Unexplored deepwater tracts draw foreign interest

Judy Maksoud

International Editor

India is sinking big bucks into hydrocarbon exploration. As the seventh largest consu-mer of oil in the world, India is looking to meet its own energy needs. Enormous financial resources are being allocated to pave the way to self-sufficiency.

Last year, the country's state-owned Oil & Natural Gas Corp. announced it would invest $9.5 billion over the next five years to increase domestic oil production.

A portion of this money is being spent in redeveloping the 1.6-Bbbl Bombay High oil and gas field in the Arabian Sea, India's largest field. A much larger portion is now earmarked for a deepwater exploration program.

ONGC is venturing into new areas, including marginal field development, optimization of field development and hydrocarbon recovery, exploration in frontier basins, and most significantly, deepwater exploration.

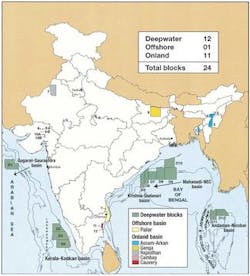

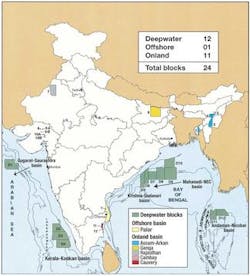

In August, ONGC, now in the midst of its 10th five-year plan, launched an enormous deepwater exploration initiative, perhaps the largest undertaken by a single operator. The company's multi-billion-dollar project, called Sagar Samriddhi, provides for 47 deepwater exploration wells.

One strong impetus for the high level of exploration is that an estimated 11 billion metric tons of oil and oil equivalent lie in India's deepwater basins. Another possible stimulus for activity of this intensity is the US government's recognition of India as a major energy market and the US Department of Energy's offer to assist India in creating its own strategic reserves.

The tempting deepwater targets in the Arabian Sea and Bay of Bengal may not be easy to hit, but ONGC is serious about extracting potential reserves. The company's determination translates into an estimated $750,000/day to be spent on Sagar Samriddhi. The objective is to add 4 billion tons of reserves from the deepsea exploration campaign.

Technological challenges, including water depth, a soft seabed, and inclement wind and weather conditions, combine to create a host of issues with which ONGC will have to contend to move Sagar Samriddhi forward. Feelers are already out for providers of the needed technologies.

null

The first phase of drilling is getting underway with three drillships contracted. The Belford Dolphin, charted from Dolphin Drilling, was to mobilize to the Bay of Bengal this month, while ONGC's Sagar Vijay resumes operations in the Krishna-Godavari basin. Transocean's Discoverer Seven Seas is mobilizing to the Arabian Sea in February 2004.

These three contracts provide the ability to undertake field delineation and development as soon as discoveries are established. ONGC's target for deepwater production is to achieve over 30 million metric tons of oil equivalent per year by the time the 11th five-year plan concludes. That amount is equal to current domestic production from onshore.

Sagar Samriddhi will bring a lot of firsts to India. Using the integrated well completion approach is one of them. ONGC plans to award turnkey contracts on single-point responsibility in order to mitigate the operational and financial risks.

Other growth

In a statement to potential investors in Houston recently, Y.B. Sinha, director of exploration at ONGC, said the company's vision is to be "a world class oil and gas company." Certainly, ONGC has invested heavily in making that goal a reality.

As ONGC embarks on a mammoth domestic project, the company is also positioning itself to grow through partnerships, strategic alliances, and joint ventures. ONGC has stated medium- and long-term goals of continuing to access E&P business both in the domestic and international sectors and to expand domestically in the downstream sector.

ONGC has recognized the need to expand its business domestically. One way it is achieving that objective is through alliances and foreign investment.

India's state oil companies, including ONGC, Indian Oil Corp., Gas Authority of India Ltd., and Oil India Ltd., are investing in international E&P projects as far afield as Russia, Yemen, Sudan, Vietnam, Iraq, and Iran.

In July, the Indian government and the government of Iran agreed on substantive collaboration in oil and gas opportunities in Iran. India's state agencies agreed to work in consortium under the guidance of India's Ministry of Petroleum & Natural Gas to develop specific projects and agreements in Iran. The responsibility for the lead role in the upstream sector was assigned to ONGC Videsh Ltd., a wholly owned subsidiary of ONGC. It was also determined at that time that ONGC would work with IOC and GAIL in downstream and gas businesses.

NELP IV

Though domestic exploration and production are now dominated by ONGC, there was significant private-sector interest in the country's New Exploration Licensing Policy IV.

Evidence of foreign interest was apparent at the Houston road show in June 2003, which saw record attendance. Recent deepwater discoveries have raised the profile of India's offshore, making investment opportunities considerably more attractive.

And it certainly didn't hurt to have analysts touting the advantages of investment in India's hydrocarbon industry.

"India offers a very significant opportunity," according to Vean Gregg, vice president of the natural resources group at JP Morgan.

"India will become a very attractive area for foreign direct investment," he said, pointing out that India is one of the fastest growing oil markets in the world.

Gregg predicted the region will undergo dramatic development in the petroleum sector, noting, "By 2010, India is expected to be the fourth largest petroleum market in the world."

Private sector participation has increased in the recent past, he said. And there is "significant running room" for new participants in a region he characterized as "underexplored and underdeveloped."

The favorable demand/supply dynamic, large unexplored hydrocarbon potential, significant recent commercial discoveries, sector deregulation, and attractive terms and conditions of NELP IV combine to make India a good place to invest, Gregg said. A testimony to the country's stability is the fact that JP Morgan itself is increasing investment in India.

"Expect India to be among leaders of countries worldwide for petroleum growth," he said.

Bids for NELP closed at the end of September, and awards are expected by Dec. 31, 2003.

Foreign investment

Cairn Energy has a long history of success in India's offshore, and the level of exploration under way indicates that there will be more successes in the near future. Success has bred optimism and has encouraged increased investment. Over the past five years, Cairn and its partners have invested $1.5 billion in Southeast Asia.

Cairn's production off Eastern India comes from the Ravva oil and gas field, which has plateaued at 50,000 b/d of oil and is expected to produce until 1Q 2005. The field produces 65 MMcf/d of gas. Cairn has stated that more drilling will take place on the Ravva field in 2003 and 2004.

One of Cairn's primary areas of interest has been the shallow water of Gujarat off western India. According to Michael Watts, vice president of exploration, the reason for this is that deepwater "is beyond the balance sheet and technical capability of Cairn." That is why the company is bringing in partners to explore its deepwater Krishna-Godavari acreage off India's east coast.

Meanwhile, Cairn is working several discoveries in development, the most prominent of which is the 66-MMbbl Lakshmi field, which has been producing gas since May 2002.

Drilling is continuing on blocks CB/OS-2 and RJ-ON 90/1, where Cairn has identified significant potential. The third development well on Gauri field on CB/OS-2 struck oil in September. The well has been designated as a producer in the Gauri gas field, a satellite of Lakshmi. Gauri holds gas reserves estimated at 60-200 bcf.

Exploration work off eastern India consists of reviewing and evaluating data following a successful exploration program on block KG-DWN-98/2.

In mid-June, Watts estimated Cairn would spend $140 million in India this year. And the way forward looks bright.

"Cairn's activities are strongly aligned with the host governments priorities," he said.

The BG Group, which has invested in India for 10 years, is increasing its investment in the region. According to Dave Roberts, BG's executive vice president and managing director for the eastern hemisphere, the company has invested $500 million in the region to date and expects to invest at least that much more in the next five years. India has been identified as one of BG's six core countries, Roberts said, noting, "We only go places where we can succeed."

BG considers India to be "one of the largest growth markets in the world for natural gas," Roberts said, a strong reason for "very aggressively looking at the NELP IV round."

A tiff regarding operatorship of the Panna, Mukta, and Tapti fields off western India has not diminished the company's enthusiasm for working off India. The question of operatorship for the fields reached a settlement in March. BG, ONGC, and Reliance Industries Ltd. agreed to an integrated joint operating framework to oversee field development. Operations for the field will be conducted through a three-member operator board comprising a representative from each company, with the chairmanship rotating on every two years.

The partners plan to invest $700 million over the next few years. A priority will be to maintain field production and expand output from the Tapti gas field. According to Roberts, the partners are on the same page and are "keen to bring these prospects on."

A solid democracy, a good economic market, well-managed state-run and private domestic oil companies, and reasonable investment terms provide considerable incentive for doing business in India. The attractive investment climate will keep BG and others in India and will certainly encourage more foreign companies to invest.

Domestic competition

India's Reliance Industries Ltd. is the only domestic private player to have achieved success in India's oil and gas industry. And the company's spectacular results have been achieved in a brief three-year involvement in the oil and gas industry.

In April 2002, Reliance began a $350-million exploration program that has yielded unprecedented success from the wells drilled in its Krishna-Godavari block, one of which constituted the largest in the world in 2002.

While Reliance considers development op-tions for its prolific Krishna-Godavari field, the company is investing in additional acreage beyond that acquired in NELP III. In late December 2002, Reliance purchased stakes in five offshore oil and natural gas exploration blocks from Tullow Oil Plc. Reliance will operate the blocks, which lie in the Arabian Sea and the Bay of Bengal. And it is a safe bet that the company will bid on blocks made available in NELP IV.

Reliance held over 288,000 sq km of acreage before NELP IV and interest in 32 onshore and offshore blocks. Only 2,000 sq km of that total has been explored.

According to Thakur Sharma, president of Reliance Infocom Inc., Reliance is planning a lot of investment in the oil and gas industry. And much of that investment will go toward the "mostly unexplored" offshore acreage.

Reliance's Krishna-Godavari discovery proved India is not "a barren land," Sharma said. And Reliance's continued run of successes has proven that private companies can compete with India's state-owned oil companies in the search for hydrocarbons in India's offshore.