Michael Crowden

Houston

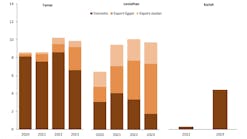

- Table: US Gulf of Mexico Federal OCS platforms with slot capacity of five or more wells.Source: Platform Petroleum Directory (DDS-144).copyright James K Dodson Co. All rights reserved (800 275-0439 - US only/ fax: 817 488-4273).

DeCrane urges industry to sound trumpet for change

Alfred C. DeCrane Jr., Texaco chairman and chief executive, said serious flaws in U.S. energy policy bode ill for both the U.S. and its international partners. He specifically cites "indiscriminatory taxation policies" and "environmental regulations whose costs exceed the potential benefits." DeCrane offered this critique during the recent Arthur Andersen symposium in Houston last month.

"These trends carry major and ominous implications - not only for the nation's economic balance sheet, but for our status as a world power as well," said DeCrane.

Urging industry leaders to "sound the trumpet" for policy change, he said, "Clearly, it is now time for the people of this country to reconsider our national policies toward this vital industry, and decide whether it makes sense to continue this self-destructive course. If these policies are to be changed, the American public must know that better policy choices are available and must know what they are.

"The American oil industry used to be considered a major asset to this nation. It can be again. But for that to happen, the American people must weigh the value of our industry's contributions to the national economy. They must weigh this against the temptation to tax or regulate this industry to the point where its domestic operations are no longer as attractive as those abroad, or even more absurd, are more attractive to foreign-based companies than to U.S. operators.

DeCrane concluded by saying that countries around the world are courting U.S.-based oil companies. "The place that needs our most concerted attention now is right here at home. We cannot stand by while a great national asset simply slips away. We have the information. We have the facts. We have the responsibility. Step up and be heard."

Statistics show platform removal boom forthcoming

Is a boom in platform removal coming? Analyst James Dodson says statistics show it is inevitable. Reserves are being depleted at a rate far faster than aged platforms are being removed. Since federal rules require inactive platforms to be removed, a huge backlog could be in the making.

The Gulf of Mexico has been host to offshore structures for more than 40 years. Currently, there are 1,235 large structures - those having at least five well slots. Since the average productive life of a Gulf of Mexico field is less than 10 years, it is reasonable to expect a brisk business in platform removal in the coming years, Dodson said.

Most of the platforms are in shallow water, represented the most exploited regions of the Gulf. Even if deepwater and subsalt plays bring reserves additions, all but a few of the vast complex of platforms still will require removal.

Consider the latest reserves statistics from the Minerals Management Service. Proven original recoverable reserves in federal waters of the Gulf were 11.15 billion bbl of oil and 136.8 trillion cu ft of gas from 849 proven fields. Proven remaining recoverable reserves are 2.14 billion bbl of oil and 29.1 trillion cu ft of gas from 729 proven and active fields. This means only 19% of the gulf original crude oil reserves remain to be produced; only 21% of the natural gas remains; but a whopping 92% of the large platforms remain in place.

Apache buys $600 million in property

Apache is paying $600 million to acquire 300 producing fields from Texaco. The sale is expected to close during the first quarter 1995. The properties are located in the Gulf of Mexico and throughout the U.S.

The deal boosts Apache's reserve base by 51% by adding 81 million bbl of oil and 220 billion cu ft of gas. Apache is selling $150 million of its existing properties and incurring additional debt to finance the deal. Just three years ago, Apache paid Amoco $545 million for a package of properties.

Texaco says it will reinvest the money. In fact, it plans to invest $19 billion to increase its production by 145,000 b/d by 1999. Areas targeted for E&P investment are the deepwater Gulf of Mexico, West Africa, Asia, Russia, and the North Sea.

News Briefs

- Amoco, Exxon, and Shell are planning a $1 billion deepwater project - Ram-Powell. The partners plan to build, install, and commission a tension leg platform in a record 3,220 ft of water at a location 140 miles southeast of New Orleans. The TLP is expected to be in production by 1998.

- Shell Pipe Line says it will construct a major new deepwater pipeline system to transport crude oil. Construction is expected to begin in mid 1995. Completion is expected in 1996. The major portion of the 100-mile system will connect Green Canyon and Ewing Bank areas to the Mars pipeline and LOOP's Clovely storage facilities. A separate 25-mile line will transport crude oil from Garden Banks to the Bonitor and Eugene Island lines, then on to St. James storage facilities.

- An opinion from the Interior Department's solicitor indicates MMS has little leeway in interpreting the Oil Pollution Act of 1990 - specifically, the $150 million proof of liability, up from $35 million. Watch for legislative changes to be sought. Rowan's Paul Kelly, chairman of the OCS Policy Committee, is leading a special advisory group studying possible options.

- Ashland Exploration has discovered gas at Vermilion 410. The discovery well cut through 90 ft of net gas pay in five zones. A platform will be installed this year, with initial production in 1996.

- Leviathan Gas Pipeline Partners has acquired 50% interest in the Placid Green Canyon pipeline system. The sellers were Hunt Petroleum and EP Operating. Terms were not disclosed. The pipeline has been renamed Manta Ray.

- Phillips Petroleum has contracted Aker Omega for engineering, procurement, and construction management services for its SeaStar project, Garden Banks 70/71.

- Shell Oil says its 1995 capital and exploration expenditures will be $3.4 billion, up $500,000 from 1994. About $1.8 billion is allocated for E&P activities, up $400 million from 1994.

Copyright 1995 Offshore. All Rights Reserved.