David Paganie • Houston

Newfield hits deepwater pay

Newfield Exploration has made two deepwater discoveries. The Gladden prospect in Mississippi Canyon block 800 in 3,116 ft (950 m) of water found 80 ft (24 m) of net oil while the Anduin West prospect in Mississippi Canyon block 754 in 2,696 ft (822 m) of water hit 30 ft (9 m) of net gas and condensate.

First production from both Newfield-operated fields is expected in late 2009 via tieback to ATP-operatedInnovator moored in Mississippi Canyon block 711. Meanwhile, ATP plans to sell working interests in a number of its holdings including the MC 711 hub and Telemark (Mississippi Canyon blocks 941/942 and Atwater Valley block 63).

BP contracts Pride drillship

BP has awarded Pride International a five-year drillship contract for an initial term in the GoM. Samsung Heavy Industries (SHI) is building the rig at its shipyard in Geoje, South Korea. Delivery is expected in mid-2010.

Estimated revenues over the five-year contract, excluding the reimbursement of costs associated with rig mobilization, will be approximately $984 million.

The rig is designed to drill in up to 12,000 ft (3,658 m) of water to a total vertical depth of 40,000 ft (12,192 m). It will be equipped with 20,000 metric tons (22,046-tons) of variable deck load, DPS-3, expanded drilling fluids capacity, 1,000-ton (907-metric ton) capacity top drive, and living quarters for up to 200 personnel.

The drillship also will include a 160-metric ton (176-ton) active heave compensated crane for setting subsea trees and manifolds in up to 10,000 ft (3,048 m) of water, an additional 2,000 ft (610 m) of marine riser, and capacity to expand to dual-activity drilling.

Cobalt books ENSCO 8503

Cobalt International Energy L.P. has booked ENSCO International’s semisubmersibleENSCO 8503 for a two-year primary term with an option to extend one or two years. The aggregate day rate revenue for the base two-year contract term is expected to total $372 million. Delivery of the rig to Cobalt is anticipated in late 2010 or early 2011.

Meanwhile, ENSCO has awarded Keppel FELS Shipyard a $512-million contract to build its fifth ENSCO 8500-series semisubmersible –ENSCO 8504. Delivery is expected in the second half of 2011.

Noble secures deepwater work

Noble has secured a two-year contract from Shell for the semisubmersibleNoble Jim Thompson. The contract begins in 2009. The Noble Lorris Bouzigard was scheduled to begin a two-year term in May with LLOG, and Noble Amos Runner also was to begin work in May, with Anadarko. The contract runs through March 2011.

MMS approves Cascade, Chinook

MMS has approved development plans for Petrobras-operated Cascade and Chinook in Walker Ridge in 8,200 ft (2,499 m) of water. This project will be the first in the US GoM to use an FPSO.

The next step in the approval process is the MMS review of Petrobras’ Deepwater Operations Plan. The plan, which outlines the specific details and capabilities of the FPSO and associated new technologies, must be approved before production can begin.

Petrobras has proposed to use five new technologies in the development plan, according to the MMS. The new technologies include an FPSO with a disconnectable turret, crude oil transportation via shuttle vessels, subsea electric submersible pumps, free-standing hybrid risers (FSHR), and a polyester mooring system.

The initial development phase calls for drilling and completing two new wells on Cascade and one new well on Chinook. Subsequent development phases may require up to 24 additional wells. The wells will be tied back to a converted, double-hulled, ship-shaped FPSO via 9 5/8-in. (24.4-cm) flowlines and FSHRs. The BW Offshore-owned FPSO is designed to process 80,000 b/d of oil, store 600,000 bbl of oil, and export 16 MMcf/d of natural gas.

Produced oil will be transported to shore by shuttle vessels. Produced gas will be sent from the FPSO via FSHR and a 6-in. (25-cm) export pipeline to the BP-operated Cleopatra pipeline system in Green Canyon block 829 or the Enterprise-operated Anaconda pipeline system in Green Canyon block 606. First production is expected in 2010.

Petrobras also is participating in two additional deepwater developments – Chevron-operated St. Malo and Shell-operated Stones. FEED work on a St. Malo and Jack joint development is expected to begin mid-year.

Petrobras is investing $4.9 billion (32% of its total investment outside Brazil) in the US through 2012.

Shell’s Perdido to push deepwater boundaries

Shell’s Perdido development will push the boundaries of deepwater development, said Lisa Johnson, Shell’s venture manager of North America Offshore, at the Offshore Technology Conference in May.

The host facility will be the deepest installed direct vertical access spar in the world, Johnson said. It will be moored on the Great White field in about 8,000 ft (2,438 m) of water.

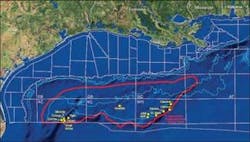

The deepwater Lower Tertiary trend has an estimated discovery volume of 2.8 Bbbl of commercial hydrocarbons, which represents about a 15% addition to total GoM oil and gas volumes. Source: MMS.

One of the project’s subsea satellite fields (Tobago) also will represent a world record once onstream, she said. The well will be the world’s deepest subsea completion in about 9,627 ft (2,934 m) of water. Production from Tobago and planned tiebacks including Silvertip will be separated subsea and boosted to the drilling and production hub designed with capacity to process 130,000 boe/d.

Startup of Perdido, expected by the end of 2009, will represent first production from Paleogene reservoirs in the Gulf’s Lower Tertiary region, Johnson said. “Perdido will open a new era of production from the Paleogene area.”

The spar’s hull sailed from Pori, Finland on May 27, en route to Ingleside, Texas where it will be outfitted for installation. Heerema’sThialf is scheduled to install the platform’s topside in 2009. Shell operates Perdido with a 35% working interest. Partners are BP (27.5%) and Chevron (37.5%).

Eni plans Longhorn development

Eni plans to develop its Longhorn gas field as a subsea tieback to the Crystal platform. Longhorn is in Mississippi Canyon blocks 502 and 546 in 730 m (2,400 ft) of water. Three wells will be completed subsea and tied back 32 km (20 mi) to the host facility. Transocean’sAmirante will begin completing the wells in the third quarter. First production is expected in March 2009.

Eni operates Longhorn with a 75% working interest; Nexen Petroleum Offshore USA Inc. holds the remaining 25%.

Gulf Island gets second MinDOC

Bluewater Industries, under contract with ATP Oil & Gas, has issued a letter of intent to Gulf Island Fabrication for a second MinDOC T3 hull for ATP’s Telemark project. Gulf Island built the first hull for ATP, which is slated for installation this year.

Helix Producer I delivery delayed

Delivery of Helix Energy Solutions’ floating production unitHelix Producer I (HPI) has been delayed. The vessel is expected to be delivered, installed, and producing, in early 2009. The original schedule called for first production by the end of 2008.

HPI is a converted ship-shaped disconnected floating production unit. The vessel initially will be used to develop the Helix-operated Phoenix field in Green Canyon block 237.

Meanwhile, repair work on BHP-operatedNeptune TLP continues. Analysis determined that part of the support structure inside the hull’s pontoons required additional reinforcement, according to BHP. The company was working to bring the facility onstream by the end of the second quarter, subject to regulatory approval.

The TLP originally was scheduled to start production at the end of March.

Chevron’sBlind Faith also is scheduled for first production this year. The semi sailed from Ingleside, Texas, to Mississippi Canyon block 650 in the first quarter.

Stone to acquire Bois d’Arc

Stone Energy is set to acquire Bois d’Arc Energy. Under the agreement, Bois d’Arc stockholders will get $13.65 in cash and 0.165 shares of Stone common stock for each share of Bois d’Arc common stock. The transaction has an aggregate value of approximately $1.8 billion.

Following the merger, Stone expects to produce over 300 MMcfe/d, with over 700 bcfe of estimated proved reserves and approximately 275 bcfe of probable reserves. Also included is a multi-year exploration prospect inventory, 3D seismic coverage, and a leasehold position of over 800,000 net undeveloped acres.

The transaction is expected to close in the third quarter.

Petrobras strikes oil in Lower Tertiary

Petrobras America Inc. has confirmed oil in the Stones No. 3 well operated by Shell in Walker Ridge block 508. Transocean’s semisubmersibleDeepwater Nautilus drilled the well in 2,286 m (7,500 ft) of water to 8,960 m (29,396 ft) TD finding oil in multiple Lower Tertiary reserves. More drilling is planned. Partners in WR 508 are Shell (operator) with a 35% working interest, Petrobras America and Marathon with 25% each, and ENI with 15%. Deepwater Nautilus is working with Shell under a three-year contract extension, which could be extended an additional year by June 30. At print, the semi was drilling on the Mars field in Mississippi Canyon block 807.

MMS extends lease sale evaluation period

MMS has extended the post-sale evaluation period by 30 days for bids received in Central Gulf of Mexico Sale 206. The lease sale, held in March, attracted $3,677,688,245 in high bids. MMS received 1,057 bids on 615 tracts, with 513 of those tracts requiring additional detailed evaluations.

The high number of bids received on a large number of tracts, and the substantial volume of recently processed and reprocessed seismic data identified, significantly increased the workload for reviewing the adequacy of bids, and made it necessary to allow more time for MMS geoscientists and engineers to gather, interpret, and evaluate the enhanced data, MMS says. The regulatory agency will complete the evaluation by July 17.

McMoRan drilling to record depth

McMoRan is drilling its South Timbalier block 168 No. 1 exploration well to 33,000 ft (10,058 m) proposed total depth, which would be the deepest well drilled below the mud line in the GoM, according to the company.

Wireline logs at 30,964 ft (9,438 m) indicated the well encountered a potential hydrocarbon-bearing zone, McMoRan says. Pre-drill estimates were 500 MMboe, according to partner Energy XXI.

McMoRan-operated ST 168, formerly known as Blackbeard West, is in 70 ft (21 m) of water. The well was drilled to 30,067 ft (9,164 m) by the original operator and its partners but was temporarily abandoned in August 2006 prior to reaching the objective depth. McMoRan acquired rights to the prospect in August 2007. The company re-entered the well with Rowan’s jackupRowan Gorilla IV on March 18, 2008, and then spudded a new hole on April 16, 2008.