ‘package’

MFDevCo, based in Manchester, UK, heads a consortium of international engineering contractors that can provide turnkey delivery of minimal facilities development projects, such as normally unattended installations, from design and engineering through construction, installation, operations, decommissioning, and redeployment. Its better-known members include Arup, Aibel, and Kongsberg Maritime and the focus initially was primarily on the development of stranded oil assets. The track record of the consortium members includes engineering and delivery of the self-installing fixed tower for Shell Todd’s Maui B platform in the Taranaki basin offshore New Zealand. In addition, MFDevCo has this year entered into arrangements with companies that bring the specific experience required to deliver Gas-to-Wire projects, and has the capability to help secure or contribute financing of projects and to take equity positions.

Gas-to-Wire (GTW) is said to maximize economic recovery of gas resources by eliminating the reliance on pipeline networks, instead converting the gas to a commodity (electricity) that can be exported to shore more efficiently and at lower cost to satisfy local demand. The concept capitalizes on existing assets such as nearby platforms and power infrastructure, combined with an emphasis on cost-effective operations, with a view to creating commercially and technically sound development solutions.

In January this year, MFDevCo entered a collaboration agreement on GTW with Italian shipping conglomerate Marnavi Offshore. The two parties later signed a letter of intent to form a Special Purpose Vehicle (SPV) that would facilitate delivery of GTW projects as a ‘package’ – including the export route – securing financing on the same lines as shipping financing. More recently, MFDevco formed a separate agreement with Petrofac to jointly pursue opportunities for the recovery or redevelopment of marginal gas fields in UK waters. Petrofac, through its Engineering and Production Services division, is providing engineering support and assisting feasibility studies and screening of potential opportunities. Siemens’ Dresser-Rand business has also come onboard, agreeing to supply the platform-based turbines that would convert the gas to electricity.

So, what type and size of field are the partners pursuing? “We don’t specify a range in terms of gas volumes,” said MFDevCo managing director Alison Pegram. “Scenarios can vary, such as the field’s location, distance to the shore and other infrastructure. Or there could be fluids associated with the gas that require processing. It also depends on the operator and their position, or that of the field owners. There may be unlicensed fields or others held by operators, close to infrastructure, but which are not producing for whatever reason. Any of these could provide an opportunity that might fit our model.”

“We are not looking to take over offshore gas fields per se. But we might take an interest in a field via our private financing vehicle, with Petrofac assuming the role of duty holder of the offshore installation, as it does throughout the UK North Sea. For some of the projects we have been investigating, there are companies that are interested in remaining as operator of the license, with Petrofac as duty holder. And there are others that don’t want this.”

The North Sea, which according to Britain’s Oil & Gas Authority has the world’s greatest concentration of undeveloped marginal fields, appears best suited to GTW. “However, we can look at opportunities anywhere,” Pegram stressed. “There needs to be a combination of in-place gas resources and a local market for power. The North Sea and the UK are applicable because of the present stage of the basin’s lifecycle. There are numerous fields where gas has been exported through pipelines to the shore for many years, and volumes are declining. That in turn introduces changes to the flow characteristics through the pipeline, pushing up operating expenditure.

“Many North Sea fields are producing gas on a traditional basis, and in the southern North Sea, there are a lot of normally unattended installations. Converting these for Gas-to-Wire would mean simplifying the process on the platforms to bring down opex costs going forward – for instance by removing the compressors used to export the gas – then installing the turbines to convert the gas to power, and the subsea cables to take it to the shore or a nearby wind farm. All the replacement systems would be established technology, fully proven in a marine environment.”

Gas compositions and levels of purity can vary widely, but this is not an insurmountable issue, Pegram said. “Modern gas-driven turbines are fairly robust. Offshore, they are most efficient where the gas contains a high percentage of pure, dry methane, but they can also take a certain fraction of hydrogen sulfide or carbon dioxide. Depending on the level you can also get around that with pre-processing of the gas, as might be the case in a traditional processing arrangement.”

Most of the projects MFDevCo and its partners have been discussing with interested parties are redevelopments, she added, “where there are offshore facilities that we could re-use or re-condition to accommodate the equipment we would need. Petrofac has relevant experience in design and engineering, as well as operations.” An alternative approach could be to replace the offshore installation altogether. “There are cases where we have proposed our own platform designs, although that would depend on the location and the water depth.

“But our main focus is on redeveloping an existing facility, and we are confident that we can do this cost-effectively. Redevelopment provides an economic benefit to offshore operators, enhancing the life of the field as opposed to the alternative of decommissioning and all the large associated costs. The entire methodology of Gas-to-Wire is driven by the need to bring costs down. As an example, with Siemens onboard, we can lease the turbines instead of committing to an outright purchase. And removing some of the equipment needed for gas export purposes also reduces maintenance costs.

“Our interests and objectives are fully aligned with those of our co-venturers Siemens, Marnavi and Petrofac, and there are incentives for these companies to look at new ways of reducing costs, because doing so can lead to repeat projects.”

For a project to be financially sound there would have to be a minimum base case of typically eight to 10 years duration, Pegram explained, perhaps tying in additional gas resources nearby to strengthen the economics. “Or there might be other companies interested in applying Gas-to-Wire to similar fields in the area, and they could assist in the negotiations. In certain cases, they might by necessity be dealing with other companies if their pipeline is the sole possible export route and they may be looking for an alternative.”

Location of the gas is another factor. “Ideally, the subsea power cable would be no more than 40 km [25 mi] long, because the longer the length of cable needed to take the power to a wind farm or the onshore substation, the higher the associated costs will be. In that case, justification for the investment would be determined by the size of the resource and the length of the project. We are talking to a cable manufacturer about the potential scenarios. With AC cables, you don’t really want to be looking at a distance of more than 60-70 km [37-43 mi], and some wind farms around the southern North Sea gas basin are farther out than that. However, wind farm infrastructure is constantly increasing, so three years from now, what is currently considered ‘stranded’ gas might be different. There are alternative approaches that can be used for longer lines, but they can also impact efficiency and cost-effectiveness.”

The southern North Sea has an extensive network of flowlines and pipelines, but MFDevCo does not foresee any major issues for cable crossings. “Marnavi has a joint venture with Next GeoSolutions which is a company that has experience in geotechnical site surveys. There is a lot of infrastructure on the seafloor that needs to be taken into account, but if you’re retrofitting a platform that has an existing pipeline corridor, you can simply retrace the route of the pipeline and use that same corridor for the power cable, after going through the normal risk assessments for HSE purposes.

“The local environment also influences the project cost. The southern part of the North Sea is more benign, and the environment is favorable in other prospective regions for Gas-to-Wire, such as parts of West Africa and Asia/Pacific.

“MFDevCo has all the required design and engineering capabilities and with our new partnerships, we can cover all angles that we’re looking at currently. At some point, when the program enters a different phase, we might have to bring in some supplementary capability, but we can do things cost-efficiently and our set-up is relatively lean, so we don’t want to change that.

“Apart from the cables, Siemens has the entire electrical side covered with its existing equipment designs. Petrofac has design and engineering and huge experience in managing operations at numerous fields in the southern North Sea, plus an onshore base which it uses to operate some of the facilities, because a lot of SNS facilities are normally unattended. Depending on the size of the platform, our intention would be to minimize manning where possible for our projects. Marnavi is an Italian family-owned shipping company – its Marnavi Offshore division has anchor handler vessels, and they are constantly adding units to their fleet. We also have relationships with cable companies that could provide a turnkey supply and installation service. As for financing Gas-to-Wire projects, we hope to have our SPV in place shortly which is expected to take whatever interest might be appropriate in the field in question and raise the finance required to develop it.”

Support for Gas-to-Wire in the UK appears to be gathering momentum following the publication of a study into its potential by the Oil & Gas Authority in September 2018. “We’ve had a great deal of interest since announcing our gas-to-wire initiative from operators who recognize the potential it has to maximize the recovery of gas resources and defer the decommissioning of their assets,” Pegram said, “and we have selected a small number of projects to focus on where gas-to-wire is an ideal fit – we think it’s an important component of the current ‘cleaner2greener’ transition towards a zero or low carbon future.” •