Editor's note: This column first appeared in the January-February 2023 issue of Offshore magazine. Click here to view the full issue.

By David Paganie, Houston

The stage is set for an upcycle-type of year for the drilling and development of offshore oil and gas, with industry sentiment improving and plenty of data points that support the positive expectations. In the recent Offshore-Energy Maritime Associates (EMA) survey of reader thoughts on the outlook of the floating production market, about 29% of respondents, up from 27% in 2022, are highly optimistic about the outlook for this year. There is also less pessimism this year, with only 5% of respondents indicating somewhat or highly pessimistic views, down from 8% in 2022 and 19% in 2021. But there are headwinds, namely inflationary pressures that could cause some operators to rethink the timing of project approvals. Nearly 100% of survey respondents expect higher prices this year. About 50% expect a 5-10% increase in capex costs, and 40% anticipate inflation will increase by more than 10%. David Boggs, managing director of EMA, reviews these and other key findings from the survey.

But with rising demand for oil and gas and commodity prices expected to remain high, operators have been increasing investments in longer cycle offshore developments – a trend that typically occurs in tandem with investor confidence in the market. Offshore exploration and production capex spending rebounded by 21% in 2022, and it is expected to rise another 8% to $178 billion in this year, according to Rystad Energy’s industry outlook.

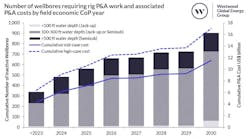

Another data point that supports improving industry sentiment is last year’s $51 billion in offshore upstream EPC contract award value – the highest mark since 2013 and a 27% year-over-year increase led by 74 FIDs. This year, offshore oil and gas-related EPC contract award value could rise by another 43% to $73 billion, driven by an expected 80 project FIDs. These are some of the findings of Westwood Global Energy Groups’ forecast and analysis.

The Offshore-EMA survey also looks for areas of technology development that are likely to have the largest impact on the offshore industry. While floating wind continues to top the survey results, unmanned production facilities moved up one spot to second place, and subsea production moved up one spot to third place. Both floating wind and fully automated facilities will have a great impact once the technologies advance to a level that promotes operator and developer confidence. For subsea production, the basic elements are mature. But there are some areas of ongoing development and qualification for subsea that could extend field production profiles with longer tiebacks and improved power efficiency. Inside this issue, Offshore reviews a selection of these technologies and host projects with a focus on subsea gas processing and compression. Offshore also details how the Jansz-Io project combines variable speed drives and power from shore.

One technology featured inside is called pseudo subsea dry gas/liquids separation technology. A six-week trial of a full-scale prototype of the technology is expected to start soon. The technology developers describe its benefits as having the potential to extend subsea tiebacks out to 200 km or more, to increase recoverable gas volumes through lessening backpressure on the reservoir; having lower development capex compared to other solutions; and a lower power requirement compared with topsides or subsea compression, which in turn reduces the carbon intensity per barrel.

Jeremy Beckman, Offshore Editor, Europe, reviews the technology and its progress toward full technical readiness. Also, there will be a presentation from the inventors at Subsea Technology Eastern Mediterranean in Cyprus on May 18.

High costs are causing some concern in the marketplace, but if industry sentiment holds, it should be a rewarding year for offshore oil and gas operators and contractors.