Editor's note: This story first appeared in the July-August 2022 issue of Offshore magazine. Click here to view the full issue.

By Bruce Beaubouef, Managing Editor

Offshore operators are responding to growing demands to reduce flaring on their production platforms, demands that are being driven by stakeholders, international organizations, and government agencies.

Driven by the need to “green” their operations, operators and producers have agreed to ambitious timetables to reduce and eliminate flaring, and are embracing new methods and technologies toward that end.

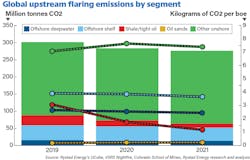

As reported by Rystad Energy, gas flaring activity in the global upstream sector fell last year to its lowest level in a decade due to improved productivity, increased environmental awareness and lower fuel demand caused by COVID-19 lockdowns and travel restrictions. Rystad Energy says that its research shows that upstream flaring emitted about 276 million tonnes of carbon dioxide (CO2) in 2021, down marginally from 283 million tonnes in 2020, continuing a downward trend since the onset of the pandemic.

Improvements in the US shale sector have been a significant driver of the decline in flaring activity. The tight oil sector, dominated by the US, flared the equivalent of about 12 million tonnes of CO2 in 2021, less than half of the 30 million tonnes seen in 2019.

Improvements in the offshore market in Africa are particularly positive from a climate perspective, including significant reductions in Algeria, both in upstream flaring activity and performance. A continental production decline, as well as reduced output from mature offshore wells, helped lower Africa’s environmental impact associated with flaring.

But Rystad Energy also reported that a rebound in flaring activity is, however, likely this year as global fossil fuel demand increases with the relaxation of COVID-19-related restrictions, and supply remains tight due to sanctions on Russian fuel over its invasion of Ukraine in late February.

Rystad Energy analyst Dzenana Tiganj noted that “flaring represents about 30% of the total carbon dioxide emissions produced by the oil and gas industry, and the practice has come under increased scrutiny over its environmental impact in recent years. Even with the backdrop of the pandemic and supply decline, there are still signs that the latest improvements could be partially sustained.”

Many E&P players have set ambitious targets to end flaring, and for many fields reducing flaring remains the first step on the abatement journey, Rystad says. Through satellite data estimation, Rystad Energy says that it can detect and track flaring activity globally for all oil and gas fields. Satellite analysis shows that global flaring reduction efforts have not seen any significant effect as flaring activity has remained relatively flat for the past 10 years. However, Rystad says that “2020 marked a step in the right direction,” and the 2021 estimates suggest that the trend is continuing.

Regional breakdown

With a clear global downward trend from 2019 to 2021, comparing flaring volumes to pre-pandemic 2019 levels provides an interesting look at the regional differences in the upstream sector. Africa, North America, Australia and Europe show persistently decreasing flaring activity, whereas other regions remain flat.

Africa continues the downward trend with significant developments in the offshore segment. The continent’s CO2 emissions from offshore flaring decreased by 4 million tonnes from 2019 to 2021. This trend is primarily driven by the abandonment of mature assets, production declines for mature assets and increased production from less mature fields.

With production declining from 2019 to 2020, Angola and Nigeria alone reduced offshore flaring volumes by over 2 million tonnes of CO2 and continued with a flat development into 2021. Algeria also delivered significant decreases in overall volumes and flaring per boe in 2021. The estimated reduction totaled 3 million tonnes of CO2, and the intensity dropped from almost 18 kilograms per boe to 13 kilograms per boe. This marks a significant shift for a country where the norm has been a steady increase in flaring over the last decade.

North America has been driving global flaring decreases from 2019 onwards, with shale focusing on operational efficiency improvements. The US continues to make up ground with persistent efforts to eliminate routine flaring at shale production sites and operators communicating better production practices and infrastructural improvements. Satellite data shows substantially decreased flaring volumes and increased on-site utilization or redirection of gas for other purposes. US shale production contributed approximately 38% of upstream flaring in North America in 2021, compared to 68% in 2019.

Considering all supply segments, including shale, the US continued to perform well throughout 2021, with a decrease of more than 4 million tonnes of CO2 from 2020 and an overall reduction of flaring intensity by an estimated 30%, reaching 1 kilogram per boe in 2021.

Offshore Europe continues to decrease routine flaring, with the UK being a key driver, reducing flaring emissions by almost 40% from 2019 to 2021. Key operators, such as UK major BP, have implemented improved practices at the well start-up phase and optimized flaring set points to comply with environmental targets and increase fuel efficiency.

North Sea developments

Significant efforts are being made to reduce flaring in the North Sea. Flaring in the UK North Sea fell by 19% in 2021, according to the North Sea Transition Authority, with a 22% decrease reported so far in 2022. Operators reduced overall flaring from offshore production facilities by 6 bcf to 26 bcf. Flaring volumes in June 2021 represented an all-time monthly low for the UK sector. And for the fourth consecutive year, offshore flaring intensity also decreased, to 90 cf/bbl in 2021 – an 11-year low for the amount of gas flared per unit of oil. Overall venting was 24% lower, with venting of inert gases (mainly carbon dioxide) 29% lower and methane 8% lower.

The North Sea Transition Authority (formerly the Oil and Gas Authority) claims that its initiatives contributed to the reductions, with the organization using new guidance, its consenting regime, active stewardship, monitoring, benchmarking and reporting to help drive down flaring and venting and, where possible, eliminate them.

The Authority expects the UK offshore industry to achieve zero routine flaring and venting by 2030 or earlier, with all new field developments designed to accommodate zero routine flaring and venting. Operators requests for flaring and venting consents for new field development plans and existing production are under close scrutiny, with the North Sea Transition Authority able to halt operations if excessive levels are reached.

In one instance, the Authority insisted that a major operator reinstate a flare gas recovery system on a platform. In another, it helped identify a fault with valves on an installation where flaring is said to have become excessive. The reductions in flaring and venting also coincided with planned maintenance shutdowns on multiple installations, which had been largely postponed in 2020 due to the pandemic.

In addition, a growing number of North Sea operators have committed to the World Bank’s Zero Routine Flaring by 2030 (ZFR) initiative. Launched in April 2015, the initiative is a climate collaboration that brings together governments, oil and gas companies, and development institutions from around the world to eliminate routine flaring by 2030. Over 80 governments and organizations have joined the initiative to date.

Two North Sea operators, Harbour Energy and Neptune Energy, have endorsed the Zero Routine Flaring by 2030 initiative. Harbour says that it is taking steps to cut emissions from its oil and gas operations as it seeks to achieve Net Zero for Scope 1 and 2 emissions by 2035. Its initiatives include upgrades to gas turbines, reducing fuel and power consumption, examining options for low or zero carbon energy to power platforms, and participating in various initiatives to explore opportunities for CO2 capture and storage. The company says that it will continue to report emissions annually, including a breakdown of flaring.

Neptune Energy’s VP Operations-Europe, Pete Jones, says that the ZFR initiative is in line with the company’s “broader decarbonization initiatives.” These include targets to achieve a carbon intensity of 6 kg CO2/boe and net zero methane emissions by 2030. To achieve these targets, Jones said that Neptune will be using the best available technologies to eliminate routine flaring, upgrading equipment, and improving energy efficiency. Neptune officials also said that the company will report annually on its flaring, and progress toward meeting the initiative’s objective.

Practical solutions

A number of practical solutions for reducing and eliminating flaring were offered by Mike Wyllie, Managing Director of Open Water Energy Ltd., at the recent “Floating Energy Systems Asia” virtual event hosted by Endeavor Business Media. Taking a hypothetical generic FPSO operating in the Brazilian presalt as his reference case, Wyllie noted that the typical sources of FPSO CO2 emissions are general power, power for gas compression, power for water injection, inert gas, flared gas, fugitive emissions, and helicopters. He noted that the first four categories account for nearly 91% of an FPSO’s potential or likely emissions, while flaring only constitutes five percent. But, he recognized the importance of reducing or eliminating flaring. He advised that increased utilization of digital technologies could help. By embracing digital technologies to improve machine reliability, the industry could lower the number of trips and thus the flaring that often takes place during restart, Wyllie said.

In his presentation, “Decarbonizing Floating Production Sytems,” Wyllie discussed how operators could employ closed flare technology to eliminate routine flaring by capturing purge gas and recycling it back to the process. He also noted that another way to recycle excess gas is to use it for hydrocarbon gas blanketing of cargo tanks, as an alternative to inert gas blanketing, for the crude oil in storage. This would also reduce or eliminate routine flaring, Wyllie contended. These methods of reducing flaring have been employed extensively offshore Norway, he said, but so far have not been employed in other offshore producing areas.