Floating production platform construction market maintains momentum from high oil, gas prices

Editor's note: This cover story first appeared in the January-February 2023 issue of Offshore magazine. Click here to view the full issue.

By David Boggs, Energy Maritime Associates

The floating production construction market continued to grow in 2022, maintaining a rebound that began in 2021. As we enter a new year, the industry sentiment remains buoyant, with most respondents optimistic about the future.

Recently, Energy Maritime Associates conducted its tenth annual Global Floating Production Industry Survey, which gauges current market sentiment and collects data on where the industry is headed in the future. Respondents come from all areas of the industry and from all parts of the globe.

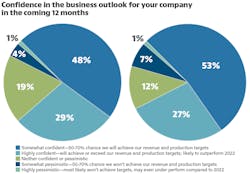

There is less pessimism this year, continuing the trend from the last two years. In 2021, 19% were somewhat or highly pessimistic, which declined to 8% in 2022 and now 5% for 2023. On the other end, the number of highly optimistic responses increased slightly from 27% to 29%. However, the number of somewhat optimistic views dropped by 6% (from 53% to 47%). Also increasing was the percent of those in the middle, with 19% having a neutral outlook (up from 12% last year).

This would indicate that while great optimism remains for most, there is an increasing uncertainty. This could be attributed to increased activity alongside inflationary pressures. In addition, there are concerns over a global recession and delays to project sanctions. A few selected comments are listed below:

“The offshore sector is looking strong currently.”

“Concern is on the financing of projects – more and more lenders do not finance oil and gas projects.”

“Our forecast already factors in a slowing down in the global economy, higher inflation etc.”

Cost inflation

Higher prices are a certainty for 2023 according to 99% of respondents. Increased activity, higher commodity prices, reduced competition, and COVID measures continue to drive this escalation. Almost 50% expect a 5-10% increase in capex costs, while 40% believe inflation will be more than 10%. This is a shift from last year, when only about a quarter of responses believed costs would increase by more than 10%.

The main areas pushing cost inflation remain labor, logistics, and commodities. Last year there was more concern over logistics, while this year labor is the leading issue. Several respondents indicated the war in Ukraine was also contributing to inflation. Higher interest rates and financing costs are a growing concern with 17% of responses (up from 11% last year).

Growth obstacles

For the second year in a row, political issues were named the greatest obstacle to offshore project growth. The war in Ukraine and windfall taxes on energy companies may cause delays or cancellation of some new developments.

Access to finance moved up two places from last year as an increasing number of banks have stated they will not provide funding for hydrocarbon developments. As a result of this and higher financing costs, some field operators have shifted their contracting approach from leasing to EPC. It remains to be seen how long this trend will last.

ESG issues/investor sentiment jumped from sixth place to third this year, alongside environmental regulations. Environmental regulations remained unchanged in third place. Some respondents believe that these are an existential threat to the industry, and companies certainly factor in these issues when making investments, as seen by Shell’s exit from the UK’s Cambo development. However, other investors may have a different view and be attracted to these opportunities. We agree that the energy transition will impact the offshore hydrocarbon sector and believe that the industry has a large role to play for many decades to come.

The price of oil, which had been the main issue for seven years, fell to second place last year and dropped further this year to fourth place. Tied for fourth place is industry capacity, which has been a growing concern, increasing to 10% of respondents, up from 7% last year and 5% the prior year.

Costs remain low on the list of concerns, with less than four percent worried about FPS, drilling or subsea costs in the next two years. This is interesting, as rising costs were cited as one of the reasons for delaying project sanction of Shell’s Gato do Mato in Brazil, Equinor’s Wisting in Norway, and Santos’ Dorado in Australia.

Potential bottlenecks

The main issues are fabrication yards, shipyards, project management, and offshore installation. These were the top four issues last year as well. However, this year there is even more concern from respondents about fabrication yards and shipyards. In addition to a busy offshore sector, there has been a huge surge in demand for renewable infrastructure and shipping with many yards now having full orderbooks for the next three years.

From 2017-2020, there was little concern about industry capacity and the top response for this period was “no capacity constraints expected.” This has been changing over time, from 36% in 2017 to 15% in 2020 to 3% this year.

Subsea equipment has become a greater issue, moving up from 11th place to 5th place since last year. Constraints in SURF and mooring equipment remain low, reflecting substantial availability in 2023-2024.

Growth regions

Brazil remains the top growth region again this year, as it has been since the beginning of the FPS Market Sentiments Survey. Petrobras awarded three Buzios FPSOs in 2022 and has plans for many more to develop presalt fields as well as replace aging FPSOs in the Campos basin. Independent operators are redeveloping older fields, while larger players such as Equinor and Shell are progressing new developments. EMA is tracking 30 potential projects in Brazil, which could require up to 40 floating production units.

In second place is West Africa, unchanged from last year. However, the number of votes increased from 13% to 16%, buoyed by the prospects of long-awaited awards in mature areas like Angola as well as new discoveries in frontier areas like Namibia.

South America (ex-Brazil) remained in third place, with a growing number of responses (up from 11% to 14%). ExxonMobil has placed orders for five FPSOs and has plans for a further five units in Guyana (10 in total). There could be potential for double this number to develop the entire basin, which extends to neighboring Suriname.

The Middle East and US Gulf of Mexico again tied for fourth place. The most notable changes were the Mexican side of the GoM, which dropped from being tied with the US GoM last year to eighth place. This is likely as a result of continued issues with Pemex and delays in sanctioning developments by international operators.

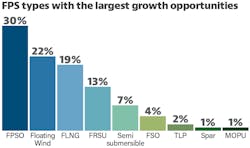

FPS types in demand

FPSOs remained the clear leader as the floating production system with the most promising growth potential, according to 30% of respondents. Floating wind held second position again, reflecting continued enthusiasm for renewables. The prospects for FLNG continue to grow, with 19% of responses, up from 14% last year. This is driven by the surge in LNG prices and drive for energy security. These same issues have also increased the growth potential for FSRUs, which was also up 5% (from 8% to 13%). As a result of Russia’s invasion of Ukraine, almost all available FSRUs were contracted for Europe. A clear sign of optimism for this sector was Excelerate’s newbuild FSRU order placed in October 2022 for delivery in 2026. This is the first speculative newbuild FSRU order since 2016.

Technology game changers

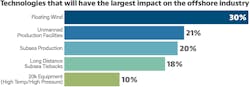

This year, when we asked which type of technology will have the largest impact on the offshore industry, floating wind was again the winner by far, accounting for almost one third of the votes. While still in its infancy, there is a great deal of enthusiasm and hope for floating wind. Time will tell if it can live up to the expectations. FLNG was the top ranked technology in this survey from 2013- 2019, before dropping off the list.

Unmanned production facilities (UPFs) moved up one spot to second place. Several reasons account for UPF’s popularity – notably the high cost of personnel as a portion of operating costs, application of digital solutions, and increasing comfort with working remotely. While unmanned fixed facilities are common, the technology is just beginning to be transferred to floaters. Even if a completely unmanned facility is not realized, reductions in personnel offshore would result in lower operating costs. In 2022, Chevron placed a $554 million order with Daewoo for the Jansz-Io production semisubmersible, which would be the first normally unmanned floating facility.

Subsea production also moved up one spot to third place with 20% of the vote, up from 16% last year. Use of this technology can reduce the topside requirements on floating facilities and keep them within existing designs. Once again, the Jansz-Io project features a $795-million subsea gas compression station, which is connected to the previously mentioned production semisubmersible.

Long-distance subsea tiebacks dropped two places to fourth position this year. This technology could increase the utilization of existing facilities and follows the trend of infrastructure-led investment. Tiebacks certainly will extend the life of currently installed production units, while the impact of future requirements is yet to be seen. Some stand-alone FPS developments could be replaced by tiebacks, while an FPS hub with tieback of multiple fields could also become economic.

The supercycle

The oilfield service sector, particularly offshore, has seen strong growth starting in 2021. Deepwater drilling rates have doubled in the last two years and stacked rigs are being reactivated against long-term contracts. Leading shipyards have full orderbooks for at least the next three-plus years. We asked respondents how much longer this cycle will continue.

The vast majority expect this growth to continue for many years to come. About one fourth believe that the sector will remain busy through 2024, with two thirds saying that it will last through 2025 or beyond. Less than five percent think that a downturn will occur in the next year. This is in-line with the current floating production orderbook, which stands at over 60 units. Half of these are scheduled for delivery in the next year. Another 35% should be completed by 2025. New orders for large floating production units have expected lead times of three to four years.

Floating wind market

There continues to be a great deal of excitement regarding floating wind, with many companies looking to diversify into the renewables space. We asked about the impact of floating wind on the existing floating production sector. Would it compete or be complementary and over what period?

Some 35% expected floating wind to be complementary and enable new floating oil and gas units (down from 40% last year). These units could then be powered by renewable sources, rather than from shore, and reduce their carbon footprint.

A slightly larger number (43%) believed that floating wind would be competition (unchanged from last year). Some 35% expected that it would overtake hydrocarbon production in the long term (2040+). However, 8% thought that this shift would happen sooner.

Just over 20% of respondents felt that electricity from floating wind would not have a significant impact on the floating production sector. This is up 6% from last year. Demand for floating hydrocarbon-production facilities remains strong and while there is certainly a huge potential for floating wind, it remains to be seen if costs will decline as expected. Recent offshore wind developments have already encountered delays and cost overruns, which may result in a reassessment of future cost estimates.

Looking forward

These busy times are expected to continue for at least the next two to three years, despite expected cost inflation and growing supply chain concerns, particularly with fabrication facilities and shipyards.

The floating production market remains one of the brightest spots in the offshore industry today, with continued excitement about the floating wind sector. Offshore development costs remain low, with break-evens under $35/bbl for the most robust projects. Activity levels are expected to remain high from in the 2023-2025 timeframe, but will be challenged by capacity constraints and access to finance.

About the author

David Boggs is the Managing Director of Energy Maritime Associates, which publishes market leading reports on the floating production industry and advisory services for developments requiring FPSOs, FLNGs, FSRUs, Semis, Spars, TLPs, MOPUs, and FSOs. Boggs holds a bachelor of arts cum laude from Harvard University and an MBA with honors from the University of Texas at Austin.