In the wake of recent license awards in both the Norwegian Sea and the North Sea, oil companies are preparing both seismic and drilling plans. The Norwegian Sea licenses were issued as part of Norway's 17th round, and the North Sea licenses under North Sea Awards 2001.

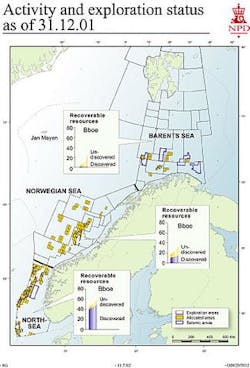

According to official statistics, a lot remains to be explored in the Norwegian sector - 28% of total estimated resources of 86.8 Bboe remain undiscovered. Of total undiscovered resources totaling 27.4 Bboe, 7.6 Bboe lie in the North Sea, 10 Bboe in the Norwegian Sea, and 6.1 Bboe in the Barents Sea. Oil accounts for an estimated 8.5 Bbbl, and gas for 2.4 tcm.

The government's policy is one of encouraging exploration activity through the regular licensing of new acreage. Norwegian Sea acreage is offered every two years and North Sea acreage on an annual basis. In a white paper issued in June, Minister of Petroleum and Energy Einar Steensnæs proposes defining certain mature areas in the North Sea as permanently available for licensing. While annual rounds would still be held, companies could also make applications for acreage in these areas at any time. The proposal will be debated by the Storting after the summer holidays.

Activity and exploration status as of 2001.

It is also a plank of government policy that offshore oil and gas activities must not be detrimental to the activities of other users of the sea or the marine environment. Studies are to be made of the impact of all-year-round activities in northern areas that are important to fishing or are environmentally sensitive.

Since the first licenses were issued in the Norwegian Sea in 1981, exploration has been relatively successful, with a much higher ratio of proven reserves discovered per wildcat than in the North Sea, according to Bente Nyland, director of data, information, and knowledge management at the Norwegian Petroleum Directorate. But while the region is believed still to contain a large potential, it also presents many challenges when it comes to unlocking its geological secrets.

There was huge disappointment, for example, over Shell's recent well on the President block, 6406/5-1, which made only a small discovery. Perhaps the expectations were unrealistically high. The prospective formations lie so deep that seismic data is of limited quality, and it is difficult to define where the porosity is located, Nyland says. Nevertheless, important elements were present in the discovery, and with some 10 prospects identified in the three blocks included in the President license, it is too soon to come to any firm conclusions.

Conditions can also be so extreme that technical expertise is tested to the limit. In 2000, ExxonMobil's Victoria exploration well 6506/6-1, previously known as Belladonna, made what is thought to be a large gas-condensate find. The NPD estimates gas reserves at 118 bcm. But the hydrocarbons lie at 5,000-m depth in an extremely hot, highly pressured reservoir. Logging proved problematic, and for technical and safety reasons, no attempt was made to test the well. ExxonMobil, which will soon have to relinquish part of this license, has yet to reveal its next step.

Victoria lies on the same Halten Bank-Nordland trend that contains Lavrans, Kristin, and Sm rbukk in 6406/2, 6506/11, and 6506/12 in the southwest; Skarv and Idun in 6507/5 and 6507/3, and Norne in 6608/10. One of the recent awards, Phillips-operated license PL 284, will look at the northeast extension of this trend, focusing on the D nn area in blocks 6607/11 and 6607/12, where the terrace on which these finds have been made turns east.

In the south of the Norwegian shelf, the closure to exploration of the Skagerrak area between Norway and Denmark and the coastal region off southwest Norway is to be reviewed. Some unsuccessful drilling took place there on first and second-round licenses, but good seismic data was lacking. Interest has been re-awakened not least by the fact that geological conditions are analogous to those at the recent Buzzard discovery in the UK's central North Sea.

Seventy percent of mapped undiscovered reserves are located on existing licenses. There is a growing concern at the NPD that companies often seem happy to sit on such acreage, and the directorate may well have to take up the issue with companies and find ways of encouraging them to take action, Nyland says.

Ten licenses were awarded earlier this year under the North Sea Awards 2001 round, several of them to newcomers and smaller companies such as Kerr-McGee, DONG, and RWE-DEA, which are expected to bring a renewed zest to exploration.

There is still significant potential in parts of the North Sea. The NPD awaits with interest the results from the Sturlason well that Phillips was drilling in 35/1 in mid year. This prospect lies on a trend running northeast from Snorre and Visund in blocks 34/ 7 and 34/8. Between these fields and Sturlason, Conoco has acreage in blocks 34/5, 34/6, and 34/9.

The NPD expects 25-30 exploration and appraisal wells to be drilled this year, most of them in mature North Sea areas. This is about the level of the last few years. If the industry only goes for the most obvious prospects, the NPD may have to encourage it to take a more enterprising approach, as it did back in the early days of exploration on the Norwegian shelf, Nyland says.